Support for Conversion up to KRW 8.5 Trillion with Maximum Interest Rate of 6.5%

Application Acceptance to Implement 5-Day Rotation System Based on Business Registration Number for One Month

[Asia Economy Reporter Sim Nayoung] The Korea Credit Guarantee Fund announced on the 30th that it will implement a refinancing guarantee program that converts high-interest loans with an annual interest rate of 7% or higher for self-employed individuals and small business owners into low-interest guaranteed loans.

The support targets are individual business owners or small corporate businesses that have been affected by COVID-19 and are conducting normal business activities without any business suspension or closure, tax arrears, or loan delinquencies. The debts eligible for refinancing are business loans received before the end of May 2022, with an interest rate of 7% or higher at the time of refinancing application.

However, industries related to gambling and speculative businesses, entertainment bars, real estate leasing and sales sectors are excluded from the support. Loans that are difficult to consider as business loans, such as household loans, account loans, and leases, which are not appropriate for refinancing in line with the purpose of reducing financial burdens on business loans, are also excluded from refinancing targets.

The Korea Credit Guarantee Fund plans to supply 8.5 trillion KRW in refinancing guarantees by the end of 2023. The loan limit is 50 million KRW for individual business owners and 100 million KRW for small corporate businesses, with a term of 5 years.

The loan interest rate is fixed at the rate at the time of loan issuance for the first two years within a maximum range of 5.5%, and a variable interest rate is applied from the 3rd to 5th year with the agreed rate (bank bond AAA 1-year + 2.0%p) as the upper limit. Additionally, the guarantee fee is 1%, and early repayment fees are fully waived.

More detailed information can be found through the online refinancing guidance system, which was pre-opened on the 26th. Customers can directly check eligible loans or preliminarily assess their eligibility through this system.

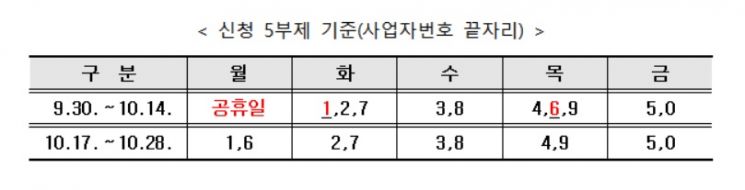

Applications for refinancing loans will be accepted from the 30th via mobile apps and branch counters of 14 banks. To minimize customer inconvenience during the initial implementation of the system, a five-day application schedule based on the last digit of the business registration number will be enforced for one month.

A Korea Credit Guarantee Fund official stated, “We hope that the low-interest refinancing guarantee will help alleviate the financial burden and enable quick business stabilization for self-employed individuals and small business owners who had no choice but to use high-interest loans due to the prolonged COVID-19 pandemic.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.