Foreign Media's Negative iPhone Reports Affect Stock Prices

LG Innotek Increases Apple Sales Share by 75%

Challenges in Diversifying Substrate and Automotive Electronics Businesses

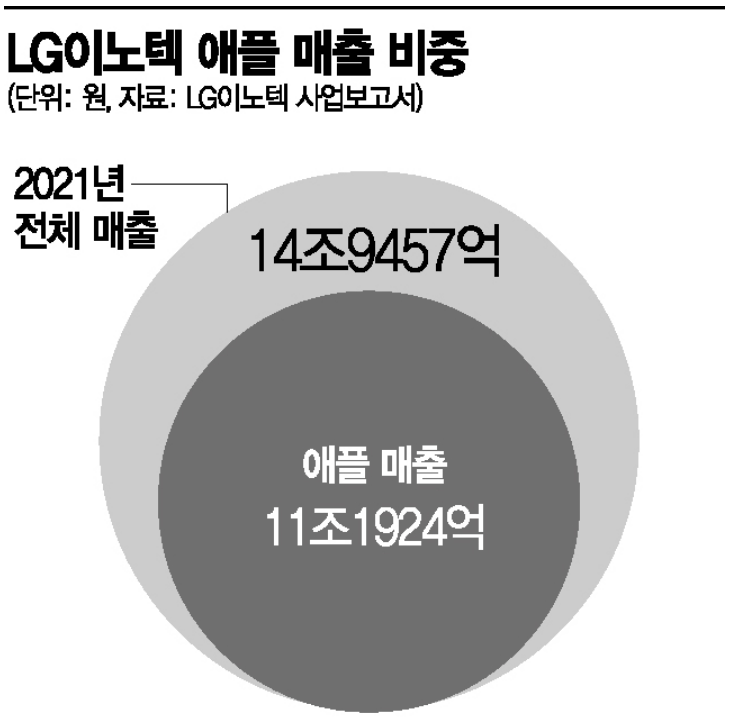

[Asia Economy Reporter Kim Pyeonghwa] LG Innotek, which achieved record-high performance last year thanks to Apple, is now struggling with iPhone issues. Following reports that the plan to increase production of the new iPhone 14 has been canceled and subsequent foreign media coverage about sluggish initial demand, the stock price has been affected. In the market, there is an evaluation that LG Innotek, with its 75% dependence on Apple, needs to overcome such risks through business diversification.

Stock Price Falls 23% in 6 Trading Days Due to iPhone Issues

On the 30th, according to related industries and foreign media, Apple reportedly withdrew its plan to increase production of the new iPhone 14 series, causing fluctuations in the New York stock market and a sharp drop in the stock price of LG Innotek, a major parts supplier. As of the closing price on the 22nd of this month, LG Innotek was at 355,000 KRW, but it showed a continuous decline for 6 trading days and closed at 273,500 KRW, down 22.96% on that day. On the 28th, it also recorded a closing price of 277,000 KRW, down 10.50% compared to the previous day.

LG Innotek is a representative Apple parts supplier. The proportion of Apple in LG Innotek's total sales increased to 75% (11.1924 trillion KRW) last year. In the second quarter of this year, the optical solutions division, which supplies camera modules to Apple, generated sales of 2.8035 trillion KRW, accounting for 75.72% of total sales. The news that Apple decided to cancel the additional production of 6 million units beyond the existing production plan (90 million units) for the iPhone 14 series, coupled with foreign media reports that initial shipments in China for the new product were sluggish compared to the previous model, affected LG Innotek, which has a large business share with Apple.

As LG Innotek's stock price plummeted, securities firms evaluated that market concerns were excessive. It is difficult to assess the success of the iPhone 14 series at this point, and LG Innotek's profits are significant in the high-end models of the iPhone 14 series, which have high demand. Kim Jisan, head of Kiwoom Securities Research Center, stated in a report on the 29th, "The plan to increase production by 6 million units was presumably made considering parts supply shortages and production disruptions before the launch," and predicted an upward revision of LG Innotek's performance through the iPhone 14 series. He also added that the fourth-quarter performance is expected to exceed market consensus (forecast).

Expanding FC-BGA Investment for Business Diversification

LG Innotek has increased its Apple business share relying on solid iPhone demand. According to market research firm Counterpoint Research, Apple is the number one player with a strong fan base, holding a 57% market share in the premium smartphone market priced above $400 (about 570,000 KRW) as of the second quarter of this year. In a situation where basic smartphone technology has been leveled up, Apple has competed with rivals such as Samsung Electronics in camera performance over recent years, increasing demand for high-performance camera modules. As a result, LG Innotek's Apple sales share rapidly increased from 37% in 2016 to 68% in 2020.

The electronics industry views LG Innotek's business portfolio as a double-edged sword. While LG Innotek benefits from Apple's performance, it is also vulnerable to rapid negative impacts from issues like this. Some argue that the significant sales share with Apple, which is selective in supplier selection, is proof of LG Innotek's technological prowess. However, concerns remain as variables may arise depending on Apple's business strategies such as supply chain diversification. This is why there are evaluations that business diversification should be pursued in areas such as substrate materials and automotive components, in addition to optical solutions.

To this end, LG Innotek is looking to expand its flip chip (FC)-ball grid array (BGA) business, a next-generation semiconductor substrate. In February, it announced a 413 billion KRW investment plan for FC-BGA facilities and equipment, officially entering the market. At that time, Son Gildong, head of LG Innotek's substrate materials division, said, "We will expand the substrate business from mobile to servers, PCs, communications, networks, digital TVs, and vehicles." In July, LG Innotek also announced plans to invest 1.4 trillion KRW to additionally secure production facilities related to camera modules and FC-BGA.

Additionally, LG Innotek is strengthening its automotive business by concretizing plans for mass production of in-vehicle radar products. LG Innotek supplies key components for autonomous vehicles such as vehicle-to-everything (V2X) communication and LiDAR to global automakers. Securities firms predict that if Apple Car enters the market in the future, LG Innotek could be the biggest beneficiary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)