Tax Authorities Detect Suspicions Including Concealment of Death of Overseas Immigrant Head of Household, Illicit Domestic Asset Transfers, and Use of Employee-Name Nominee Accounts

[Asia Economy Sejong=Reporter Kim Hyewon] The National Tax Service (NTS) detected that a minor A residing abroad acquired high-priced domestic real estate worth several billion won. The investigation revealed that the father B had reported overseas migration and transferred foreign currency for the purpose of moving abroad, but in fact continued to reside in Korea by conducting business and using credit cards domestically. There was no trace of father B acquiring overseas assets with the transferred funds. The NTS has launched a gift tax investigation against father B on suspicion of disguising as a non-resident and gifting funds to minor A from abroad. This is a case exploiting the fact that if the recipient or donor is a non-resident and the property gifted is overseas assets, there is no obligation to pay gift tax.

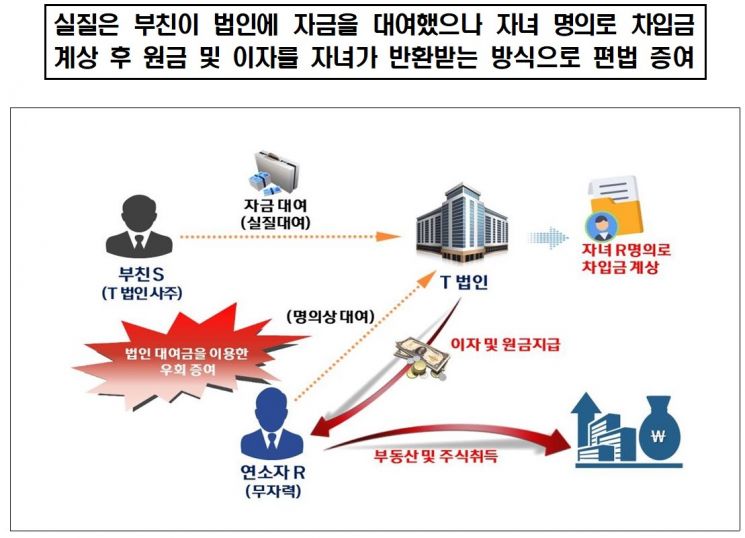

Minor C, who has no fixed occupation, was found to have acquired high-value real estate and stocks. Upon analyzing the source of funds, the NTS found that minor C had tens of billions of won in loans set up with corporation E, owned by father D. It was also revealed that minor C received high interest payments and principal repayments. Minor C appeared to lack the financial capacity to lend large sums to the corporation due to no significant income or assets, and at the same time, father D’s deposit assets decreased. This suggests that father D provided the loan to the corporation with his own funds and recorded minor C as the creditor on the corporation’s books, thereby making a disguised gift.

The NTS announced on the 6th that it has started tax investigations into intelligent and unfair tax evasion suspicions of high-net-worth individuals, such as disguised inheritance and gifting under the pretense of overseas migration, disguised domestic asset gifting, and indirect gifting using employee-named nominee accounts. The investigation targets 99 high-net-worth individuals and their children.

According to the NTS, some high-net-worth individuals go beyond directly gifting real estate and stocks, which are easily exposed to tax authorities, by using overseas migrant status to conceal inheritance and gifting, or by using nominee financial assets and insolvent corporations in transactions, disguising names and transactions in a sophisticated manner to evade tax burdens and transfer wealth to the next generation.

In response, the NTS developed an integrated overseas migrant inquiry system to strengthen verification of overseas migrants and has begun tax investigations into suspected tax evaders.

There are 21 suspects related to overseas migration. They are accused of gifting to children after transferring assets abroad under the pretext of overseas migration expenses, disguised gifting through overseas foreign exchange remittances, and disguised gifting of rental income from domestic real estate owned by overseas migrants. There is also a case of concealing the death of an overseas migrant to evade inheritance tax.

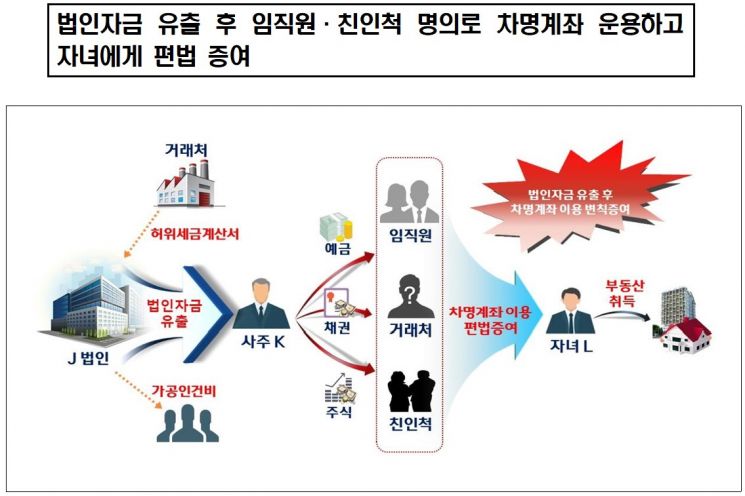

There are 21 suspects who operated nominee accounts under employees’ names after corporate fund outflows to make disguised gifts to their children.

Additionally, 57 suspects are accused of false or collusive transactions to evade capital gains tax by inserting loss-making corporations with no income during real estate transfers, selling at low prices, and then reselling at high prices to actual buyers within a short period, disguising the transaction. Among them, if it was confirmed that sales were omitted or corporate funds were improperly diverted to increase assets, the related businesses were also selected as investigation targets.

The NTS stated, "We will continuously verify not only domestically but also overseas, where wealth is cleverly inherited or private interests are appropriated and intelligent tax evasion occurs during corporate operations. If malicious tax evasion such as name disguise or nominee accounts is confirmed, we will respond strictly with measures including criminal prosecution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.