Trade Deficit Widens to $4.45 Billion

President Yoon Chairs Emergency Economic and Livelihood Meeting

"Must Maintain Fiscal Soundness Policy"

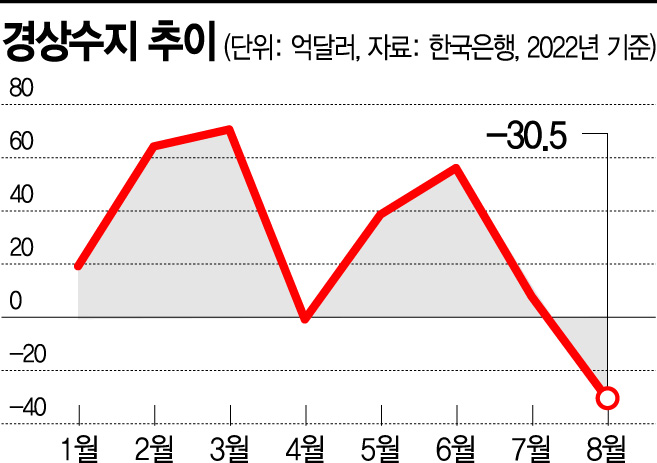

[Asia Economy reporters Seo So-jeong and Lee Ki-min] The current account balance turned to a deficit again in August after four months, due to rising international raw material prices and sluggish exports to China. Except for every April when overseas remittance dividends increase, the last time South Korea’s monthly current account showed a deficit was in February 2012. Amid growing global uncertainties caused by the Ukraine crisis, the current account balance, which had been a pillar of the Korean economy, has also shifted to a deficit, raising warning signals for the Korean economy. President Yoon Seok-yeol emphasized the need to proactively establish a ‘safety net’ to alleviate public and market anxiety, as the complex crisis may continue for a considerable period.

According to the ‘August Balance of Payments (provisional)’ released by the Bank of Korea on the 7th, the domestic current account recorded a deficit of $3.05 billion. Compared to the same month last year, this is a decrease of $10.49 billion. The current account posted a deficit of $79 million in April, then increased its surplus to $3.86 billion in May and $5.61 billion in June, but the surplus sharply shrank to $790 million in July before turning to a deficit in August.

The shift to a current account deficit was mainly due to a significant expansion of the deficit in the goods account, which holds the largest share. The goods account recorded a deficit of $4.45 billion, a sharp drop of $10.48 billion compared to the same month last year, continuing a deficit for the second consecutive month following July. During this period, exports amounted to $57.28 billion, increasing by $4.1 billion (7.7%), but imports ($61.73 billion) rose by $14.58 billion (30.9%), nearly four times the increase in exports.

The services account, which showed a surplus in July, also turned to a deficit. Due to increased payments for intellectual property (IP) royalties, it shifted from a surplus of $840 million in the same month last year to a deficit of $770 million. The net financial account, calculated as assets minus liabilities, decreased by $610 million in August. Regarding direct investment, domestic investors’ overseas investment increased by $3.6 billion, and foreign investors’ domestic investment rose by $1.81 billion. Domestic investors’ overseas securities investment increased by $610 million, while foreign investors’ domestic securities investment expanded by $2.59 billion.

Meanwhile, President Yoon, after receiving a report on the ‘International Balance of Payments Response Direction’ at the 10th Emergency Economic and Livelihood Meeting held at the Yongsan Presidential Office on the morning of the same day, stated, "It is important to maintain the government’s stable and consistent policies and external creditworthiness," and added, "Securing fiscal soundness is also very important, so the fiscal soundness policy stance must be maintained during the upcoming deliberations on next year’s budget."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.