Eugene Investment & Securities Analyzes Returns of Top 30 Short-Selling Stocks

Top 30 Stocks Show -5% Returns Over 3 and 6 Months

Bottom 30 Stocks Show 7% Returns Over 3 Months, 21% Over 6 Months

"There Are Reasons for High Short Selling; Caution Is Needed"

[Asia Economy Reporter Ji Yeon-jin] It has been found that stocks with lower short-selling balances yield better returns than those with higher short-selling balances. Additionally, while a 'long-short strategy'?buying stocks with low short-selling and selling those with high short-selling?has been suggested as an investment method during bear markets, analysis shows its effectiveness diminishes in sharp declines exceeding 20%.

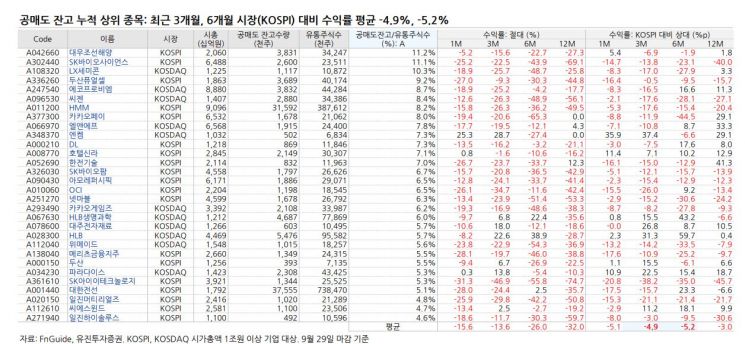

On the 8th, Eugene Investment & Securities examined stocks with the highest cumulative short-selling balances relative to floating shares among companies with a market capitalization of over 1 trillion won listed on the KOSPI and KOSDAQ. The top 30 stocks by short-selling balance underperformed the KOSPI by 5% over the past 3 and 6 months. Looking at recent monthly earnings, 73% of 10 companies underperformed the KOSPI returns.

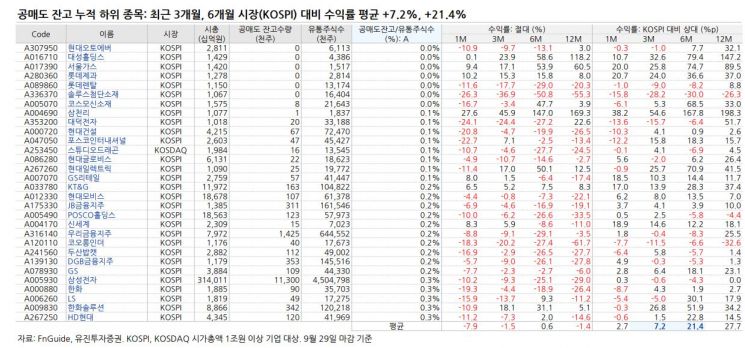

Conversely, the 30 stocks with the lowest short-selling balances recorded excess returns of 7% and 21% over the KOSPI in the past 3 and 6 months, respectively. Kang Song-cheol, a researcher at Eugene Investment & Securities, stated, "Considering that there may be reasons for high short-selling in certain stocks, it is reasonable to be more cautious when investing in those stocks. While high short-selling can be interpreted as a negative signal for stock prices, low short-selling can conversely be seen as a positive signal."

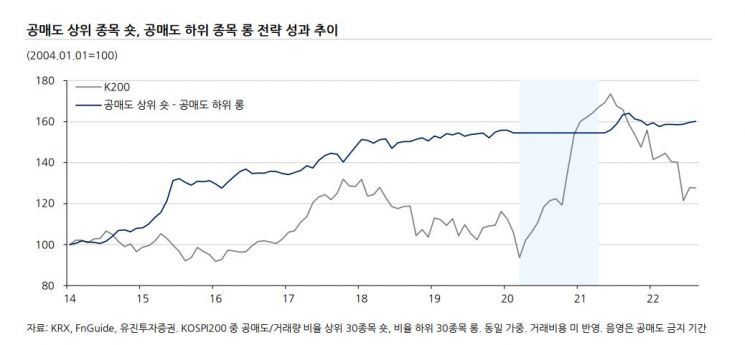

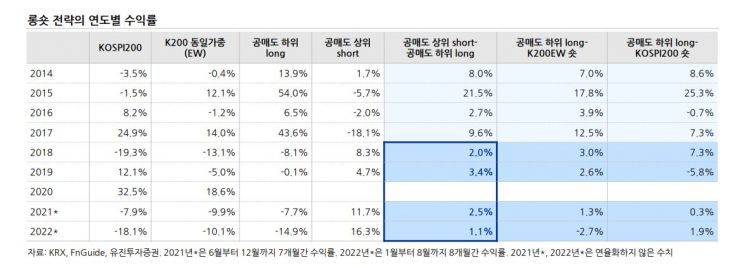

Using this short-selling data, Researcher Kang analyzed monthly returns from 2014 to August for KOSPI200 companies by selling the 30 stocks with the highest short-selling and buying the 30 stocks with the lowest short-selling. The period from March 2020, when short-selling was banned, to the end of April last year was excluded.

As a result, the annual average return of this 'long-short strategy' was 6.6%. Notably, the strategy of buying only the 30 stocks with the lowest short-selling in the KOSPI200 achieved a cumulative return of 63% during this period. The selling strategy yielded a cumulative return of 31%. Researcher Kang noted, "Over the entire period, the positive returns of the long-short strategy were more contributed by the long positions than the short ones." From 2014 to August this year, the KOSPI200 index rose by 28%.

However, the long-short strategy was heavily influenced by market sentiment. From 2018 to 2019 and from the second half of 2021 to August 2022, performance significantly declined, with annual average returns around 2% to 3%, lower than the 10.4% annual average return from 2014 to 2017.

From January 2018 to February 2020, the KOSPI200 index fell by 20%, and from June 2021 to August 2022, it dropped by 26%. Both periods were bear markets with declines exceeding 20% from their peaks.

Researcher Kang explained, "In bear markets, especially when the market falls more than 20%, the differences in returns among stocks narrow because all stocks fall 'indiscriminately.' In such market conditions, it is difficult to outperform the market through stock selection."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.