Chairman Kim Byung-joo of MBK Gains Over 3.5x Valuation Profit from Investment in bhc

Last Year bhc Operating Margin 32.2%... This Year's Shareholder Dividends 156.8 Billion Won

"Management Focused Solely on Maximizing One Party's Profit May Face Backlash"

"Self-Regulation Should Precede, but Government Penalty Measures Also Needed"

Controversy Over 'Private Equity Funds Penetrating Local Small Businesses' Rekindled Ahead of National Assembly Audit

[Asia Economy Reporter Kim Yuri] Ahead of this year's national audit, controversy over 'private equity funds penetrating local small businesses' has reignited. It is pointed out that private equity funds, which tend to focus on short-term profits with an eye on resale, are investing in food service franchises and maximizing profits at the expense of livelihood-type franchisees. At the center of the controversy are the chicken franchise bhc and MBK Partners, a private equity fund (PEF) management company led by Chairman Kim Byung-joo.

According to the National Assembly on the 5th, Yoon Jong-ha, CEO (Vice Chairman) of MBK Partners, has been summoned as a witness for the Ministry of SMEs and Startups and the Korean Intellectual Property Office audit scheduled for the 6th under the Industry, Trade, and Small and Medium Venture Business Committee. Democratic Party lawmakers Kim Kyung-man and Kim Hoe-jae plan to question the situation where franchisees suffer damages due to private equity funds entering the food service franchise sector and securing investment profits.

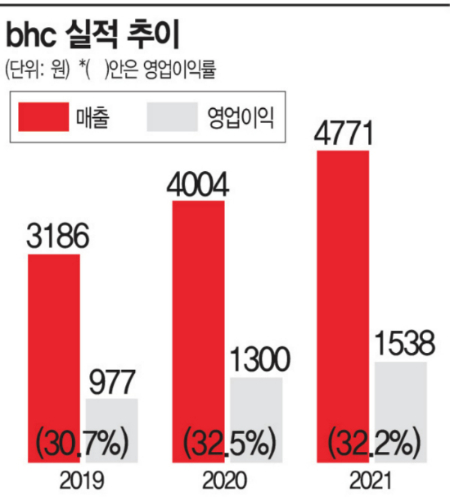

Last year, bhc recorded sales of 477.1 billion KRW and operating profit of 153.8 billion KRW. Compared to the previous year, sales increased by 19.2% and operating profit by 18.3%, marking record highs. The operating profit margin reached 32.2%, surpassing global IT companies like Apple and Google. It is also overwhelmingly higher than competitors such as Kyochon (5.7%) and BBQ (16.8%). Riding on strong performance, 156.8 billion KRW was allocated as shareholder dividends this year, which is 3 billion KRW more than last year's operating profit.

MBK Partners is the largest shareholder of bhc. In 2018, MBK Partners established an affiliate, MBK Partners Special Situations Fund, and invested about 150 billion KRW in bhc's holding company convertible bonds (CB) along with the Ontario Teachers' Pension Plan (OTPP) from Canada. At that time, they formed a consortium with bhc Group Chairman Park Hyun-jong and Elevation Equity Partners to acquire bhc.

In 2020, MBK increased its stake in bhc to nearly 60% by reinvesting. The total amount MBK invested in bhc, including reinvestment, is known to be about 570 billion KRW. During this period, bhc increased its corporate value from 680 billion KRW in 2018 to 1.8 trillion KRW in 2020 (as evaluated by external agencies) based on its high operating profit margin. With acquisitions such as Outback Steakhouse last year, bhc's corporate value has grown to be evaluated at up to 3.4 trillion KRW. According to this, MBK has gained more than 3.5 times the value relative to its actual investment, even considering its shareholding ratio.

"Private Equity Funds Focused on Short-Term Profits Maximize Gains at the Expense of Livelihood-Type Franchisees," Critics Say

Franchise businesses are based on goods transactions between headquarters and franchisees, so when headquarters maximize profits, franchisees' earnings decrease accordingly. The industry points out that if private equity funds focus solely on maximizing profits, the franchise ecosystem centered on small business owners could be damaged. Some believe that private equity funds also influenced the maximization of differential franchise fees taken by headquarters. The margin secured in this way resulted in a 32.2% operating profit margin, and large sums were distributed as shareholder dividends, including to MBK. The industry views that most private equity funds must recover their investments within a set period, so they prioritize short-term performance and do not hesitate to increase distribution margins, an easy way to generate profits.

Experts have suggested measures such as sharing a portion of profits with franchisees when liquidating profits and selling funds to address these issues. However, what must precede this is improving the private equity fund industry's perception that market principles are the absolute good and fostering self-regulation within the industry. Among the ESG (Environmental, Social, Governance) topics recently highlighted, the social aspect requires franchises to consider various stakeholders, including headquarters, franchisees, suppliers, and consumers. Management styles focused on maximizing the interests of one party may face backlash.

Professor Jung Yeon-seung of Dankook University's Business Administration Department said, "Private equity funds generally consider coexistence and symbiosis with various stakeholders less than typical entrepreneurs. A structure where some partners bear more pain while headquarters earn more money, and a unilateral profit-first approach, is not welcomed in the market," adding, "I believe self-regulation should be prioritized, but government penalties may also be necessary if needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.