"Winter Season Soft Coal Demand Rises, Prices Keep Increasing... Producers Face Losses the More They Produce"

Electricity Cost Hike, Accounting for 25% of Production Cost, Also a Direct Blow... Struggling Amid '5 Highs'

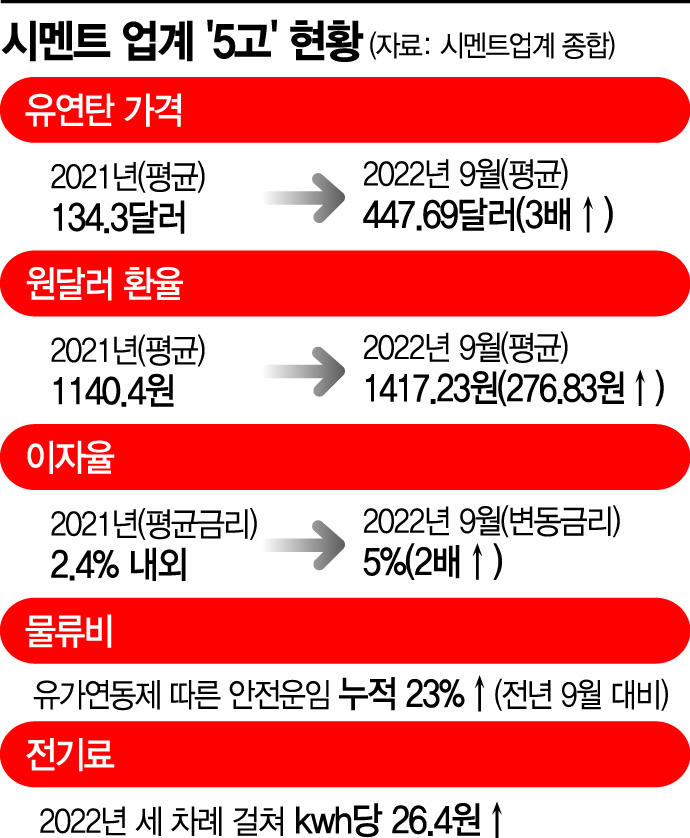

[Asia Economy Reporter Kim Jong-hwa] The cement industry is struggling with the '5 highs'?soaring thermal coal prices, high exchange rates, high interest rates, high logistics costs, and high electricity fees. The industry faced difficulties in the first half of this year due to the surge in thermal coal prices and the Cargo Solidarity strike. In the second half, profitability has further deteriorated as high exchange rates and high interest rates were followed by a significant increase in electricity fees.

According to the cement industry on the 4th, the average cost of goods sold (COGS) ratio for major domestic cement companies in the first half of this year was 83%, up about 5% from 78% during the same period last year. The COGS ratio indicates the proportion of costs in sales revenue. The lower the cost relative to sales, the higher the profit. Therefore, an increase in the COGS ratio means that the profitability of the cement industry has declined accordingly. A representative from Company A said, "The COGS ratio in the first half of this year rose significantly compared to the same period last year, and the situation is worsening," adding, "We are already at an emergency management level, and without resolving external crisis situations, it will be difficult to expect a turnaround."

The biggest cause of the rise in COGS is the surge in thermal coal prices. Typically, producing 1 ton of cement requires about 0.1 tons of thermal coal, which accounts for about 30% of production costs. According to GCI, a UK-based thermal coal price evaluation agency, the average thermal coal price from January to August this year was $344.7. In September, the average price reached $447.69, more than triple that of last year and over seven times higher than in 2020.

High exchange rates are forcing the industry to forgo profits. Reducing export volumes in the first half to stabilize domestic demand also had a negative impact. The three coastal companies Ssangyong C&E, Sampyo, and Halla Cement have supplied an additional 30% of their export volumes to the domestic market since April. With export volumes reduced, hedging has become impossible. Last year, the average KRW-USD exchange rate was 1,140.4 won, and the average from January to August was 1,253.9 won, which was a bearable level. However, with the average rate in September soaring to 1,417.23 won, up 276.83 won from last year, an industry insider said, "This is an unbearable situation. We have to worry about deficits rather than profits."

Environmental investments driven by the government's carbon neutrality policy are also at risk. The rise in interest rates has left no room for additional investments. According to the Korea Cement Association, the industry's capital investment this year is 538.6 billion won, exceeding the average investment of 368 billion won over the past five years. A representative from Company B said, "Last year's average interest rate was around 2.4%, but this year it has approached 5%, more than doubling," adding, "Due to variable interest rates, interest-bearing debt increased by 150 billion won this year alone. Although the investment was planned, if survival is threatened, it will inevitably be deprioritized."

The burden of logistics costs linked to oil prices has also increased. Following the basic freight and oil-linked freight rate increase on February 1, two additional hikes occurred in April and July, pushing this year's increase rate into double digits. A representative from Company C explained, "The cumulative increase in the safe freight system until September this year exceeds 20%," adding, "Operating expenses such as limestone transport vehicles and ship fuel costs have also risen by about 30%."

The electricity fee hike is a direct blow. In April, electricity fees increased by 9.8 won per kilowatt-hour (kWh), including a 2% climate environment charge, followed by a 5.0 won increase in July. On the 30th of last month, the government announced another electricity fee increase, raising fees by a whopping 16.6 won per kWh starting in October. This marks the third increase this year, totaling a 26.4 won per kWh rise. Electricity accounts for 25% of cement production costs, second only to thermal coal in the cost structure. The cement industry estimates that the electricity fee hike will increase manufacturing costs by about 80 billion won annually.

An industry insider said, "The government must have agonized before raising electricity fees, but the industry's difficulties are intensifying," adding, "The rapid rise in manufacturing costs means losses increase the more cement is produced, and although this situation is expected to continue for some time, there is no clear way to overcome it, which is a major concern."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.