Increased Production Costs... Focus on Tentpole Works

Mainstream Works Priced Between 20 to 50 Billion Won

Need for Large-Scale and Genre-Convergence Fund Formation

Tax Benefits for Cultural Industry Specialized Companies

Resolving Domestic-Overseas CP Disparities Including Network Usage Fees

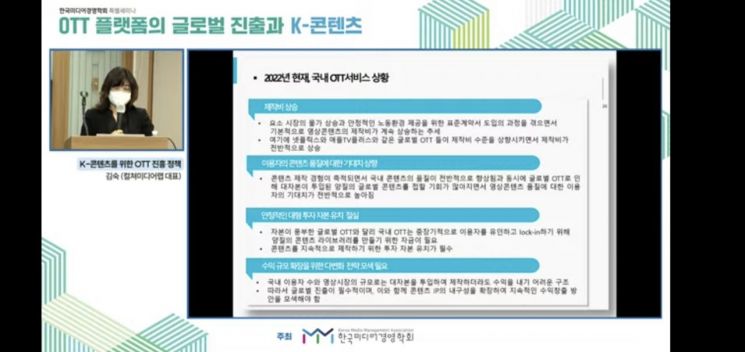

Kim Sook, CEO of Culture Media Lab, emphasized the need for platform promotion policies through the creation of large funds and tax benefits for investors at the special seminar "Global Expansion of OTT Platforms and K-Content," hosted by the Korean Media Management Association on the 13th at the Korea Press Center. Photo by YouTube Capture

Kim Sook, CEO of Culture Media Lab, emphasized the need for platform promotion policies through the creation of large funds and tax benefits for investors at the special seminar "Global Expansion of OTT Platforms and K-Content," hosted by the Korean Media Management Association on the 13th at the Korea Press Center. Photo by YouTube Capture

[Asia Economy Reporter Cha Min-young] Domestic online video service (OTT) providers such as TVING, Wavve, and Watcha, which are exploring overseas expansion, have called for policy support such as fund establishment or investment incentives to enhance their content competitiveness.

Kim Sook, CEO of Culture Media Lab, made this claim at a special seminar titled "Global Expansion of OTT Platforms and K-Content," hosted by the Korean Media Management Association on the 13th at the Korea Press Center. The seminar was also broadcast live online.

CEO Kim Sook diagnosed, "With the influx of global OTT capital including Netflix, almost all production companies are focusing on tentpole projects," adding, "As production budgets have increased, user expectations have also risen."

Looking at recent production budgets, works in the 20 billion KRW range include Squid Game (25.8 billion KRW), Space Sweepers (24 billion KRW), Extraordinary Attorney Woo, Vincenzo, Sisyphus, Hellbound, and Kingdom. In the 30 billion KRW range are Sweet Home and Bulgasal. Works in the 40 billion KRW range include Mr. Sunshine and Alchemy of Souls, while the 50 billion KRW range includes Arthdal Chronicles (54 billion KRW), Dr. Brain, Moving (planned, 50 billion KRW), and the 100 billion KRW range includes Pachinko.

Considering the importance of content procurement, there is a call for K-OTT promotion policy support. CEO Kim Sook proposed support for funding such as large funds and genre fusion funds, increasing production support amounts, investment activation through tax incentives, mandatory domestic investment by global OTTs, and support for training global planning coordinators.

Kim Sook said, "The production support from the Content Promotion Agency for dramas (feature-length) is up to 1.44 billion KRW per work, but since the production cost per episode is at least 20 billion KRW, this needs to increase," adding, "To activate investment, methods such as recognizing content company crowdfunding and cultural industry specialized companies as venture businesses to provide income tax reduction benefits to investors are also possible."

Professor Lee Sang-won of Kyung Hee University also said, "Although the domestic content market is said to be ranked 7th, it is only one-fourteenth the size of the U.S. market," adding, "The government cannot solve everything, but additional support such as increasing the tax credit rate is worth considering."

Professor Kim Jeong-hwan of Pukyong National University said, "Like Disney utilizing artificial intelligence (AI) technology in content, much technological research is being conducted," adding, "If the government invests in infrastructure so that small and medium-sized production companies can use subtitle translation systems or virtual studio technology, it would be helpful."

In this process, there is a call to re-examine the policy direction for supporting OTT overseas expansion, which is currently divided among three government ministries: the Ministry of Culture, Sports and Tourism, the Ministry of Science and ICT, and the Korea Communications Commission, and to provide effective integrated policy support.

There was also a call for a broad discussion to re-examine overall OTT regulations and resolve conflicts across the OTT industry, such as copyright fee disputes. The Korea Music Copyright Association has raised music copyright issues, and filmmakers are pushing for copyright legislation under the name of fair compensation rights.

Professor Kwak Kyu-tae of Soonchunhyang University’s Department of Global Cultural Industry said, "Overseas research and trend analysis also need efforts to collect primary data through research teams rather than reprocessing global research data," pointing out, "Although K-OTT operators are at a disadvantage, there seems to be a strong perception that they are already 'predators.'"

Domestic OTT operators expressed concerns about domestic business discrimination due to burdens such as network usage fees that overseas OTTs do not pay, despite operating at a loss. In 2021, Netflix Services Korea posted an operating profit of 17.1 billion KRW, a 94% increase from the previous year. Meanwhile, although the sales of the three domestic OTT companies increased during the same period, their total operating loss reached 156.8 billion KRW, maintaining deficits.

Ko Chang-nam, Director of External Cooperation at TVING, said, "TVING continues to operate at a loss due to investments exceeding 200 billion KRW annually in original content, as well as investments in subtitles and image quality to raise platform quality to a global level," adding, "Wavve and TVING spend over 20 billion KRW on network usage fees, but overseas OTTs do not pay these fees, and there are too many regulations on such platforms."

Lee Hee-joo, Head of Policy Planning at Content Wave, also said, "We appreciate the meticulous support from government ministries for establishing overseas bases, but the real tasks for government ministries are resolving issues of discrimination, network regulations, and taxes that remain unsolved," urging, "Please clearly distinguish between global OTTs and K-OTT."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.