Exemption from External Audit for Listed Companies with Assets Under 100 Billion KRW

Including Unlisted Companies with Assets Under 500 Billion KRW

External Audit Setup Cost Next Year: 46 Million KRW

Annual External Audit Cost Savings: 46 Million KRW

[Asia Economy Reporter Ji Yeon-jin] The government has decided to exempt external audits of internal accounting control systems for listed companies with assets under 100 billion KRW, scheduled to be introduced next year. Approximately 800 small-scale listed companies are expected to save about 450 billion KRW annually in external audit costs.

The Financial Services Commission announced the 'Measures to Rationalize Accounting Burden for Small and Medium Enterprises' containing these details on the 5th.

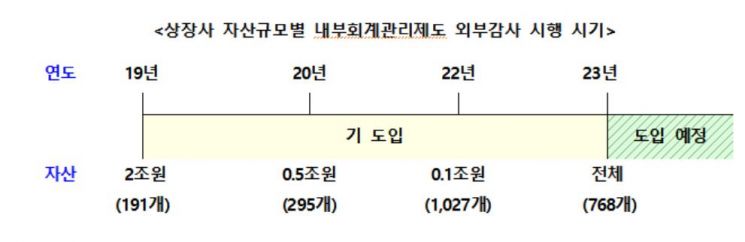

The internal accounting control system is an internal control system that companies must establish and maintain to ensure the reliability of financial information. Listed companies have been subject to external audits of their internal accounting control systems since 2019, depending on their size. This year, listed companies with total assets of 100 billion KRW or more were included, and next year, it was planned to expand to listed companies with assets under 100 billion KRW.

However, it was pointed out that small-scale listed companies have small transaction volumes and simple business structures, making the costs of external audits of internal accounting control systems exceed the benefits.

Accordingly, the Financial Services Commission decided to exempt small-scale listed companies with assets under 100 billion KRW from external audits of internal accounting control systems and maintain a review method where external auditors question the internal accounting operation status report prepared by the CEO.

Additionally, the exemption standard for unlisted companies will be raised to 500 billion KRW in assets, and companies with assets below this threshold will be exempt from external audits of internal accounting control systems. Currently, only special purpose companies (SPC) with legal grounds are exempt from external audits, but going forward, exemptions will be granted regardless of asset size or legal basis.

Strengthening Disclosure of Internal Control Activities Instead of Exemption from Internal Accounting Control System

Instead, the Financial Services Commission plans to prepare detailed disclosure formats that include internal control activities performed by management to prevent fraud in the 'Internal Accounting Operation Status Report,' which must be disclosed by corporations subject to business report submission, in anticipation of internal accounting fraud such as embezzlement arising from this regulatory relaxation.

The format includes controls over fund fraud (fund transfers, records, reconciliation, and physical controls), comprehensive fraud risk assessments, general IT controls, and identification of fraud incentives and pressures related to compensation policies.

Furthermore, companies will be encouraged to actively disclose additional controls implemented to prevent or detect fund fraud such as embezzlement. To this end, the current standard that selects KOSDAQ-listed companies for a substantial review of listing eligibility if they receive two adverse audit opinions on internal accounting control systems from external auditors will be abolished. However, the system that designates a company as an investment caution item if it receives one audit opinion refusal to alert investors will be maintained.

If accounting fraud occurs and is self-disclosed, sanctions will be mitigated by one level, and if management reports no significant vulnerabilities in internal accounting, sanctions will be increased by one level.

Additionally, a casebook will be created and distributed to promote opinion exchanges between companies and auditors during external audits, and a Small and Medium Enterprise Accounting Support Center will be established at the Korea Exchange to support the preparation of accounting standard inquiries and responses, provide consulting on financial statement preparation, and assist with difficulties in audit contracts.

Accounting Fraud Whistleblower Rewards to Triple

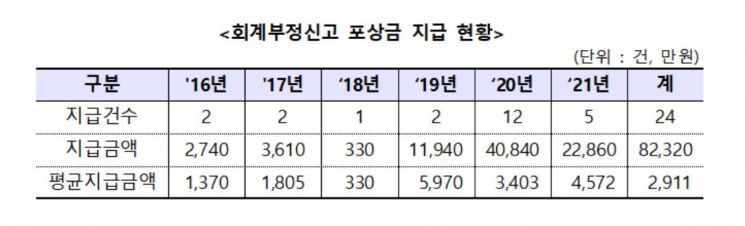

Rewards for reporting accounting fraud in companies subject to external audits will also be significantly increased. Currently, whistleblowers can receive up to 1 billion KRW, but due to various deduction factors such as the specificity of the report and evidence, the average reward per case last year was only 45 million KRW.

However, the per-case reward cap will be doubled from the current 500 million KRW, and deduction factors in reward calculations will be minimized to only the core elements. The Financial Services Commission explained that this could increase the size of rewards per case by more than three times compared to the current level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.