Expansion of Jeonse Loan Limits for Youth and Newlywed Couples as a Support Measure

The maximum limit for the Buttress Jeonse Loan targeting young adults and newlyweds will be expanded to up to 300 million KRW.

On the 3rd, the Ministry of Land, Infrastructure and Transport announced that from the 4th, the loan limit for the Youth and Newlywed Buttress Jeonse Loan from the Housing and Urban Fund will be increased.

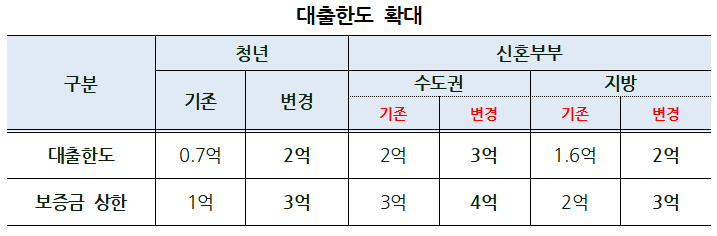

The youth-exclusive Buttress loan previously supported up to 70 million KRW for housing with a deposit of 100 million KRW or less, but going forward, it will support up to 200 million KRW for housing with a deposit of 300 million KRW or less.

For newlywed Buttress loans in the metropolitan area, the deposit ceiling will be raised from 300 million KRW to 400 million KRW, and the loan limit will increase from 200 million KRW to 300 million KRW. In non-metropolitan areas, the deposit ceiling will increase from 200 million KRW to 300 million KRW, and the loan limit will rise from 160 million KRW to 200 million KRW.

Additionally, a conversion loan will be introduced to allow those who used the Didimdol loan, a housing purchase loan from the Housing and Urban Fund before marriage, to switch to the preferential newlywed loan with a higher loan limit after marriage.

Until now, unmarried single household heads aged 30 or older who had received a Didimdol loan had to fully repay the existing loan if they wanted to purchase a larger home after marriage and apply for a newlywed preferential Didimdol loan.

However, by using the 'Lifecycle-type Purchase Fund Conversion Loan' introduced on the 4th, they can switch to the preferential newlywed loan without repayment procedures. This eliminates the cumbersome process and provides an additional 0.2 percentage point interest rate discount.

Furthermore, to alleviate the financial burden on Didimdol loan (purchase fund) users due to the recent sharp rise in interest rates, a temporary measure will be implemented for six months starting October 21.

This measure allows Didimdol loan users to switch from variable interest rates to fixed interest rates to prepare for interest rate fluctuation risks and permits mid-term changes to the current principal and interest repayment method.

Detailed information can be found on the Housing and Urban Fund website or the Fund e-Dundun website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)