[Asia Economy Reporter Minji Lee] Porsche has been listed on the stock market as the 5th largest global automaker by market capitalization, and analysts predict a positive stock price trend. This is based on the expectation that demand will increase due to its electric vehicle competitiveness and attractive dividends.

On the 2nd, Porsche's stock price was 82.48 euros, similar to the public offering price of 82.5 euros. On the listing day, the 29th, it even rose to 86.18 dollars. Meanwhile, Volkswagen's stock price fell more than 8% over two days following Porsche's listing, showing a downward trend. This reflects the conversion demand to Porsche.

The Volkswagen Group split its entire 100% stake in Porsche into common shares and preferred shares equally to list the sports car brand Porsche. Among the preferred shares, 25% were listed on the stock market. This means that 12.5% of the total shares were listed. Qatar Investment Authority acquired 4.99% of the preferred shares, approximately 2.5% of the total shares, and Abu Dhabi Investment Authority, Norway's sovereign wealth fund, and T. Rowe Price also participated as anchor investors. Porsche SE, controlled by the Porsche family, will acquire 25% of the voting common shares.

Porsche's corporate value is 75 billion euros (105 trillion KRW). Through this IPO, Volkswagen secured 19.5 billion euros (about 27 trillion KRW) in funds. Arno Antlitz, CEO of Volkswagen, the parent company, stated that about half of the raised funds, 9.6 billion euros, will be invested in electric vehicle production, and the rest will be distributed to shareholders as special dividends. The company plans to use about 49% of the total funds for special dividends early next year.

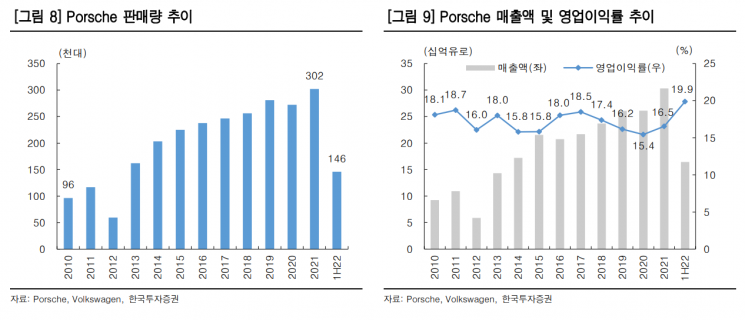

The decision on new investments is an important measure of cash flow capability amid an external environment of rising interest rates and growing recession concerns. Porsche's free cash flow last year was 3.4 billion euros, 2.5 times higher than in 2020. Annual sales were 33.1 billion euros, lower than Mercedes-Benz's 134 billion euros and BMW's 111.2 billion euros, which produce a large number of commercial vehicles, but Porsche's business model selling high-end vehicles results in relatively high sales margins. Porsche's gross profit margin is 26.7%, surpassing BMW (25.4%), Mercedes-Benz (22.9%), and Volkswagen (18.8%).

The strong trend in Porsche's stock price and the weak trend in Volkswagen's stock price are expected to continue for the time being. For popular models, Porsche has a waiting period of up to four years due to a backlog of orders. Jinwoo Kim, a researcher at Korea Investment & Securities, said, "As raw material costs rise and power shortages worsen, the role of solid order volume becomes more important," adding, "Porsche has proven top-level electric vehicle competitiveness through the Taycan, and Porsche's growth will continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)