[Asia Economy Reporter Myunghwan Lee] The big fish have disappeared from the initial public offering (IPO) market. It appears to be due to the shrinking IPO market amid increased stock market volatility caused by concerns over economic recession and tightening measures. The proportion of large-scale IPOs with a public offering size exceeding 100 billion KRW among all IPOs has also decreased.

According to IRQduss, a specialized IR consulting firm, a total of 48 companies (excluding SPACs and previous listings) newly listed on the domestic stock market from the first quarter to the third quarter of this year (January 1 to September 30). By market, 4 companies were newly listed on KOSPI, and 44 companies on KOSDAQ.

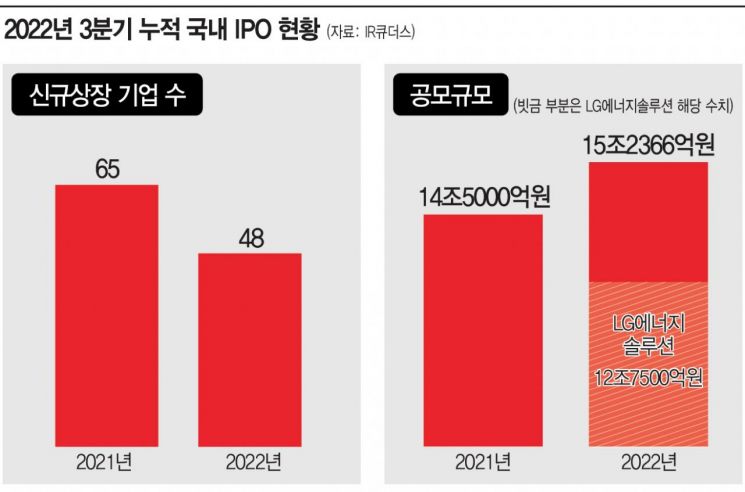

This is a significantly reduced figure compared to the same period last year. From the first quarter to the third quarter last year, a total of 65 companies went public on the domestic stock market. Compared to last year, the number of newly listed companies decreased by about 26.15%.

However, the total public offering size through the third quarter of this year recorded 15.2366 trillion KRW, an increase compared to 14.5 trillion KRW in the same period last year. But this is attributed to the listing of LG Energy Solution in January, which is considered the largest IPO ever. The public offering size of LG Energy Solution alone reached 12.75 trillion KRW. Excluding LG Energy Solution, the public offering size shrank to 2.4866 trillion KRW, which is only about 20% of the same period last year.

The proportion of large-scale IPOs with a public offering size exceeding 100 billion KRW also decreased. Among IPOs through the third quarter this year, only 5 cases (10.42%) had a public offering size exceeding 100 billion KRW. Considering that 14 companies (21.54%) exceeded 100 billion KRW in public offering size last year, it can be interpreted that the proportion of small and medium-sized IPOs has increased.

The popularity of public subscription for IPO shares has also cooled. Through the third quarter this year, about 20% of newly listed companies, or 10 companies, had subscription competition rates exceeding 1000 to 1. In the same period last year, nearly half of the newly listed companies, 33 companies (50.77%), had subscription competition rates exceeding 1000 to 1.

When dividing subscription competition rates into general subscription and institutional subscription, the low interest of general investors in the IPO market becomes even more apparent. According to Eugene Investment & Securities, the institutional demand forecast competition rate for the IPO market in the third quarter this year was 968:1, and the general subscription competition rate was 663:1. Eugene Investment & Securities explained that the average general subscription competition rate in the third quarter this year is lower than the third quarter competition rates over the past five years. Researcher Jongseon Park of Eugene Investment & Securities diagnosed, "While institutions have steadily maintained interest through IPO public offering funds, individual investors have reflected concerns as market volatility increases."

Despite the IPO market showing little sign of boom, new listings by companies are expected to continue in the fourth quarter. According to IRQduss, 43 companies newly submitted listing applications during the third quarter. Among them, 5 companies had their listing reviews approved as of the 30th of last month.

However, the drought of large-scale IPOs is expected to continue in the fourth quarter. Researcher Park said, "The fourth quarter is expected to see the highest number of companies pursuing listings this year," but added, "There will not be many large-scale companies."

As volatility is expected to continue in the fourth quarter, caution is required in investing in public offerings. An IRQduss official said, "Attention should be paid to IPO challenges in unique industries in the second half (distribution platforms, online banks, subscription-based reading platforms, games, etc.)," but also diagnosed, "Due to market cooling caused by high inflation, high exchange rates, and high interest rates, a conservative approach to the IPO market in the second half is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.