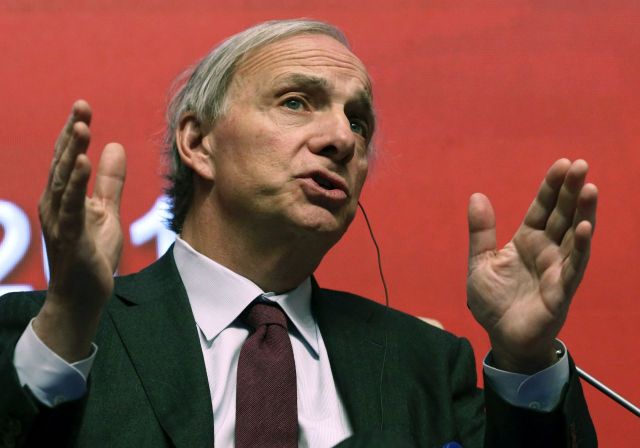

[Asia Economy Reporter Park Byung-hee] Ray Dalio, former Co-Chief Investment Officer (CIO) of Bridgewater Associates, the world's largest hedge fund, has warned that a perfect storm is approaching the US economy.

According to major foreign media on the 10th (local time), Dalio pointed out at the Greenwich Economic Forum held in Greenwich, Connecticut, that the massive government support measures during the COVID-19 pandemic created a bubble, and significant risks lie ahead. He warned that as the US central bank, the Federal Reserve (Fed), raises interest rates, the bubble will burst, and a perfect storm of economic pain will spread.

Dalio criticized, "The Fed and the US government together issued massive credit and debt to the public, and the market became intoxicated, creating a bubble." He added, "Now the Fed and the government are applying the brakes, and the market's intoxication will recede."

Dalio also pointed out that the risk of a perfect storm is increasing due to growing conflicts within the US and added international disputes. Regarding the growing conflicts within the US, he explained that irreconcilable differences and widening wealth gaps are the causes.

The Fed recently decided on three consecutive giant steps (raising the benchmark interest rate by 0.75 percentage points each time), raising the benchmark interest rate by a total of 3.0 percentage points over five hikes this year. According to the Fed's dot plot, the current US benchmark interest rate of 3?3.25% is expected to rise to 4.6% next year.

Dalio said the Fed will continue to raise interest rates to combat inflation and that if the benchmark interest rate exceeds 4.5%, the US economy could enter a recession. However, he added, "I don't know whether the interest rate level before the economy falls into recession will be 4.5% or much higher."

Dalio also predicted that real interest rates will be negative or very low over the next five years.

Dalio founded Bridgewater in 1975 and grew it into the world's largest hedge fund managing $151 billion in assets. Recently, he handed over all his voting rights to the board and stepped away from Bridgewater's management.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)