New Leadership, Real Competition at the Global IT Headquarters in Silicon Valley

Building a Global C2C Portfolio in Japan, Southeast Asia, Europe, and North America

Actively Targeting the North American MZ Generation Community

[Asia Economy reporters Yuri Choi and Nahum Kang] Naver is acquiring Poshmark, a secondhand fashion platform known as the North American version of 'Danggeun Market.' Having long invested in peer-to-peer (C2C) platforms with a global market in mind?covering Korea, Japan, and Europe?Naver plans to add the North American market to its portfolio and engage in full-scale competition with global big tech companies.

Acquisition Amount of 2.3 Trillion KRW... Largest Big Deal Since Company Founding

On the 4th, Naver announced its acquisition of Poshmark. Naver valued Poshmark at $17.9 per share (25,760 KRW), with an enterprise value of $1.2 billion (1.7268 trillion KRW). The acquisition amount totals approximately 2.3441 trillion KRW, marking the largest deal in Naver's history.

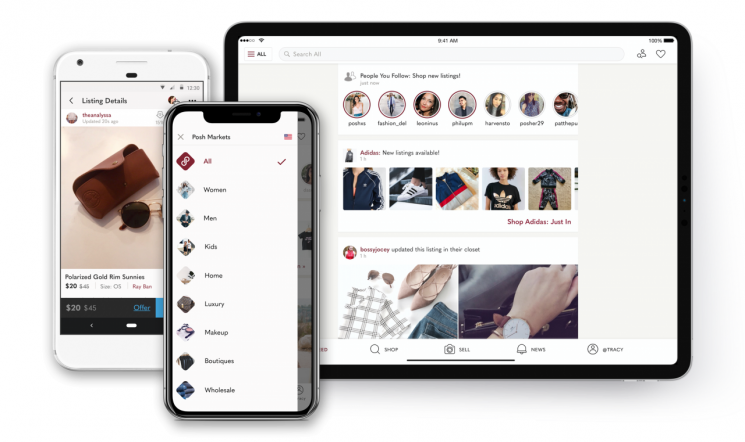

Poshmark is a leading U.S. C2C platform combined with community services. Since its establishment in 2011, it has secured over 80 million users. Naver has actively invested in the global C2C market, including Korea's Cream, Japan's Vintage City, and Europe's Vestiaire Collective.

This merger and acquisition (M&A) was realized as both companies agreed that, based on their mutual understanding of the values and consumption patterns of the MZ generation (Millennials + Gen Z)?the core demographic of the next-generation market?and their generous technological investments, they could create greater growth together.

This acquisition is also the first global 'big deal' since CEO Choi Soo-yeon took office. As growth in the core advertising business slowed, Naver took a bold step into commerce and concretized this strategy through M&A. The plan is to engage in serious competition with Poshmark as a foothold in the global IT headquarters.

CEO Choi explained the acquisition background during a conference call related to the Poshmark deal, saying, "We judged that the most optimal field where we can directly secure a business base and utilize the latest technology trends and human networks we possess is C2C fashion commerce."

She added, "As a Korean company in Silicon Valley, the global IT industry hub, we will continue to innovate and challenge ourselves to achieve a higher level of growth. We will create a new trend in the global C2C market by providing differentiated experiences that span shopping, webtoons, and K-pop content to future core users."

Naver CFO Kim Nam-sun also stated, "Despite the macro environment, we believed now was the right time to pursue the acquisition. Given the significantly lowered external valuations in capital markets, it was a great opportunity to acquire a good company at an attractive price."

Targeting North American MZ Generation Communities Centered on Content, Commerce, and Entertainment

The most notable aspect of Naver's acquisition of Poshmark is the shift of the company's core business axis from advertising to a C2C commerce platform that combines community and social networking, transplanted from Korea to the global market.

Among Poshmark's over 80 million users, 80% are composed of the MZ generation. Regardless of their country of origin or cultural background, they enjoy global content, appreciate stories in consumption and distribution, and pursue rational consumption, targeting the MZ generation.

Naver plans to integrate its proprietary technology into Poshmark and create synergies through content businesses. Using Naver's search, artificial intelligence (AI) recommendation, vision technology, and live commerce technology, it will provide innovative experiences to Poshmark users. Additionally, it will introduce differentiated services by linking the webtoon and web novel businesses, which are spreading mainly among the North American MZ generation, with commerce.

Global revenue growth effects are also expected. As of 2021, Poshmark's annual gross merchandise volume (GMV) reached $1.8 billion, with revenue of $330 million. In the second quarter, GMV was $480 million, and revenue was $90 million. Poshmark invests about 20% of its revenue in R&D, focusing on technology.

CFO Kim said, "Poshmark is a unique company among commerce firms that achieved positive adjusted EBITDA in 2020 and 2021. Although demand growth has slowed due to the COVID-19 endemic, we expect to quickly restore previous growth and profitability with Naver's technical support."

Building a Commerce Portfolio Connecting North America, Japan, and Europe

With this acquisition, Naver has established a global commerce portfolio connecting North America as a base with Korea, Japan, and Europe. Moving beyond domestic platforms, it will strengthen its commerce business by directly competing as a player in the global market.

Naver has steadily expanded its footprint in the global commerce market. Domestically, it operates the resale platform 'Cream'; in Japan, the vintage specialty platform 'Vintage City'; and in Europe, it has invested in the luxury resale platform 'Vestiaire Collective' through 'Corelia Capital K-Fund 1.'

Through Cream, Naver is expanding a commerce ecosystem connecting various countries by investing in Thailand's resale platform 'Sasom Company,' Singapore's used electronics trading platform 'Revello,' Malaysia's top sneaker resale platform 'Shake Hands,' and Japan's limited edition trading platform operator 'Soda.'

Previously, Naver mainly served as a platform connecting sellers and buyers domestically, but it is now directly entering the global market by acquiring competitive sellers. The initial focus is on the vertical C2C market, which is rapidly growing as a platform for transactions between individuals sharing the same interests within limited categories such as fashion, limited editions, and luxury goods.

A Naver official said, "We will proactively respond to the global C2C market's strong trend toward vertical platforms and secure long-term commerce competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)