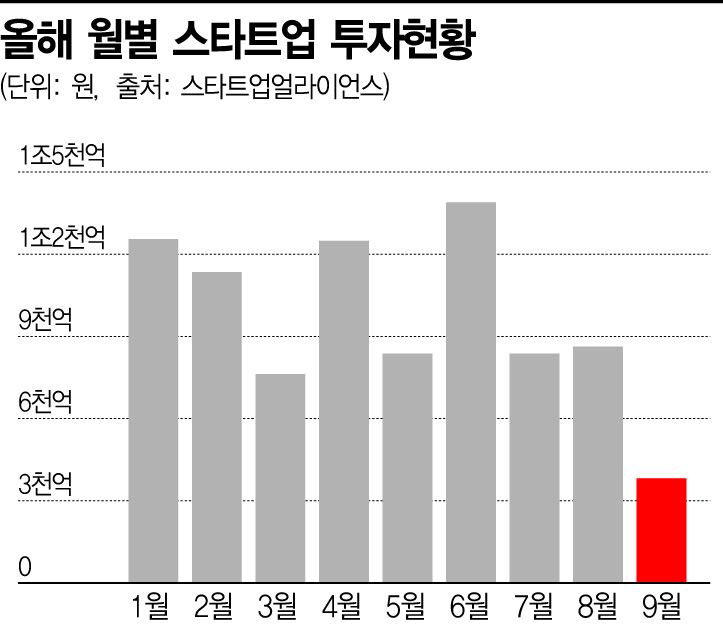

[Asia Economy Reporter Choi Dong-hyun] The startup investment market has frozen. Due to global interest rate hikes and economic downturns, the venture investment market has contracted, causing domestic investment amounts to fall below 500 billion KRW for the first time this year.

According to Startup Alliance on the 13th, last month's startup investment amount was 381.6 billion KRW, a sharp drop of 55.7% compared to the previous month (836.8 billion KRW). This is the first time this year that startup investment has fallen below 500 billion KRW. Compared to the same period last year (628.5 billion KRW), it decreased by 39.2%.

Looking at investment status by company, medium to large-scale investments of 50 billion KRW or more have completely disappeared. The company that attracted the highest investment amount last month was Seoul Robotics, a 3D LiDAR software developer, with only 35.2 billion KRW. In September last year, there were 29 investments exceeding 10 billion KRW, including Dunamu which raised 100 billion KRW, but last month there were only 18 such cases.

Within the startup community, as the investment market cools down, the internal atmosphere has changed significantly compared to before. The soaring salaries of IT developers have stalled, and there are many cases where hiring is completely halted until the market recovers. Some companies have eliminated PR teams, with marketing departments taking over those duties, showing signs of workforce reduction and organizational downsizing. A representative from startup A said, "Recently, two C-level executives left the company, which has greatly dampened the company atmosphere," adding, "As far as I know, there are no plans for new hires in the near future."

In this situation, mergers and acquisitions (M&A) between companies and personnel movements of C-level executives are increasing in the startup sector. This is so-called 'recession-type alliances' of companies and personnel. According to Startup Alliance statistics, domestic M&A in the third quarter of this year totaled 46 cases. The number of M&A cases has been increasing, with 16 in the first quarter and 36 in the second quarter. Until last year, large corporations mostly acquired startups, but this year, acquisitions between startups themselves have also increased.

A representative example is MyRealTrip, which operates a travel application, acquiring Startrip on the 26th of last month. Startrip is a startup that provides travel destination information and reservation services related to 'K-content.' MyRealTrip also acquired Iwatrip, a startup operating the kids travel platform 'Donkey,' in March. This is interpreted as an effort to secure market competitiveness by acquiring companies that can create synergy within the 'travel' category. A VC official said, "Companies without funds have no choice but to sell subsidiaries if they cannot attract additional investment," adding, "Conversely, companies with abundant cash assets see this as an opportunity to buy good assets at low prices, so competition in the recent M&A market is fierce."

Experts predict that going forward, selection will focus on companies with good cash flow. Yoo Hyo-sang, director of Unicorn Management and Economic Research Institute, said, "Interest in bio and platform-related companies, which received high attention during the previous investment boom, is rapidly cooling, while distribution-related companies with relatively good cash flow generation capabilities are gaining attention recently," adding, "Even if growth is somewhat slow, low-tech industries that do not require large amounts of capital are becoming more competitive compared to high-tech industries." He continued, "Typically, the investment recovery period is seen 1 to 2 years after the base interest rate peaks, but the current interest rate hike trend has not ended yet," and added, "It will take 2 to 3 years from now for the startup investment market to recover."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.