The Next Step in Response to Plummeting Demand: Inevitable Production Cuts and Investment Reduction Environment

[Asia Economy Reporters Sunmi Park, Pyeonghwa Kim] The memory semiconductor industry, which is experiencing severe demand slumps, is showing signs of production cuts and investment reductions. Domestic companies, which occupy more than 70% and 50% of the global DRAM and NAND flash markets respectively, are in an environment where production cuts and investment reductions are inevitable as the next step in response to the sharp drop in demand.

According to the semiconductor industry on the 5th, memory semiconductor companies have begun to boldly reduce supply and investment in response to the sharp decline in demand. Micron, the world's third-largest memory semiconductor (DRAM + NAND flash) company based in the U.S., announced in its earnings conference call that it plans to cut capital expenditures by 50% next year and reduce factory operating rates by 5% at the end of this year and early next year. Japan's Kioxia, which ranks third in the world in NAND flash, also announced a 30% reduction in NAND production starting this month.

Domestic companies, which occupy more than half of the entire memory semiconductor market, have not yet officially started production cuts. A representative from a domestic semiconductor company said, "We are still maintaining 100% operating rates," adding, "We are adjusting inventory by lowering prices and responding by increasing the proportion of high value-added memory semiconductors."

However, the industry views that since companies within the 'Top 5' have started production cuts and investment reductions, if memory semiconductor prices continue to fall, leading Korean companies will inevitably have to join in production cuts and investment reductions. Samsung Electronics and SK Hynix are reducing inventory by lowering prices, but semiconductor inventory assets as of the end of the first half of the year are already at an all-time high. Previously, when memory semiconductor demand sharply declined in 2019, SK Hynix adjusted production volume through production cuts.

Researcher Noh Geun-chang, in charge of semiconductors at Hyundai Motor Securities, said, "The industry has already entered the stage of adjusting factory operating rates and reducing investment," and added, "Especially, Samsung Electronics, ranked first, maintains a DRAM factory operating rate of over 100%, so it is expected to consider adjusting operating rates by controlling wafer input volume in the future." Do-yeon Choi, a semiconductor research fellow at Shinhan Investment Corp., also diagnosed, "Memory semiconductor companies plan to reduce supply in response to the sharp drop in demand by leveraging their monopoly power," and noted, "The speed of semiconductor order reductions is fast."

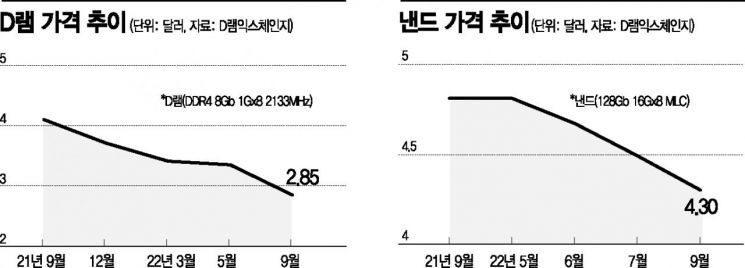

Memory semiconductor prices are rapidly falling. Last month, the average fixed transaction prices for general-purpose DRAM and NAND were $2.85 and $4.30 respectively, continuing a monthly downward trend. Prices a year ago were $4.10 and $4.81 respectively. Taiwanese market research firm TrendForce forecasts that DRAM and NAND prices in the fourth quarter will fall by 13-18% and 15-20% respectively compared to the previous quarter.

DRAM Sales Decline Forecast for Next Year

As the semiconductor market centered on memory semiconductors enters a downturn, the outlook for the DRAM and NAND flash markets next year is not favorable.

Market research firm TrendForce predicted in a report that the global DRAM market sales next year will be $75.884 billion, a 16.0% decrease from this year's forecast of $90.31 billion. TrendForce also expected this year's forecast to decrease by 4.9% compared to the previous year ($94.915 billion). Unlike last year, when DRAM market sales grew sharply by 41.6% compared to the previous year, a downward trend is expected from this year onward.

The NAND flash market, which forms the other axis of memory semiconductors along with DRAM, is expected to avoid negative growth but sales growth will slow compared to boom periods. TrendForce forecasts next year's NAND market sales to increase by 3.7% to $74.66 billion compared to this year's forecast of $71.98 billion. In 2020 and 2021, NAND market sales grew significantly by 26.0% and 21.1% respectively compared to the previous year. The NAND market sales for 2024 are expected to reach $81.52 billion, a 9.2% increase from the previous year.

Supply oversupply in the memory semiconductor market is expected to continue next year as well, maintaining inventory pressure. To adjust the supply-demand imbalance next year, many manufacturers will need to adjust DRAM production volumes. TrendForce also expects NAND market production adjustments by manufacturers similar to DRAM, which could reduce NAND inventory pressure in the second quarter of next year. The price decline trend is expected to ease only next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.