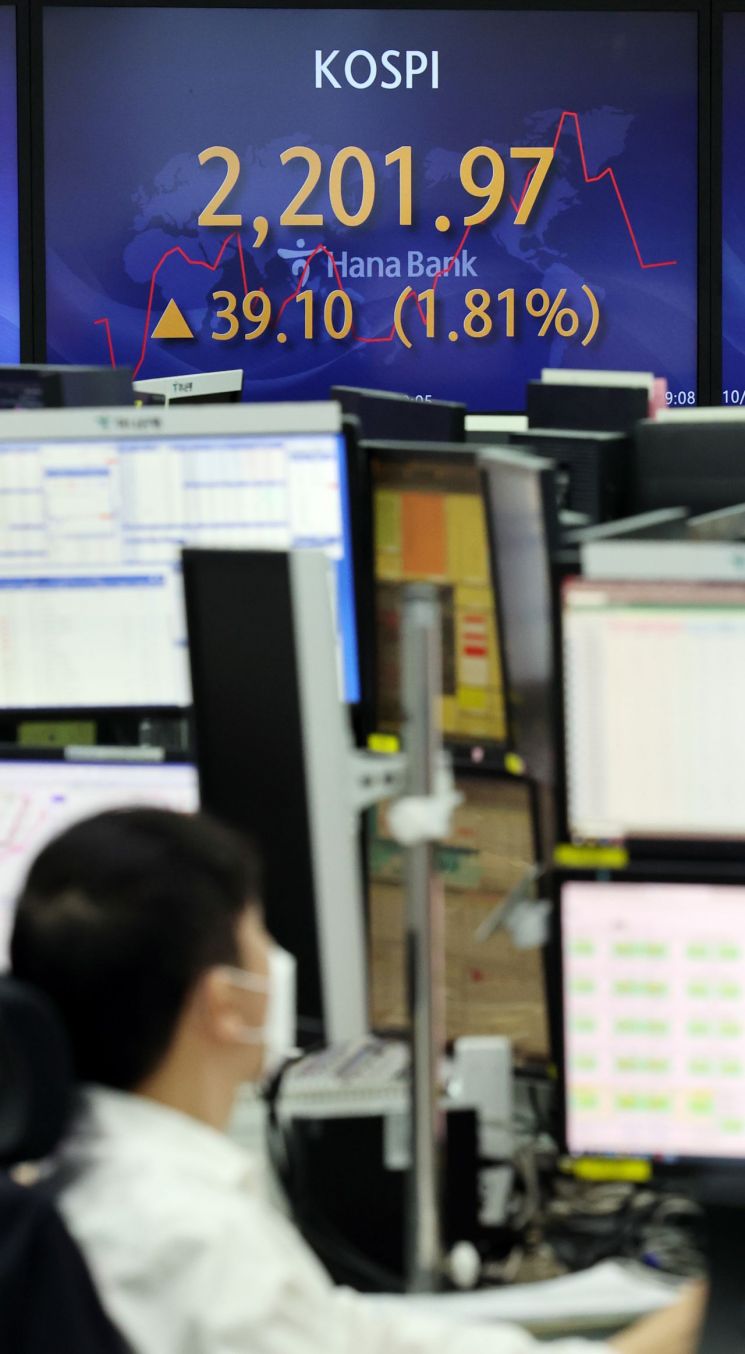

[Asia Economy Reporter Lee Seon-ae] The KOSPI, which recovered to 2200 after turning upward in just one day, is attempting to stabilize above the 2220 level as it extends its gains in the afternoon session. Supported by positive momentum from the U.S. stock market, net purchases by foreigners and institutions are bolstering the index's rise. However, individual investors, still wary of volatility, are selling off.

At 1:32 p.m. on the 14th, the KOSPI recorded a 2.49% increase at 2216.66, attempting to settle above the 2220 mark. The index opened at 2200.66, up 37.79 points (1.75%). The KOSDAQ is also expanding its gains, rising 4.30% to 679.61. It started the day at 665.17, up 13.58 points (2.08%).

Net buying by foreigners and institutions is driving the index higher. Notably, foreigners have been purchasing stocks in the KOSPI market for 10 consecutive trading days. As of now, foreigners are net buyers of approximately 262.5 billion KRW, while institutions have bought around 268.8 billion KRW. Conversely, individual investors, fearful of volatility, have sold about 524.2 billion KRW. The KOSDAQ market shows a similar pattern: foreigners and institutions are net buyers of 164.1 billion KRW and 94.8 billion KRW respectively, while individuals are net sellers of 266.1 billion KRW.

This reflects the prevailing fear of volatility. Lee Kyung-min, a researcher at Daishin Securities, said, "Since the previous day’s option expiration caused a large drop, the market is sharply rebounding today, but from a longer-term perspective, this is only a short-term relief." He added, "We need to be cautious about the possibility of further declines due to fundamental variables such as economic recession and deteriorating earnings."

Seo Sang-young, a researcher at Mirae Asset Securities, also noted, "The fact that the recession period is approaching quickly is a burden," urging caution regarding volatility.

Warnings were also raised about the brief rally in the U.S. stock market. The New York stock market plunged after the September Consumer Price Index (CPI) exceeded expectations but then sharply rebounded, ending higher after a rollercoaster session, which was considered unusual. Bloomberg analyzed that short-covering was the reason behind the U.S. market’s sharp rebound. On the 3rd (local time) at the New York Stock Exchange (NYSE), the Dow Jones Industrial Average closed at 30,038.72, up 827.87 points (2.83%) from the previous session. The Standard & Poor’s (S&P) 500 index rose 92.88 points (2.60%) to 3669.91, and the tech-heavy Nasdaq index closed at 16,649.15, up 232.05 points (2.23%). The S&P 500 ended a six-day losing streak and rebounded after seven trading days.

Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, said, "As investors digest inflation data and the earnings season begins, market volatility will continue," adding, "There are still many factors that can cause volatility." Greg Swenson, founding member of investment bank Brigg Macadam, warned, "Getting excited about the current rally could be a mistake," describing it as "close to a bear market rally" and cautioning that worse news is likely ahead, urging preparation for greater volatility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.