KB Financial '2022 Korea Single-Person Household Report'

[Asia Economy Reporter Buaeri] Four out of ten single-person households were found to be so-called 'N-jobbers' holding two or more jobs. As of last year, the number of single-person households in Korea surpassed 7 million. This figure is 1.8 times that of traditional Korean households consisting of four or more members.

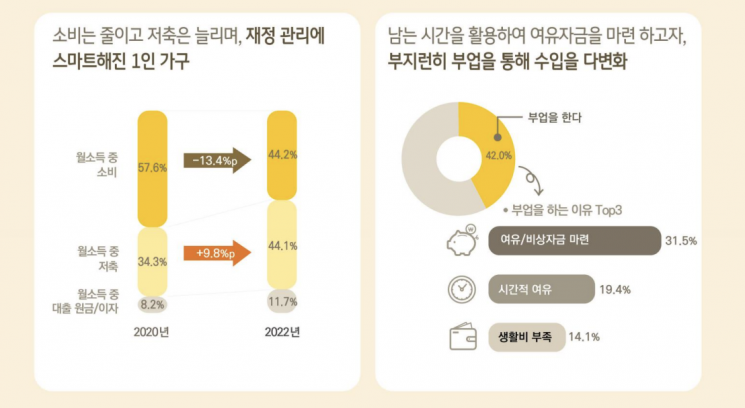

Contrary to the assumption that single-person households would spend more with a 'YOLO' (You Only Live Once) mindset, recent single-person households have reduced consumption and increased savings.

According to the '2022 Korea Single-Person Household Report' released by KB Financial Group Management Research Institute on the 3rd, an online survey of 2,000 single-person households aged 25 to 29 nationwide showed that 42% diversified their income through various side jobs.

The reasons behind being an N-jobber included securing extra or emergency funds (31.5%), having more free time (19.4%), and insufficient living expenses (14.1%).

The proportion of consumption in single-person household expenditures decreased by 13.4 percentage points from the previous survey (57.6%) to 44.2%. In contrast, savings increased by 9.8 percentage points to 44.1%.

In particular, people in their 20s did not lag behind other age groups in consumption, expenditure, and asset management. The institute diagnosed that this reflects the current single-person households who build and manage assets from a young age. More than half of single-person households answered that they "spend within their income" (56.3%) and "regularly check and adjust assets considering the financial environment or situation" (51.4%).

Breaking down the financial assets of single-person households by type, liquid assets (cash, demand deposits, CMA, MMF) accounted for the largest share at 41.8%, followed by savings/deposits (26.7%), and stocks, ETFs, futures, and options (19.1%). The proportion of liquid assets increased across all age groups, more than doubling among those in their 20s.

60.3% of single-person households also considered insurance enrollment essential. The insurance subscription rate rose by 13.4 percentage points from 2020 to 88.7%.

The average expected retirement age for single-person households was 63.2 years. Although they recognize the importance of retirement and old-age preparation, the actual preparation rate was 15.9%, down 6.4 percentage points from 22.3% in 2020.

The minimum amount of funds single-person households consider necessary for old-age preparation averaged 770 million KRW, and the most commonly used retirement preparation method was personal pensions. The proportion using personal pensions increased by 17.3 percentage points from 2020 to 62.5%.

The most common housing type for single-person households was 'apartments.' In the 2020 survey, the most common housing type was 'row houses and multi-family houses.' Currently, apartments account for 36.2% of the housing types occupied by single-person households. The proportion of single-person households living in medium to large-sized homes has steadily increased since 2019, and the desire to expand living space has grown even after COVID-19.

Among single-person households aged 30 to 49, the top 10% income earners, called 'Rich Singles,' had twice the average monthly income of typical singles. Although the proportion of consumption in their monthly income was lower than average, their savings ratio was higher, and they actively managed surplus funds.

For Rich Singles, consumption accounted for 30.1% of monthly income, compared to 40.8% for typical singles. Rich Singles had a higher proportion of investments in funds, stocks, or long-term products such as pensions.

More than half of Rich Singles held financial assets ranging from 50 million to less than 300 million KRW. Their monthly savings amounted to 2.04 million KRW, 2.5 times that of typical singles (820,000 KRW).

The retirement funds Rich Singles considered necessary ranged from 1.25 billion to 1.55 billion KRW, 1.6 times higher than the average.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.