Woori Bank Raises Deposit Interest Rates by up to 1.0%p

Shinhan Up to 0.8%p, NH Nonghyup Up to 0.7%p Increase

Increased Rates Applied Sequentially from the 13th

[Asia Economy Reporter Sim Nayoung] Interest rates on savings and time deposits at commercial banks will rise starting from the 13th. The highest interest rates on fixed deposit products at each bank are approaching 5%, and fixed savings products have exceeded 5%. Following the Bank of Korea's big step (a 0.5 percentage point increase in the base rate) to raise the base rate to 3% the day before, commercial banks immediately raised their savings and deposit interest rates.

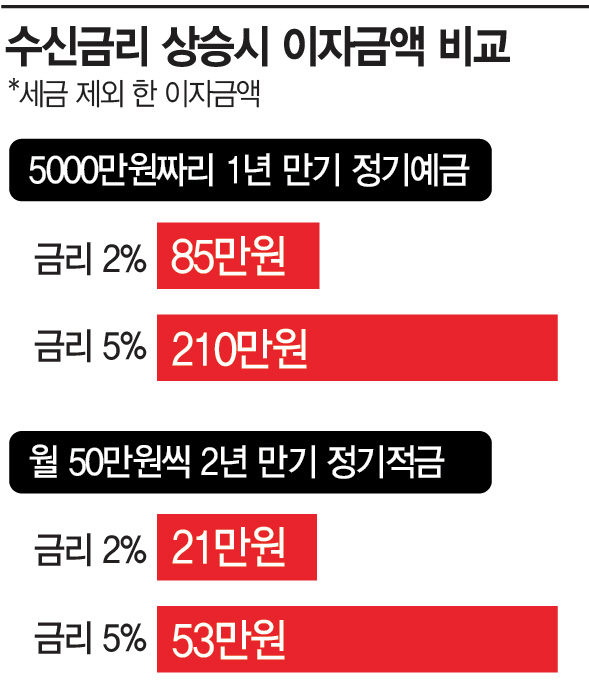

A representative from a commercial bank explained, "If you subscribe to a one-year fixed deposit of 50 million KRW, when the interest rate was 2%, the interest earned at maturity, excluding taxes, was about 850,000 KRW, but at 5%, the interest reaches 2.1 million KRW." For a savings plan of 500,000 KRW per month over two years, the interest was only 210,000 KRW at 2%, but it increases to 530,000 KRW at 5%.

Woori, Shinhan, NH Nonghyup Raise Savings and Deposit Rates Starting This Week

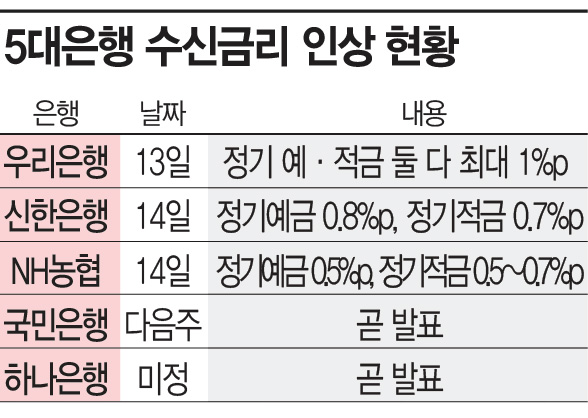

The first mover was Woori Bank, which raised interest rates on 19 fixed deposit products and 27 savings products by up to 1 percentage point on the 13th. The highest interest rate product is the non-face-to-face exclusive 'Woori First Transaction Preferential Fixed Deposit,' which increased from a maximum annual rate of 3.8% to 4.8%. Other fixed deposit products also saw increases of 0.3 to 0.5 percentage points. For savings, 'Woori Pay Savings' and 'Woori Magic Savings by Lotte Card' were raised by 1 percentage point, reaching maximum rates of 7% and 8%, respectively. Most other savings products also saw increases of 0.30 to 0.80 percentage points.

Starting from the 14th, Shinhan Bank will raise fixed deposit interest rates by up to 0.8 percentage points and fixed savings rates by up to 0.7 percentage points. The representative savings product, ‘Shinhan Al.Ssol Savings’ for one year, will increase by 0.5 percentage points to a maximum annual rate of 4.45%, and the ‘Shinhan, Hello Nice to Meet You Savings’ for first-time customers will rise to a maximum of 5.2% annually. The small business preferential product ‘Shinhan Merchant Swing Savings’ will increase by 0.7 percentage points to a maximum annual rate of 4.5%. For fixed deposits, the representative product ‘S Dream Fixed Deposit’ for one year will see a basic rate increase of 0.6 percentage points, and the ‘Future Planning Crevasse Pension Deposit’ for retirees will also increase by 0.6 to 0.8 percentage points.

NH Nonghyup will also raise fixed deposit rates by 0.5 percentage points and fixed savings rates by 0.5 to 0.7 percentage points starting from the 14th. The current highest rates of 4.3% for NH All One e-Deposit and 4.18% for NH Office Worker Monthly Compound Interest Savings will both approach 5%. Kookmin Bank has announced plans to raise deposit interest rates next week, and Hana Bank will announce its plans soon once finalized.

Variable-Rate Mortgage Loans to Rise Next Week Approaching 7%... Additional Increase Expected in November

Loan interest rates will also rise next week. When the Korea Federation of Banks announces the COFIX (Cost of Funds Index) on the 17th, commercial banks using it as a benchmark rate will immediately raise the interest rates on variable-rate mortgage loans (which adjust every six months) and some credit loan products the following day to reflect the increase. On the 13th, the highest variable-rate mortgage loan interest rate among the five major banks was 6.91%. It is predicted that the rate will surpass 7% depending on the COFIX increase.

A financial industry official said, "The COFIX announced by the Federation of Banks next week reflects the deposit product interest rates of September, and the increase in deposit interest rates following the Bank of Korea's big step on the 12th will be reflected in the October COFIX announced next month. Accordingly, mortgage loan interest rates are expected to rise significantly in November as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.