Concerns Over Asian Capital Outflows Rise, Korea on Alert for Crisis

Exchange Rate Pauses but Rebounds After Initial Drop Like During Financial Crisis

Authorities Confident in External Soundness Based on Foreign Reserves

Experts Warn "Rapid Exchange Rate Surge Could Trigger Multi-Faceted Economic Crisis"

As the value of the currencies of China, Japan, and South Korea?key economic pillars of Asia?plummets during the era of the "Super Dollar," turmoil surrounding domestic and international financial markets is intensifying. There is a possibility that if capital outflows from Asia accelerate due to interest rate differentials with the United States, domestic credit risk could increase, potentially triggering a shock on the scale of a foreign exchange crisis. Although foreign exchange authorities dismiss the possibility of a crisis based on foreign exchange reserves exceeding $400 billion, concerns remain that if the currency values of competing countries decline further and the prices of imported raw materials rise, South Korea’s export competitiveness could deteriorate further, accelerating capital flight.

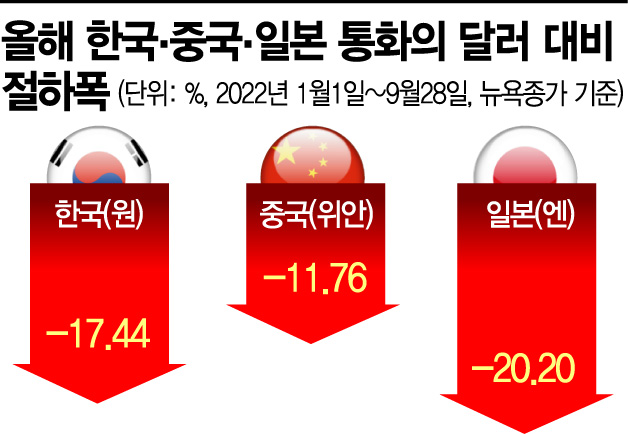

According to the financial market on the 29th, amid the continued ultra-strong U.S. dollar, the depreciation of currencies in major Asian countries is becoming even steeper. This year, the Japanese yen has depreciated 20.20% against the dollar as of the previous day, and the Chinese yuan has fallen 11.76%. Recently, the onshore yuan-dollar exchange rate in China surpassed 7.2 yuan for the first time since February 2008, and the Bank of Japan (BOJ) intervened in the market for the first time in 24 years as the yen exceeded 145 yen per dollar.

The problem is that because China and Japan have significant influence over Asian trade and finance, the depreciation of their currencies accelerates instability in the domestic market as well. The Korean won has depreciated 17.44% this year, less than Japan’s yen, but it has fallen 7.11% since the beginning of this month, showing the largest decline among Korea, China, and Japan. The won, along with the Philippine peso and Thai baht, is considered one of the most vulnerable currencies to volatility, and a major shock is expected if an Asian crisis occurs.

The won-dollar exchange rate rising to 1,440 won is also a negative factor. Generally, currency depreciation is positive for exports, but recently most countries are experiencing similar phenomena, so the consensus is that the negative impact from rising prices of imported raw materials outweighs the positive effects. Additionally, the depreciation of competing countries’ currencies is another factor undermining the competitiveness of Korean companies. On this day, the won-yen recalculated exchange rate was 989.99 won per 100 yen, significantly lower than 1,039.5 won in January this year. This means that Japanese products have become more price-competitive than Korean products in overseas markets.

However, foreign exchange authorities still maintain that external soundness remains favorable. Kim Sung-wook, Director of International Economic Management at the Ministry of Strategy and Finance, said the day before, "We have the last line of defense in foreign exchange reserves, and private external assets can also play a certain role," adding, "If difficult situations arise, we will implement measures based on what we have prepared." As of the end of August, South Korea’s foreign exchange reserves stood at approximately $436.4 billion.

Experts point out that although the current situation cannot yet be considered a crisis like past foreign exchange or financial crises, it is necessary to strengthen countermeasures. On this day, the won-dollar exchange rate opened at 1,424.5 won, down 15.4 won from the previous trading day, showing some hesitation. However, during the early stages of the 2008 financial crisis, the exchange rate rapidly rose to 1,485 won (October 9) before falling to 1,215 won within five days and then surged past 1,500 won again, demonstrating extreme volatility.

Professor Heo Jin-wook of the Department of Economics at Incheon National University said, "If foreign exchange authorities intervene excessively in the market, it could actually accelerate capital outflows, so it is necessary to tolerate some degree of exchange rate increase." However, he added, "If the exchange rate rises too rapidly, the economy could be endangered not only by capital outflows but also in various areas such as international trade, so continuous monitoring is essential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.