On the 29th, Kyungsilryeon Announces 'Analysis of LH Corporation's Public Land Sales Since 2010'

[Asia Economy Reporter Hwang Seoyul] The Citizens' Coalition for Economic Justice (CCEJ) claimed that "Korea Land and Housing Corporation (hereinafter LH Corporation) has sold 40 million pyeong (134.9㎢) of public land and 14 million pyeong (46㎢) of multi-family residential land, which should have been used for public housing, to the private sector since 2010."

On the morning of the 29th, at a press conference held in the auditorium of the Citizens' Coalition for Economic Justice (CCEJ) titled 'Analysis of LH Corporation's Public Land Sales Since 2010,' CCEJ made this announcement.

The investigation data was based on the 'LH Corporation Land Supply Statement, 2010-2019' submitted by LH Corporation as part of last year's National Assembly audit materials, the land development cost by district (as of March 2, 2020), and the land sales status posted on the LH Corporation website. CCEJ directly investigated and analyzed these materials and presented the results on this day.

Yoon Soonchul, Secretary General of CCEJ, stated, "If public institutions engage in land speculation, the realization of housing stability for ordinary citizens will become even more distant," and added, "We demand plans from public enterprises like LH Corporation, and hope that the National Assembly audit will reveal the actual situation and lead to institutional improvements."

According to CCEJ's investigation and analysis, the total area of land sold by LH Corporation since 2010 was 135㎢ (40 million pyeong), which corresponds to 22% of the area of Seoul. The sales amount was 186.7 trillion KRW. Sales were made in a total of 654 districts, including new towns.

Among these, a total of 15 million pyeong (50.1㎢) of multi-family residential land, which is the basis for public land development projects, was sold, of which 14 million pyeong (46.1㎢) was sold to the private sector. This is 16 times the size of Yeouido (2.9㎢).

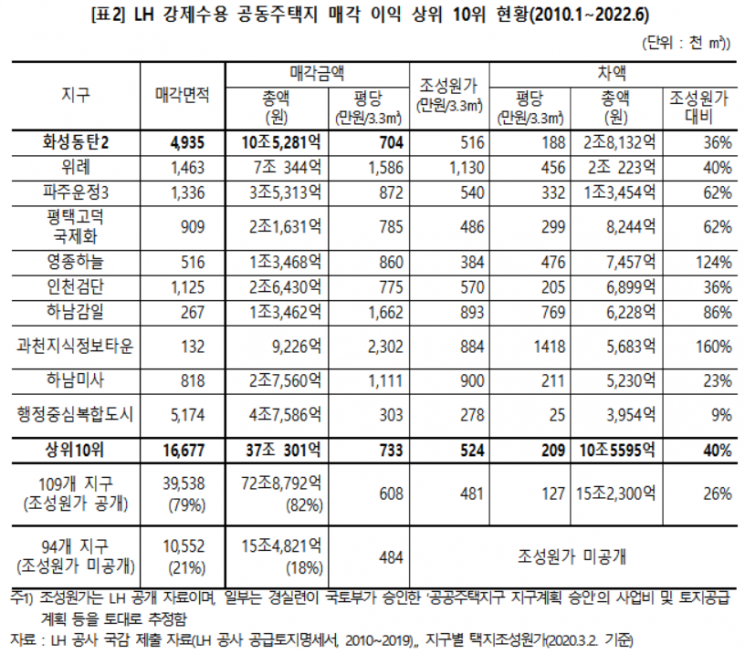

By new town, the largest sales margin was in Hwaseong Dongtan 2, where the difference between the sales amount and the development cost was 2.8132 trillion KRW. The multi-family residential land area in Hwaseong Dongtan 2 was 4.9㎢, with a development cost of 5.16 million KRW per pyeong (3.3㎡) and a sales price of about 7.04 million KRW per pyeong.

Based on the top 10 areas with the largest sales margin, the estimated profit was 10.5595 trillion KRW, with a profit rate of 40% compared to the development cost. The total profit for all 109 districts with disclosed development costs was analyzed to be 15.23 trillion KRW, with a profit rate of 26%.

Kim Seongdal, Director of Policy at CCEJ, said, "If land sales are conducted in this manner after offsetting some of the development project costs through sales revenue, a significant portion of the subsequent sales price is expected to return as development profits to the project operators."

CCEJ also claimed that LH Corporation is selling rental apartment land to the private sector. By land use for multi-family residential land, 40.6㎢ of land for sale apartments, 4.2㎢ for rental apartments, and 5.2㎢ for row houses and mixed-use complexes were sold. Rental apartment land was sold not only to the private sector but also to public rental REITs funded by the Housing and Urban Fund and LH Corporation.

Regarding this, Director Kim said, "Most public rental REITs are short-term rental apartment lands that convert to sale after 10 years of rental," and added, "Apartment land was being disguised as rental apartment land and sold to private construction companies." He further added, "It is estimated that about 1.12 million housing units could be supplied if the 14 million pyeong of sold multi-family residential land were developed with a floor area ratio of about 200%, based on 25-pyeong units."

Furthermore, it was explained that assets could actually increase if public housing is retained rather than sold. Director Kim stated, "Recently, SH Corporation disclosed assets of 102,000 public housing units," and "The acquisition cost was about 15.9 trillion KRW, but the current estimated market value is about 49 trillion KRW, an increase of about 3 to 4 times in assets." He added, "If public housing had not been sold, ordinary citizens could have been provided with affordable home ownership or long-term rental public housing, and LH Corporation could have earned monthly rental income," emphasizing, "It is about securing public assets that can be usefully utilized at any time in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.