Hanmi Science and Hanmi Healthcare Merger

Holding Company Sales Expected to Reach 150 Billion KRW

Celltrion Healthcare Acquires US Corporation

Enables Direct Local Sales... License Secured

Huen MC and Aprogen Pharma Also

Secure Growth Momentum Through Business Integration

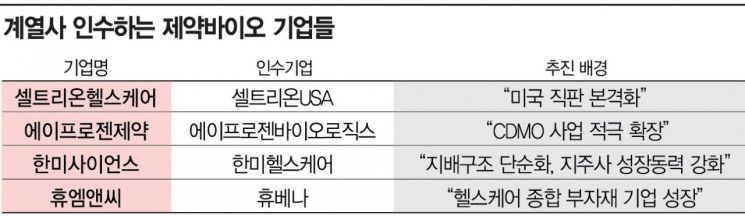

[Asia Economy Reporter Lee Gwan-joo] The domestic pharmaceutical and bio industry is experiencing a wave of mergers and acquisitions among affiliates. This is interpreted as an effort to quickly advance growth industries through simplification of governance structures and to increase work efficiency by integrating separated personnel and resources. There is also an analysis that, reflecting the recent unfavorable market conditions, the focus is on maximizing business capabilities rather than expanding size.

According to the industry on the 7th, Hanmi Science, the holding company of Hanmi Pharmaceutical Group, plans to complete the small-scale merger process of its health functional food and medical device affiliate Hanmi Healthcare on the 1st of next month. Currently, Hanmi Healthcare is led by CEO Lim Jong-hoon, the second son of Song Young-sook, chairman of Hanmi Science. In particular, its core businesses such as soy milk, surgical treatment materials, and IT solutions are evaluated to have competitiveness in each field. Last year, its standalone sales exceeded 100 billion KRW, reaching 104.6 billion KRW.

Hanmi Science’s direct merger with a prime affiliate reflects its intention to secure growth momentum for the holding company itself. It aims to directly manage and strengthen the healthcare sector, identified as a future growth engine, thereby increasing the holding company's value. Due to this merger, Hanmi Science’s annual sales are expected to grow about 500% from last year’s 36.3 billion KRW to 150 billion KRW. The simplification of governance structure and the practice of ESG (Environmental, Social, and Governance) management are also reported to be factors considered. A Hanmi Science official said, “By incorporating the competitive business sectors held by Hanmi Healthcare, we expect a positive impact on key management indicators such as sales next year,” adding, “We will further develop our business areas and focus on discovering new growth engines to soar as an excellent company leading the global healthcare market.”

Celltrion Healthcare plans to directly sell the Avastin biosimilar 'Vegzelma' in the United States in the first half of next year through the acquisition of its U.S. subsidiary, Celltrion USA.

Celltrion Healthcare plans to directly sell the Avastin biosimilar 'Vegzelma' in the United States in the first half of next year through the acquisition of its U.S. subsidiary, Celltrion USA. [Photo by Celltrion]

Celltrion Healthcare also acquired its affiliate Celltrion’s U.S. subsidiary Celltrion USA in August. The acquisition was made by purchasing 100% of Celltrion USA’s shares, with a purchase price of 18 billion KRW. Established in July 2018, Celltrion USA has served as a foothold for Celltrion’s entry into the U.S. market, securing licenses to sell products nationwide and building its own supply chain mainly for generic drugs. During the COVID-19 pandemic, it also gained experience in direct local sales, including supplying diagnostic kits within the U.S. Through this acquisition, Celltrion Healthcare can immediately utilize the licenses held by Celltrion USA to shorten preparation time for pharmaceutical distribution in the U.S. and conduct direct sales. It appears to be a strategy to strengthen ‘selection and concentration,’ with Celltrion focusing on research and product development, and Celltrion Healthcare handling distribution and sales.

Huons Group’s Huem & C also merged its subsidiary Huvena in July. Huem & C has focused on cosmetic materials, while Huvena specialized in pharmaceutical materials. The strategy is to develop into a ‘comprehensive healthcare materials company’ covering cosmetics, pharmaceuticals, and medical sectors by combining these materials companies. With the integration of human and physical resources, the company intends to expand business areas and target markets, thereby increasing sales and improving profitability.

Recently, it was also reported that Aprogen Pharmaceutical plans to absorb its affiliate Aprogen Biologics. Aprogen Pharmaceutical intends to expand its contract manufacturing (CMO) and contract development and manufacturing (CDMO) businesses by utilizing the Osong plant, the world’s largest continuous culture factory.

Analysts suggest that these mergers and acquisitions among affiliates reflect a determination to reduce costs and concentrate growth engines through unification of governance structures and business integration. An industry insider said, “While the goal of strengthening business divisions is the same, the directions differ between separating and merging affiliates,” adding, “Cases of merging affiliates for cost reduction and management efficiency are expected to continue.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)