Proportion of Forced Liquidations Relative to Outstanding Payments

Third Highest Ever at 20%

[Asia Economy Reporter Minji Lee] "Mr./Ms. Kim 00, if the payment of 1.2 million KRW is not made on the same day, the unpaid amount will be designated to a frozen account on the next business day."

As the stock market hits its worst levels, stock investors are going through fearful days. Especially amid the sharp decline in global indices, record-breaking forced liquidations (margin calls) are taking place, causing the cries of the 'debt investment (debt-financed investment)' crowd, who had hoped for a technical rebound (a short-term rebound during a sharp decline), to grow louder.

According to the Financial Investment Association's comprehensive statistics portal on the 29th, as of the 27th, the actual forced liquidation amount compared to margin loan receivables was 38.274 billion KRW, and the forced liquidation ratio compared to margin loan receivables (226.7 billion KRW) reached 20.1%. This means that one-fifth of individual investors' margin trading volume was subject to forced liquidation. This is not only the largest scale this year but also the third highest on record. During the global financial crisis on October 27, 2008, the forced liquidation ratio compared to margin loan receivables was 23%, the highest ever, and on July 14 of the following year, it recorded 21.8%.

Margin loan receivables refer to borrowing more money from securities firms to buy more stocks. For example, if a person with 10,000 KRW could only buy one share of company A stock priced at 10,000 KRW with a 20% margin, through margin trading, they could buy five shares of company A stock at 2,000 KRW each, which is 20% of the price. The maximum holding period is three days, and if the borrowed money is not repaid within this period, forced liquidation occurs.

High-intensity tightening policies by major countries and recession concerns have pushed debt investors into forced liquidation. In one month, the KOSPI dropped more than 10% from the 2450 level to the 2170 level, and with the U.S. Federal Reserve's tightening stance strengthening, the dollar's strength continued, pushing the KRW/USD exchange rate to the 1440 KRW level. As forced liquidation volumes emerged, market supply and demand became unstable. Individual investors, who were the main sellers the previous day, sold more than 240 billion KRW in the KOSPI market, most of which was analyzed to be forced liquidation volume due to margin trading.

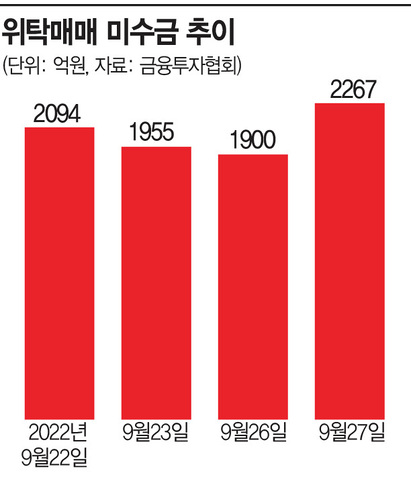

While the external environment is unfavorable, individual investors' greed for debt investment also increased the absolute amount of forced liquidation. Margin trading allows investors to increase leverage in a short period, attracting investors expecting short-term profits during index declines. In fact, margin loan receivables tended to increase when the index fell sharply, rising from 195.5 billion KRW on the 23rd, 190 billion KRW on the 26th, to 226.7 billion KRW on the 27th. However, contrary to expectations, as the index further declined, the forced liquidation amounts expanded to 17.9 billion KRW, 18.9 billion KRW, and 38.2 billion KRW. The balance of credit transactions, which involve borrowing money from securities firms for margin trading, also recorded 18.6 trillion KRW, maintaining a similar level to previous periods (17-19 trillion KRW). If the global stock market falls further, the total forced liquidation amount is expected to increase.

Experts predict that since the KOSPI has fallen excessively recently, a similar decline is unlikely to trigger additional forced liquidations that would further depress the index. The stock market also started the day with a strong rebound, allowing investors caught in panic due to forced liquidation to somewhat reduce their losses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)