August Industrial Activity Trends

[Asia Economy Sejong=Reporter Son Seon-hee] Industrial production has been sluggish for two consecutive months recently. In particular, semiconductor production, a key export item supporting the Korean economy, contracted at the largest rate in 13 years and 8 months, causing the economic recovery trend to falter.

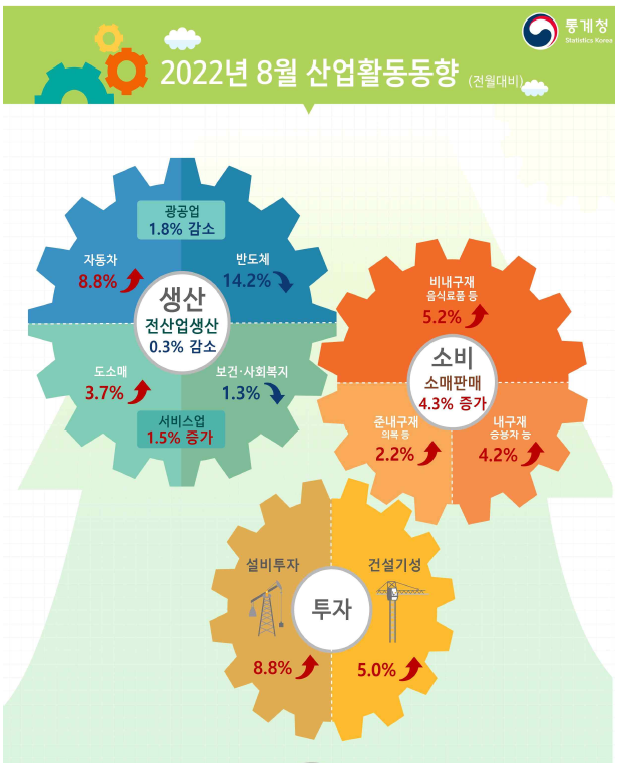

According to the industrial activity trend released by Statistics Korea on the 30th, the August total industry production index (seasonally adjusted, excluding agriculture, forestry, and fisheries) was 117.4 (2015=100), down 0.3% from the previous month. Total industry production declined for two consecutive months after turning negative in July (-0.3%). While the service sector increased by 1.5%, manufacturing and other mining and manufacturing industries (-1.8%) and public administration (-9.3%) decreased.

Oh Woon-seon, the Economic Trend Statistics Officer at Statistics Korea, explained, "Although domestic demand and service sector production showed favorable performance in retail sales and facility investment, exports and mining and manufacturing production were somewhat sluggish, causing the economic recovery and improvement trend to stall following last month."

Mining and manufacturing production fell for two consecutive months following July's decline (-1.3%), with semiconductor production dropping by 14.2%. This decrease was the largest since December 2008 (-17.5%), 13 years and 8 months ago. Semiconductors have shown continuous weakness this year. After recording negative production for three consecutive months in March (-2.2%), April (-3.6%), and May (-1.8%), production seemed to rebound in June (4.2%) but turned negative again in July (-3.5%), with the decline significantly expanding last month. Semiconductor production also contracted by 1.7% year-on-year, marking the first production decline compared to the previous year since January 2018 (-1.7%). This is attributed to export stagnation due to China's lockdown measures and weakened IT demand amid concerns over global economic slowdown caused by major countries' tightening policies.

The decrease in public administration production is interpreted as a result of reduced vaccine purchase expenditures following the easing of the COVID-19 outbreak last month.

The retail sales index (seasonally adjusted), which indicates consumption trends, rose 4.3% to 122.9 (2015=100). After five consecutive months of decline since March (-0.7%), it rebounded last month. Demand for food and beverages increased due to the COVID-19 impact, and sales of passenger cars rose as supply disruptions in imported cars were partially resolved. Officer Oh assessed, "Overall consumption continues to show an improving trend."

Facility investment increased by 8.8% last month, and construction performance also grew by 5.0%. The coincident index of economic indicators, which reflects the current economy, rose 0.5 points from the previous month to 102.3, but the leading index, which predicts future economic conditions, fell 0.2 points to 99.3.

Officer Oh said, "The economic improvement trend continues, centered on domestic demand and the service sector," but added, "There are downside risks such as the uncertain development of the Ukraine situation, continued lockdown measures in China, and worsening financial conditions due to accelerated global tightening." He continued, "There are also concerns about a global economic slowdown and weakening exports in Korea. Uncertainty about the future economic trend remains significant."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.