BBC Interview "Tax Cuts Will Promote Long-Term Growth"

"Wealthy Tax Cuts Are Unfair If They Lead to Recession"

Pound Rises Over 2%, Recovers to $1.1 per Pound

[Asia Economy Reporter Park Byung-hee] UK Prime Minister Liz Truss has stated that the large-scale tax cut policy, which caused the pound to plummet to an all-time low, is correct and expressed her intention to stick to the tax cut policy. Despite the significant turmoil in the UK financial market following the ambitious tax cut policy announcement and increasing criticism directed at her, she conveyed her determination to confront the situation head-on.

On the 29th (local time), BBC reported that Prime Minister Truss argued that urgent measures are needed for UK economic growth and that tax cuts will promote economic growth in the long term.

In an interview with the BBC, she responded to the criticism that the UK is in an economic crisis by emphasizing that the global economy is currently in crisis, implying that it is not a problem unique to the UK.

Regarding the sharp drop in the pound, Truss said that all currencies worldwide are declining due to the strong dollar. She questioned the notion that the UK economy is in crisis, stating, "I am not saying there is no crisis at all, but the UK is in a very serious situation, and the whole world is experiencing a crisis due to the COVID-19 pandemic and the Ukraine war."

In response to criticism that lowering the top income tax rate from 45% to 40% benefits the wealthy, Truss replied that if tax cuts cause a recession, that would be unfair. Her logic is that tax cuts are fair because they will lead to UK economic growth.

Truss emphasized that there is much evidence that tax cuts promote economic growth and that she will maintain her growth policy through tax cuts and increased fiscal spending. She added that although it is controversial, she is prepared to make difficult decisions.

Kwasi Kwarteng, the Chancellor of the Exchequer and a longtime political ally of Prime Minister Truss, also emphasized his commitment to the growth policy on the same day. In a separate interview, he said, "Maintaining the growth policy and helping people through the energy bill are the two top priorities." Kwarteng is also facing calls for resignation. However, through social media on the same day, he sent a message to fellow lawmakers stating, "We will confirm to the market that our growth policy is valid, reliable, and will lead to growth." He criticized the previous approach of continuously raising taxes as unsustainable and appealed to his colleagues for support, saying, "I understand your concerns, but we are one team and must stay focused."

Labour Party MP Rachel Reeves criticized the tax cut policy, referring to it as a kamikaze fiscal policy that is instead killing the UK economy. She said, "Prime Minister Truss's interview will worsen the disastrous situation."

BBC reported that the Labour Party demanded the Conservative Party cancel its party conference and immediately convene Parliament, but the Truss government refused. The UK Parliament is in recess until October 11, and the Conservative Party will hold its annual conference in Birmingham from October 2 to 5. Truss is scheduled to deliver a speech at the conference on the 3rd.

After falling to an all-time low of around $1.03 per pound on the 26th, the pound continued a strong rebound trend following the Bank of England's (BOE) announcement on the 28th of a ?65 billion government bond purchase plan.

According to Bloomberg News, the pound's value against the dollar surged more than 2% that day, with the pound-dollar exchange rate recovering to around $1.11. The pound had also risen 1.5% the previous day.

The euro also strengthened that day, somewhat easing the dollar's extreme strength caused by the pound's sharp decline earlier in the week.

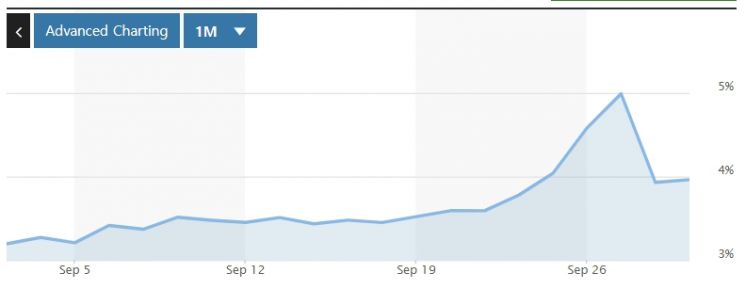

The UK government bond market also showed signs of stabilization. The 30-year government bond yield closed at 3.95%, slightly up by 0.03 percentage points. The previous day, the 30-year bond yield had plunged by 1.06 percentage points.

The 30-year bond yield was 3.77% as recently as the 22nd but skyrocketed after the UK government's announcement of large-scale tax cuts on the 23rd, reaching 4.98% on the 27th. Notably, during trading on the 27th, it exceeded 5% for the first time since 2002. This was due to concerns that the UK government’s large-scale tax cut policy would lead to massive bond issuance, causing fiscal instability and worsening inflation.

In particular, the sharp rise in bond yields led to massive bond sell-offs by pension funds that had invested in bond-linked derivatives. These pension funds had invested in derivatives using government bonds as collateral, but as bond yields surged, the value of the collateral bonds plummeted, triggering margin calls requiring additional collateral deposits. To meet these margin calls, pension funds sold large amounts of long-term government bonds, and as bond yields rose further, this created a vicious cycle of continued bond selling.

However, the sharp rise in bond yields has calmed following the BOE's announcement of the ?65 billion bond purchase plan. Nonetheless, there are concerns that the BOE's large-scale bond purchases could backfire by stimulating inflation, and there is a possibility that the UK financial market could plunge into turmoil again.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.