Stepping Down from Co-CIO Position... Bridgewater "Management Succession Completed"

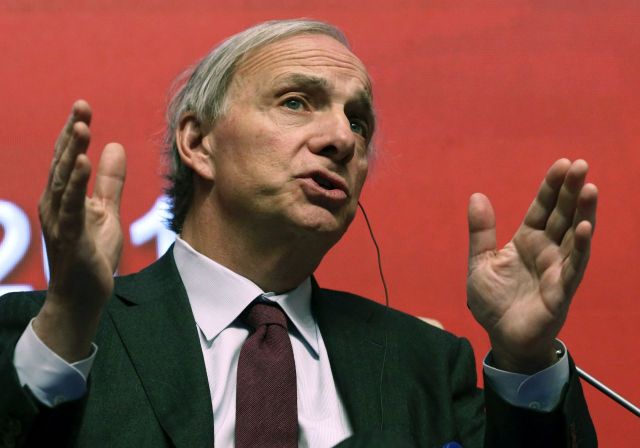

[Asia Economy Reporter Park Byung-hee] Ray Dalio, co-Chief Investment Officer (CIO) of Bridgewater Associates, the world's largest hedge fund, has handed over all his voting rights to the board and stepped away from Bridgewater's management. Dalio is the founder who established Bridgewater in 1975 and grew it into the world's largest hedge fund managing $151 billion (approximately 215.628 trillion KRW) in assets.

According to major foreign media on the 4th (local time), Bridgewater issued a statement under the name of its co-Chief Executive Officer (CEO), announcing that "the succession process related to Dalio's management rights has been completed."

Bridgewater stated, "The succession process was difficult and involved conflicts of opinion, but we have grown from a boutique (small investment advisory firm) founded by the entrepreneur into a long-lasting investment company and completed the succession to the next generation," adding, "Only a very small number of companies and founders have accomplished such a meaningful feat."

Dalio stepped down from his role as co-CIO, which he had held since 1985, as of the end of September, and plans to remain a member of the board to provide investment advice going forward.

In a post on social media that day, Dalio said, "The succession process was not easy," and added, "I intend to remain an investor, a board member, and a mentor until I die."

Dalio founded Bridgewater, initially a research company, in a two-bedroom apartment in Manhattan in 1975. The investment activities began in 1985, the company's tenth year. At that time, Bridgewater received a $5 million investment from the World Bank's pension fund and started bond trading. After years of rapid growth, it has become the world's largest hedge fund today.

Dalio held the roles of chairman, CEO, and CIO at Bridgewater but stepped down as CEO in 2017 and resigned as chairman at the end of last year.

Bridgewater is known for pursuing extreme transparency in investment. Internal employees could freely express their investment opinions, and conversations were often recorded and documented. Although there were external criticisms and some employees struggled to adapt to the unique corporate culture, Bridgewater continues to move toward its 50-year history as a successful hedge fund.

The succession process at Bridgewater has been ongoing for over ten years since 2011. It began when Greg Jensen and Eileen Murray, former Morgan Stanley executives, were brought in to manage Bridgewater. Jensen stepped down from the co-CEO position in 2016 after conflicts with Dalio but remains as co-CIO, continuing to assist Dalio. Murray left the company in 2019 and subsequently filed lawsuits against Bridgewater alleging issues of pay and gender discrimination, but both sides have now settled the lawsuits through agreement.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)