Survey on Financial Conditions Awareness Among CFOs of Top 1000 Manufacturers by Sales

[Asia Economy Reporter Kim Pyeonghwa] It has been revealed that 3 to 4 out of 10 large corporations are struggling to cover interest expenses with their operating profits. There is a claim that even if the Monetary Policy Committee implements only a baby step by raising the base interest rate by 0.25 percentage points on the 12th, half of the large corporations could become vulnerable companies.

On the 3rd, the Federation of Korean Industries (FKI) announced this result after commissioning market research firm Monoresearch to investigate the financial conditions of 100 manufacturing companies among the top 1,000 companies by sales.

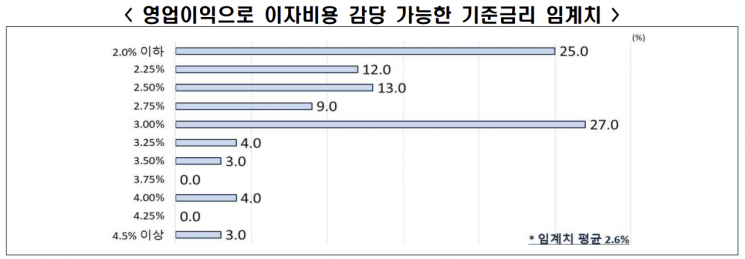

The FKI explained that the surveyed companies have an average base interest rate threshold of 2.6% at which they can cover interest expenses with operating profits. The base interest rate threshold is the level of the base interest rate at which interest expenses can be covered by operating profits. If the threshold is 2.25%, companies cannot pay interest with their earnings once the base interest rate exceeds 2.5%.

Looking specifically at the proportion of companies by base interest rate threshold, 25.0% have thresholds at or below 2.0%, and 12.0% at 2.25%, meaning more than 3 out of 10 companies (37.0%) are already struggling to cover interest expenses with operating profits at the current base interest rate (2.5%). Following this are ▲2.5% (13.0%) ▲2.75% (9.0%) ▲3.0% (27.0%) in order.

Based on this survey, the FKI pointed out that if the Bank of Korea implements a baby step on the 12th, raising the base interest rate to 2.75%, 5 out of 10 large corporations (50.0%) could become vulnerable companies. If a big step (raising the base interest rate by 0.5 percentage points) is taken and the base interest rate reaches 3.0%, the number of vulnerable companies would increase to about 6 out of 10 (59.0%).

Responding companies said that financial costs increase by an average of 2.0% each time the base interest rate rises by 0.25 percentage points. Regarding the outlook for interest rate hikes, they expected the rate to rise to 3.0% by the end of the year and increase further to 3.4% next year.

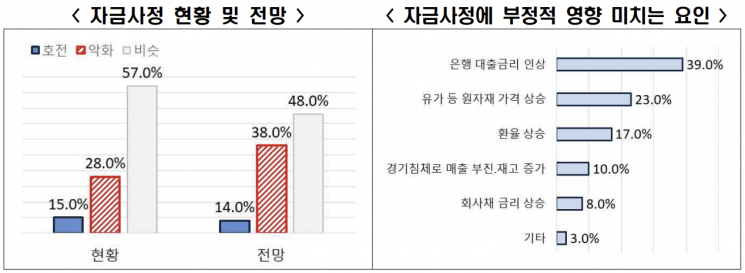

The financial conditions of companies were found to be similar to or worse than the same period last year. Specifically, when comparing to the same period last year, companies reported their financial conditions as ▲similar (57.0%) ▲worsened (28.0%) ▲improved (15.0%) in that order. The outlook is that financial conditions will deteriorate further toward the end of the year.

The reasons for worsening financial conditions were attributed to the three highs (高) phenomenon of high interest rates, high inflation, and high exchange rates. Specifically, the increase in bank loan interest rates (39.0%) and the rise in corporate bond yields (8.0%) accounted for the largest share of interest rate impacts (47.0%). The effects of rising raw material prices (23.0%) and exchange rates (17.0%) were also noted.

On the other hand, the prediction that corporate funding demand will increase until the end of this year was 37.0%, more than four times the 9.0% who expected a decrease. The expected areas of funding demand were ▲raw material and parts purchases (36.7%) ▲facility investment (23.0%) ▲loan repayments (15.0%) ▲labor and management costs (12.3%) in that order. The FKI explained that companies are actively securing raw materials and parts in anticipation of continued high inflation and high exchange rates.

When asked about difficulties in raising funds, responding companies pointed to ▲new loans and loan maturity extensions (33.3%) ▲exchange rate risk management (22.3%) ▲credit rating management (11.0%) among others. As tasks they hope policy authorities will address for stable fund management, they cited ▲minimizing volatility in foreign exchange markets such as exchange rates (24.7%) ▲interest rate hikes considering the financial resilience of economic agents (20.7%) ▲stabilizing supply of materials and parts through supply chain management (16.3%) among others.

Choo Kwang-ho, head of the Economic Department at the FKI, said, "Although additional interest rate hikes are inevitable given the situation where Korean and U.S. interest rates have inverted, careful interest rate hikes considering the financial resilience of economic agents are required as many companies are at their limit. It is necessary to minimize the burden on companies from interest rate hikes through measures such as stabilizing the foreign exchange market and expanding policy finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.