Overseas Asset 'Mass Sale' by Gwanghae Mining Corp as Part of Restructuring

Concerns Over Undervalued Sales... Canadian Mine Sold for 43 Million KRW

Financial Structure Not Improving... Debt Increased by 2 Trillion KRW in 5 Years

Loss of Resource Development Momentum... Budget Cut by 90% in 10 Years

Narabri thermal coal mine in Australia, which the Korea Mine Reclamation Corporation is promoting for sale.

Narabri thermal coal mine in Australia, which the Korea Mine Reclamation Corporation is promoting for sale. Photo by Asia Economy DB

[Asia Economy Sejong=Reporter Lee Jun-hyung] The Korea Mine Reclamation Corporation (KMRC) sold off overseas assets one after another despite incurring losses worth hundreds of billions of won because restructuring for business normalization was the top priority. KMRC had been in a state of complete capital erosion for six years from 2016 to last year. This is why the Moon Jae-in administration, immediately after its inauguration in 2017, formed the "Overseas Resource Development Innovation Task Force (TF)" and launched a large-scale restructuring of KMRC. The TF confirmed and announced in March of the following year its plan to sell all overseas assets held by KMRC.

The problem was that the "mass sale" of overseas mines did not lead to an improvement in KMRC's financial structure. KMRC's debt increased by nearly 2 trillion won over the five years of the previous government, from 5.43 trillion won in 2017 to 7.2642 trillion won last year. KMRC also spent 90.4% of its operating profit (216 billion won) on interest expenses last year. This was the result of the government sending a selling signal to the overseas market and KMRC itself lowering its price negotiation power by emphasizing "disposal" over "price."

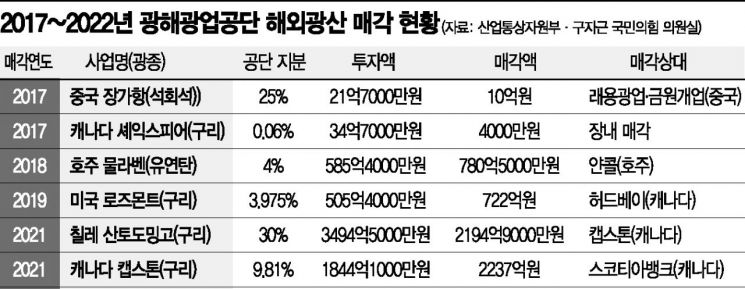

The Santo Domingo copper mine in Chile, which had a principal recovery rate of only 60%, is a case that clearly shows the "fire sale." There was even a case where an overseas mine was sold for the price of one Hyundai Motor Grandeur. KMRC sold its stake in the Shakespeare copper mine in Canada, which it had purchased for 2.4 million USD (about 3.5 billion won), for 30,000 USD (about 43 million won) in 2017.

Concerns about national wealth outflow have also increased. The government is handing over key mines that should be strategically secured for resource security to competing countries. In fact, except for the Shakespeare mine sold on the market, all major overseas assets disposed of by KMRC over the past five years were transferred to local companies. The Santo Domingo mine, bought cheaply by Canadian resource developer Capstone, is a representative example. The Moolarben thermal coal mine in Australia and the Rosemont copper mine in Canada were acquired by local mining companies Yankol and Hudbay, respectively.

Given this situation, there are also criticisms that overseas assets were disposed of based on political logic. From the perspective that if overseas resource development had not been stigmatized as a "deep-rooted evil," the conclusion to sell all overseas mines, which are key to resource security, would not have been reached.

The momentum for overseas resource development is also disappearing. According to the Ministry of Trade, Industry and Energy, the budget for the "Overseas Resource Development Special Loan Project" decreased by 89% over about ten years, from 309.3 billion won in 2010 to 34.9 billion won last year. The number of overseas resource development projects involving public and private companies decreased by 25%, from 535 cases in 2013 to 401 cases last year.

Meanwhile, KMRC's capital erosion is expected to continue for the time being. According to the "Public Institution 2022-2026 Mid-to-Long-Term Financial Management Plan" submitted to the National Assembly by the Ministry of Economy and Finance last month, KMRC's capital erosion will continue until 2025.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)