Citibank Securities, 'Sell' Opinion

Naver, Down 17.31% This Week

KakaoPay, Down 14.41% in One Day

[Asia Economy Reporter Hwang Yoon-joo] Naver and Kakao Pay are relentlessly plummeting due to 'sell' reports from foreign securities firms. This decline is attributed to the Federal Reserve's (Fed) aggressive tightening policy, which has increased discount rates, along with growing concerns about growth potential.

According to the Korea Exchange on the 8th, Naver's stock price fell 17.31% from 193,500 KRW to 160,000 KRW during this week (October 4-7), hitting a 52-week low based on closing prices.

The acceleration of Naver's stock decline is blamed on 'sell' reports from foreign securities firms. Citi Securities downgraded Naver to a 'sell' rating on the 4th, lowering the target price from 328,000 KRW to 170,000 KRW. JP Morgan also cut the target price from 270,000 KRW to 220,000 KRW.

Alongside the securities firms' sell reports, M&A (mergers and acquisitions) issues also impacted the stock price. On the same day, Naver announced the acquisition of Poshmark, the U.S. version of 'Danggeun Market.' The acquisition amount was 2.3441 trillion KRW (91,272,609 shares), and the consensus is that the purchase price was expensive.

Foreign investors net sold 749.1 billion KRW worth of shares this week alone. Although individuals and institutions net bought 704 billion KRW and 23.5 billion KRW respectively, it was insufficient to defend the stock price.

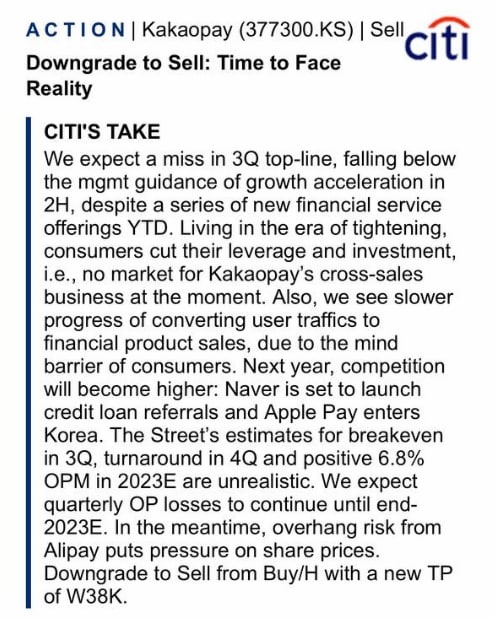

Kakao Pay barely defended the 40,000 KRW level amid Citi Securities' 'sell' report. On the 7th, Kakao Pay closed at 40,100 KRW. After the release of Citi Securities' report that day, the stock dropped 14.41% within one day. Like Naver, it set a new 52-week low.

On that day, Citi Securities downgraded Kakao Pay to a 'sell' rating and lowered the target price to 38,000 KRW. Citi Securities stated, "Due to the economic recession, people are reducing consumption, and the process of converting traffic into revenue is also delayed," adding, "The break-even point in Q3, turnaround in Q4, and operating profit margin forecast of 5.8% in 2023 are unrealistic."

They further explained, "Competition will intensify next year," noting, "Naver plans to start personal credit loans, and Apple Pay will enter the Korean market."

Kakao Pay also collapsed under foreign investors' 'sell' pressure. On that day alone, foreign investors net sold 32.599 billion KRW. Individuals and institutions bought 29.8 billion KRW and 2 billion KRW respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)