Corporate Loans Surge Sharply, Reaching Household Loan Levels

Approximately KRW 694.9 Trillion as of End-September, Expected to Surpass in October

Deteriorating Economic Conditions and Rising Interest Rates Raise Concerns Over Corporate Loan Defaults

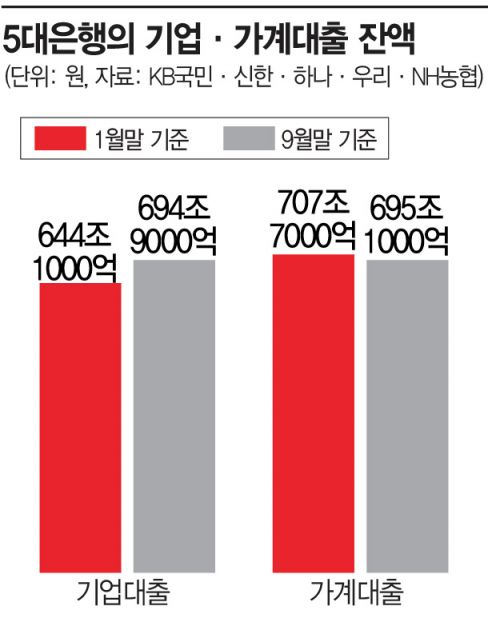

[Asia Economy Reporter Sim Nayoung] Amid the adverse conditions of high inflation, high exchange rates, and high interest rates, corporate loans have surged rapidly and are expected to surpass household loans within this month. On the 11th, the outstanding corporate loans of the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) were recorded at approximately KRW 694.9 trillion as of the end of September. This is only about KRW 200 billion less than household loans (approximately KRW 695.1 trillion).

Since the beginning of this year, corporate loans have been increasing rapidly by an average of KRW 6 trillion per month. If this trend continues, the scale of corporate loans is expected to exceed household loans in October. At a time when corporate loan interest rates have jumped above household loan interest rates, concerns are rising that if the domestic and international economic situations worsen, the repayment burden will increase mainly for vulnerable companies, raising the risk of defaults.

While household loans have been declining due to financial authorities' regulations and a housing market slump, corporate loans continue to rise. From January to September this year, the increase in corporate loans amounted to about KRW 34.7 trillion for small and medium-sized enterprises (including small merchants and self-employed) and about KRW 16.1 trillion for large corporations, totaling KRW 50.8 trillion. The causes are complex.

Above all, loan demand has not ceased, especially among merchants who suffered business downturns due to the COVID-19 pandemic and small and medium-sized enterprises lacking operating funds. When financial authorities restricted household loans, commercial banks turned their attention to corporate loans and competed aggressively in this sector.

Whenever the U.S. Federal Reserve (Fed) and the Bank of Korea implemented rapid base rate hikes, financial markets fluctuated, prompting even large corporations to seek bank loans. A representative from a commercial bank said, "The corporate bond issuance rates for companies with high credit ratings have risen from the 2% range to the 5% range within a year," adding, "Companies with poor credit ratings and small and medium-sized enterprises have found it difficult to issue corporate bonds, leading many to seek bank loans."

The problem is that as corporate loan demand increases, corporate loan interest rates are also soaring. According to the Bank of Korea's Economic Statistics System, the interest rate on small and medium-sized enterprise loans by banks was 4.65% based on new contracts in August, surpassing the mortgage loan interest rate (4.34%), which accounts for the largest portion of household loans. From last September until recently, banks that could not increase household loans competed fiercely in corporate loans, resulting in SME loan interest rates being lower than mortgage loan rates, but this trend has ended. Even large corporate loan interest rates (4.23%) have risen to levels similar to mortgage loan rates.

The same applies to the five major banks. According to the August interest rates disclosed on the Korea Federation of Banks Consumer Portal, corporate loan interest rates exceeded household loan interest rates at KB Kookmin Bank (corporate 4.45% · household 4.42%), Hana Bank (corporate 4.47% · household 4.33%), and NH Nonghyup (corporate 4.26% · household 4.21%). In July, except for Hana Bank, the other four banks had corporate loan interest rates lower than household loan rates, but the trend began to reverse from August.

As both the scale and interest rates of corporate loans rise simultaneously, warnings have been issued to pay attention to the possibility of defaults. With the trade deficit continuing for six consecutive months, prices including raw materials showing no signs of easing, and next year's growth rate being revised downward, the situation for companies is expected to worsen.

Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "As corporate profitability deteriorates, companies are covering operating costs with debt and increasing loan demand to secure funds in advance in preparation for further interest rate hikes," adding, "Since the burden of principal and interest repayments for companies is rapidly increasing, risk assessments are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.