[Asia Economy Reporter Changhwan Lee] Recently, life insurance companies have been expanding the sales of savings-type insurance through bank bancassurance channels. However, there is a concern that customers should check the actual yield rather than the nominal interest rate of the product before subscribing.

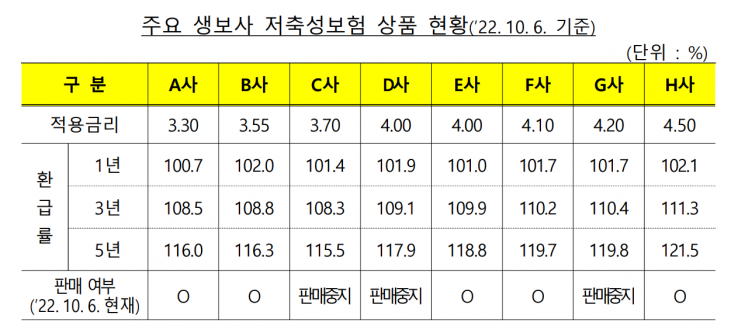

On the 6th, the Financial Supervisory Service (FSS) issued a press release stating that life insurance companies are expanding sales of fixed high-interest savings insurance through banks as market interest rates have recently risen.

The FSS emphasized that customers should verify the actual return (refund) rate rather than the nominal interest rate of the product during this process.

This is because insurance products do not accumulate the entire premium paid by the policyholder, but rather accumulate the balance after deducting the insurance premium for coverage and business expenses.

Therefore, the actual amount refunded at maturity or upon early termination is less than the amount calculated by applying the interest rate to the paid premium.

For example, for a savings insurance with an annual compound interest rate of 4.5%, the actual interest rate after 5 years is about 3.97% per annum compounded.

The FSS pointed out that product brochures from insurance companies emphasize only the applied interest rate, such as "annual compound fixed interest rate 4.5%," so caution is needed when subscribing to the product.

An FSS official said, "Savings insurance does not accumulate the entire premium paid by the contract holder at the applied interest rate, but only the remaining amount after deducting coverage premiums and business expenses is accumulated. Therefore, the payout at maturity or cancellation is less than the applied interest rate, so please be sure to check this before subscribing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.