[Asia Economy Reporter Buaeri] The proportion of IT (Information Technology) personnel at the four major commercial banks was found to be less than 10% of their total employees. As offline bank branches gradually disappear and banking services continue to shift to the digital sector, concerns have been raised about the insufficient number of IT personnel responsible for banking services and security.

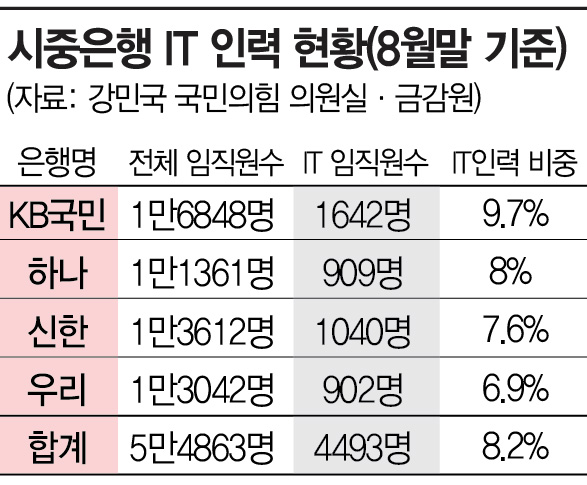

According to the 'Status of IT Personnel at Commercial Banks' data obtained by Asia Economy on the 6th through the office of National Assembly member Kang Ming-guk of the People Power Party from the Financial Supervisory Service (as of the end of August), the average proportion of IT personnel among total employees at KB Kookmin, Shinhan, Woori, and Hana Banks was only 8.2%. Out of a total of 54,863 employees, 4,493 were IT-related staff.

Even KB Kookmin Bank, which has the largest number of IT personnel among the banks, still did not reach 10%. Out of 16,848 total employees, 1,642 were IT personnel, accounting for 9.7%. Hana Bank followed with about 8%. Among its 11,361 employees, 909 were IT-related. Shinhan Bank had 1,040 IT personnel out of 13,612 employees, about 7.6%. Woori Bank had the lowest proportion among the four major banks, with 902 IT personnel out of 13,042 employees. Of course, banks have their own circumstances. While they continue to maintain a policy of securing IT talent for digital transformation, skilled developers tend to prefer IT companies such as game companies over banks.

In the case of the three internet-only banks, since they have no offline branches, the proportion of IT personnel is relatively high, but it was found that the proportion of IT personnel actually decreased compared to the end of last year. The three internet-only banks had an average IT personnel ratio of about 48% at the end of last year, which dropped to 34.4% as of the end of August. Out of a total of 2,134 employees, 734 were IT-related personnel.

Looking at each bank, Toss Bank had 192 IT personnel out of 337 employees, with the IT personnel ratio dropping from 70% at the end of last year to about 57%. Kakao Bank also saw a decrease from 42% IT personnel at the end of last year to 25.1%, with 333 IT personnel out of 1,335 employees. K Bank had 209 IT personnel out of 462 employees, accounting for 46.1%.

In securities firms, the shortage of IT personnel was even more severe. Among a total of 12,400 employees at Mirae Asset Securities, Korea Investment & Securities, NH Investment & Securities, and Samsung Securities, only 856 were IT personnel, accounting for just 6.9%. Korea Investment & Securities, which recently suffered from mobile trading system (MTS) and home trading system (HTS) errors, had an IT personnel ratio of about 9.9%. Samsung Securities (6%), NH Securities (6%), and Mirae Asset Securities (5.9%) all had IT personnel ratios well below 10%.

Assemblyman Kang said, "The poor hiring performance of IT personnel in the financial sector raises serious concerns about whether the sector can effectively respond to new security risks amid the acceleration of digital transformation in finance." He added, "The Financial Services Commission should specify the level of IT personnel secured by financial companies, which is currently only a recommended measure under the Financial Security Governance Guide of the Financial Security Institute, in subordinate regulations of the Electronic Financial Transactions Act, which is currently being revised, by collecting domestic and international cases and industry opinions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)