"Additional 400 Billion KRW Burden Due to Sharp Exchange Rate Surge" Naver Stock Falls 8% Amid Market Concerns

Valuation Adjustment Exceeds Exchange Rate Increase... Bold Decision Based on Synergy

"Exchange Rate Rose, but US Market Decline Lowered Corporate Value, Bought Cheaply"

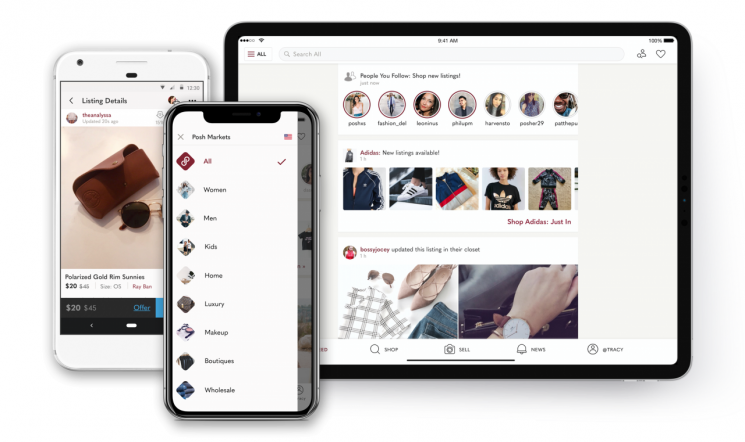

[Asia Economy Reporter Yuri Choi] Naver has bet 2.3 trillion KRW on Poshmark, the number one fashion secondhand trading platform in North America. Despite concerns about the 'expensive acquisition price' amid a significant depreciation of the Korean won, analysis suggests that the purchase was actually cheaper because the decline in the U.S. stock market exceeded the rise in the dollar's value. There are also expectations that adding Naver's strengths, such as advertising, to Poshmark's existing business model could lead to profitability in a short period.

Concerns Over Expensive Acquisition Due to Soaring Exchange Rate... Larger Valuation Adjustment

According to the IT industry on the 5th, Naver will acquire 100% of Poshmark's shares (91.27 million shares) at $17.9 per share. Naver valued the company at $1.2 billion and added Poshmark's cash holdings to reach a total valuation of $1.6 billion (approximately 2.3 trillion KRW). This deal is the largest acquisition among domestic internet companies, including Naver.

Some raised concerns that the price might be excessively high amid global economic uncertainties. The won-dollar exchange rate soared due to high-intensity tightening policies worldwide, increasing the acquisition cost. Reflecting this, Naver's stock price closed at 176,500 KRW, down 8.79% the previous day.

The exchange rate applied in this acquisition was 1,434 KRW per dollar as of the 30th. Considering the exchange rate was around 1,195 KRW at the beginning of the year, the acquisition could have been made for about 1.9 trillion KRW, which is 20% lower than the current acquisition price.

However, the story changes when looking at Poshmark's corporate value. As the U.S. stock market fluctuated and tech stocks plummeted, Poshmark's valuation was also adjusted. Reflecting this, Naver's valuation is $13.1 per share, nearly 30% lower than the $18.3 per share price at the end of last year when Naver began paying close attention to Poshmark. This means the valuation drop due to the stock price decline was greater than the price increase caused by the exchange rate.

Kim Nam-sun, Naver's Chief Financial Officer (CFO), explained, "The market value decreased due to external factors rather than Poshmark's intrinsic variables," adding, "We saw this as an opportunity to acquire a good company at an attractive price."

It was also evaluated as a reasonable price compared to competitors. Last year, Poshmark's main competitor, Depop, was sold to North American C2C company Etsy for $1.6 billion. Despite Poshmark's revenue being five times that of Depop, it was acquired at a price $400 million lower.

Expecting Synergy with Naver... "Will Generate Profit in a Short Period"

Although the acquisition could have been postponed until the exchange rate decreased, Naver decided not to delay considering synergies. Poshmark's growth potential is clear, and there are many areas to link with Naver's services, leading to a bold decision. CFO Kim also stated, "While it may seem expensive due to exchange rate fluctuations, we hold a lot of dollars and have hedging strategies, so there is no need to reconsider."

There is an analysis that the U.S. C2C market's growth potential is solid. According to market research firm Activate Consulting, the U.S. secondhand market is worth $80 billion (approximately 114 trillion KRW). It is expected to grow at an average annual rate of 20%, reaching $130 billion (approximately 185 trillion KRW) by 2025.

Poshmark's transaction volume has also grown 20-30% annually. It has 80 million cumulative users, with last year's annual transaction volume at $1.8 billion (approximately 2.6 trillion KRW) and revenue at $330 million (approximately 470 billion KRW). However, due to global conditions and the transition to COVID-19 endemic this year, the transaction growth target has been lowered to the 10% range, and operating profit has turned negative.

Naver expressed confidence that profitability will soon be restored. It explained that growth rates will return to previous levels based on a solid business model and user loyalty. Poshmark operates on a business model charging 20% commission on transaction volume and posted EBITA last year. Naver expects profitability to increase by applying its own technology to reduce costs and adding its advertising strengths to generate new revenue.

Naver CEO Choi Soo-yeon said, "Since the secondhand fashion market is still in its infancy, we see great potential," adding, "We will do our best to achieve growth that generates profits in a short period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.