Operating Profit of 53 Trillion KRW in Q3... First Decline in 8 Quarters

Concerns Over Consumption Slowdown Due to Prolonged Tightening and Economic Recession

KOSPI Falls to 2130 Intraday on 30th, Breaking Yearly Low

[Asia Economy Reporter Minji Lee] As negative growth for listed companies in the third quarter becomes certain, there are forecasts that a stronger shock will hit companies in the fourth quarter. The prolonged tightening stance has further tightened the lifelines of companies due to consumption slowdown, high exchange rates causing increased raw material costs and interest burdens. The stock market broke its low again, falling to the 2130 level on the last day of the third quarter.

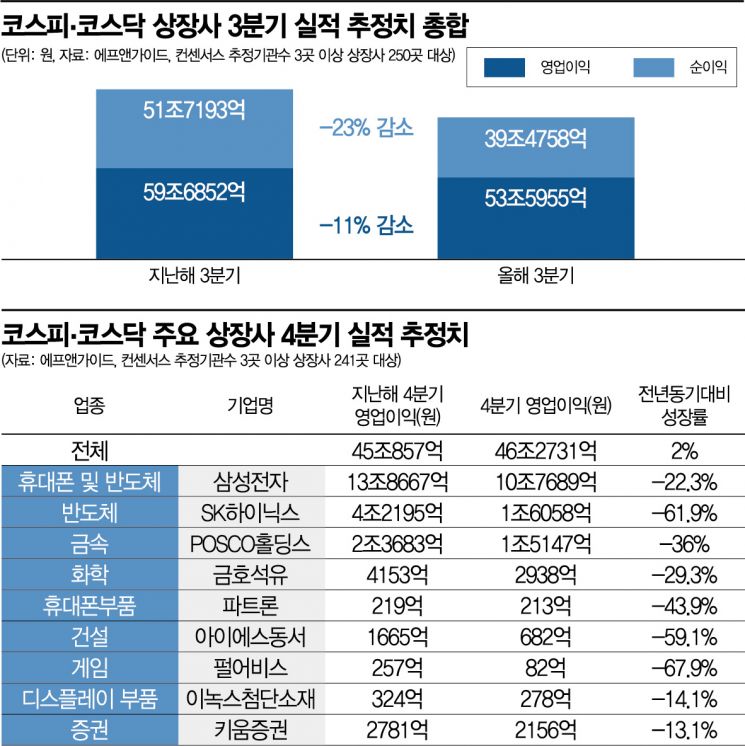

According to financial information provider FnGuide on the 30th, the estimated operating profit for the third quarter of 250 listed companies with consensus estimates from three or more institutions is 53.5955 trillion KRW, expected to decrease by 11% compared to the 59.6852 trillion KRW operating profit in the third quarter of last year. This is the first time in eight quarters since the third quarter of 2020 that the year-on-year operating profit estimate has shrunk. It is also estimated to decrease by more than about 7 trillion KRW compared to the previous quarter's operating profit of 60.3393 trillion KRW.

This is the result of the impact of rising interest rates continuing from the beginning of the year amid persistent high inflation being fully reflected in earnings. The concern over demand contraction has become a reality, and semiconductors, which have led the domestic economy, are expected to see operating profits plunge by more than 20% due to weakening IT demand. Other industries expected to see noticeable profit declines include display, steel, chemical, and securities sectors.

Kim Yong-gu, a researcher at Samsung Securities, explained, "As of the end of September, the KOSPI operating profit consensus is 233.2 trillion KRW for this year and 246.1 trillion KRW for next year, which is about 6.5% and 12.2% lower compared to the end of the second quarter." He added, "Considering domestic export sluggishness, worsening trade deficits, sharp margin declines due to rising prices and interest rates, and poor conditions in the semiconductor sector, the earnings environment for domestic companies is pessimistic."

The problem is that the third quarter is just a preliminary round for companies. Since major central banks are tightening monetary policy even more, the shock to the real economy is expected to be greater in the fourth quarter than in the third. This means the annual KOSPI operating profit estimates will further decline.

Currently, the estimated operating profit for the fourth quarter of 241 listed companies with estimates from three or more institutions is 46.2731 trillion KRW. It is estimated to grow slightly by about 2% (1 trillion KRW) compared to the same period last year (45.0857 trillion KRW), but considering factors such as the Bank of Korea's stance change on interest rate hikes and delayed recovery of the Chinese economy, the downward trend in estimates is expected to deepen. The third quarter operating profit estimates for companies have fallen more than 12% from the peak since May, and have decreased by 3% in just the past month.

In the fourth quarter, semiconductor and related component stocks are expected to continue their sluggish performance, similar to the third quarter. Samsung Electronics is estimated to record an operating profit of 10.7689 trillion KRW in the fourth quarter, which is 22.3% lower than a year ago. SK Hynix is also expected to record 1.6058 trillion KRW, down 62%. Concerns that DRAM and NAND flash prices will fall further than the decline in the third quarter have worsened earnings forecasts. According to market research firm TrendForce, DRAM prices are expected to fall by up to 18% and NAND flash prices by about 20% quarter-on-quarter in the fourth quarter.

The chemical sector remains bleak due to the burden of large-scale expansion volumes and weak demand in China. Kumho Petrochemical is estimated to see profits decrease by about 30% compared to a year ago, and Lotte Fine Chemical (-9%) and Hyosung Chemical (-6.5%) are in the same situation. Additionally, sectors such as securities, construction, and cosmetics are expected to see lower profit levels due to stock market sluggishness, high oil prices and domestic housing project contraction, and decreased demand for cosmetics in China.

On the other hand, secondary battery listed companies are expected to continue strong performance in the fourth quarter. Solid front-end demand and exchange rate effects are expected to support earnings. Battery cell maker LG Energy Solution is expected to post an operating profit of 450.5 billion KRW, a 494% increase compared to a year ago, and EcoPro BM (336%), SoluM (268%), L&F (234%), and POSCO Chemical (161%) are expected to achieve triple-digit profit growth.

Meanwhile, influenced by the sharp decline in the US stock market, the KOSPI hit a new yearly low during trading on the 30th. Due to concerns over global companies' earnings amid economic recession, the index fell to the 2130 level, showing extremely deteriorated investor sentiment. The index opened down 9.82 points (0.45%) at 2161.11, fluctuated around the 2160 level in early trading, then widened its decline to fall below the 2150 level, breaking below the yearly low of 2151.60 recorded on the 28th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)