Hana Securities Report

[Asia Economy Reporter Lee Myunghwan] Securities firms have forecasted that casino companies listed on the domestic stock market will show a recovery in their third-quarter earnings. However, there is also analysis suggesting that their appeal as dividend stocks may be somewhat limited in the current high-interest-rate environment.

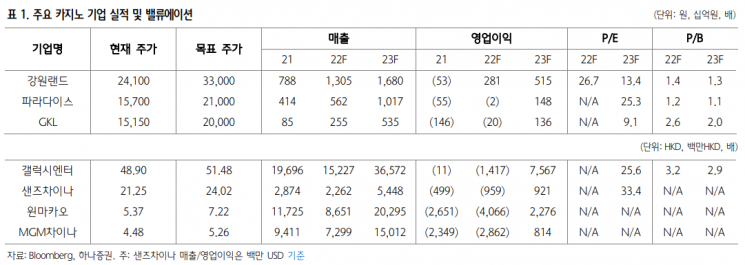

Hana Securities analyzed on the 9th that "while a sharp earnings recovery has been confirmed, there are concerns regarding their status as dividend stocks" in relation to casino stocks.

Hana Securities projected that Gangwon Land and Paradise's operating profits for the third quarter of this year will increase by 377% and 530% year-on-year, reaching 116.7 billion KRW and 30.3 billion KRW, respectively. GKL is expected to record an operating profit of 7.5 billion KRW in the third quarter, turning profitable, while Lotte Tour Development is forecasted to continue posting an operating loss of 20.8 billion KRW.

Hana Securities expects Paradise and GKL's third-quarter operating profits to exceed market estimates. This is attributed to a sharp recovery in Japanese VIP customers, including an increase in per capita casino drop amounts despite limited recovery in flight routes. Gangwon Land is noted to have recovered approximately 85% of its performance compared to the same period in 2019 before COVID-19. However, Lotte Tour Development is estimated to perform poorly due to a low hold rate despite growth in casino drop amounts.

Hana Securities forecasts that the casino drop amount from Japanese VIPs could see further growth considering the implementation of visa-free entry starting in October and the expansion of routes such as Busan and Jeju. Attention should also be paid to changes in China’s zero-COVID policy. Chinese authorities have announced plans to allow group tours to Macau as early as November. However, Hana Securities added that the recovery speed should be monitored carefully as the Chinese government recently advised against travel during the National Day holiday.

With market interest rates gradually rising recently, Hana Securities advises that the value of casino stocks as dividend stocks needs to be reconsidered. Researcher Lee Kihoon of Hana Securities stated, "Although Gangwon Land and GKL are dividend stocks, it is not easy for them to pay dividends equivalent to deposit interest rates (around 4%), so despite their earnings and valuation appeal, foreign ownership recovery is slow," and recommended, "We present Paradise, which has high earnings leverage, as the top pick."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)