Luxury Revenge Spending Lowers Cheongdam Vacancy Rate to 14.0%

Myeongdong, Cut Off from Foreign Visitors, Has Highest Rate at 52.5%

[Asia Economy Reporter Noh Kyung-jo] The luxury goods market has experienced explosive growth due to changes in consumer behavior caused by the COVID-19 pandemic. With overseas travel restricted, suppressed consumer desires manifested as luxury revenge spending. This affected commercial district landscapes, with areas in Seoul such as Cheongdam and the Itaewon Station-Hangangjin Station vicinity?where luxury brands and high-end restaurants are concentrated?enjoying a boom. In contrast, Myeongdong and Garosu-gil, which heavily rely on foreign tourists, saw a sharp increase in vacancies.

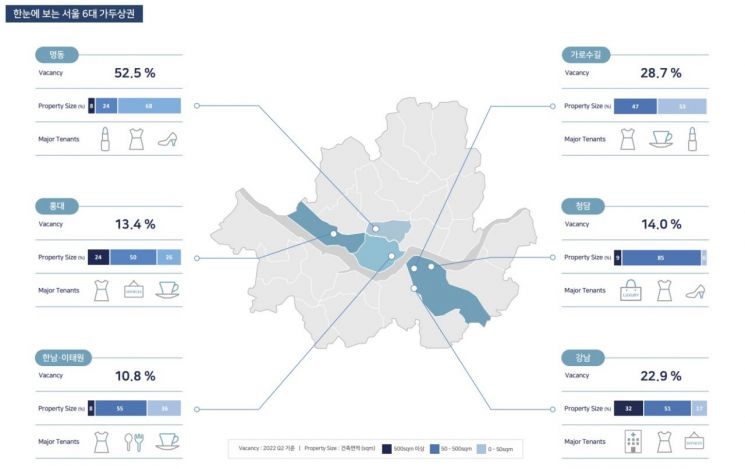

According to the "2022 Seoul Retail Street Commercial District Report" by global real estate consulting firm Cushman & Wakefield on the 10th, as of the second quarter of this year, the average vacancy rate across Seoul's six major commercial districts (Myeongdong, Hongdae, Hannam-Itaewon, Cheongdam, Garosu-gil, Gangnam) was 23.7%, down 1.9 percentage points from the previous quarter. Although this is an improvement from the peak vacancy rate of 25.8% recorded in the fourth quarter of 2021 after the COVID-19 outbreak, it has not yet returned to the pre-pandemic average of 7.5% in 2019.

The commercial district most severely impacted during the pandemic was Myeongdong. The vacancy rate, which was 4.5% before COVID-19, surged to 23.2% in 2020 and 49.9% in 2021, reaching 52.5% in the first half of this year. The large-scale withdrawal of cosmetics stores in Myeongdong, which heavily depended on Chinese tourists among foreign visitors, contributed significantly to the rising vacancy rate. The report noted that approximately 56% of vacancies in Myeongdong since 2020 were from cosmetics stores.

Next, Garosu-gil's vacancy rate was high at 28.7%. Similar to Myeongdong, the sharp decline in foreign tourists led fashion and beauty brands that had entered Garosu-gil to gradually withdraw.

On the other hand, Cheongdam was the only one among the six major commercial districts where the vacancy rate decreased after COVID-19, thanks to the growth of the luxury market. The vacancy rate in Cheongdam rose to 20.8% in 2019 when the luxury industry was sluggish but dropped to 14.0% in the first half of this year. The main consumer base for luxury goods expanded from the existing middle-aged and older generations to include the MZ generation (born from the early 1980s to early 2000s).

The area with the lowest vacancy rate was Hannam-Itaewon at 10.8%. Analysis of credit card sales data showed that sales in Cheongdam and Hannam-Itaewon increased by more than 20% year-on-year in the first half of this year, while Myeongdong was the only district to experience a sales decline during the same period.

The report attributed the growth of the luxury market and the resilience of commercial districts during the pandemic to the so-called "flex culture," centered around the MZ generation. According to the Ministry of Trade, Industry and Energy, sales of luxury and other famous overseas brands recorded 29.1% growth as of July this year, following 18.8% growth in 2021 and 32.5% in 2020.

Cushman & Wakefield stated, "According to Statistics Korea, mobile population movement in August this year recovered to about 99% of the level in August 2019, nearing pre-pandemic levels." However, they added, "Recently, inflationary pressures, which could negatively affect the recovery of private consumption, have newly emerged, so vigilance cannot be relaxed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.