Deposit Banks' Loans with 4-5% Interest Account for 44.7%

Loans Below 3% Interest Shrink Sharply to 6.5%

Loans Over 6% Interest Make Up One-Tenth of Total

"10% Interest Loans Expected to Appear Next Year"

[Asia Economy Reporter Song Seung-seop] Due to the rapid increase in the benchmark interest rate, loan interest rates at first-tier commercial banks have also settled in the 4% range. This phenomenon, observed for the first time in over a decade, shows a much stronger upward trend in interest rates compared to when benchmark rates were similar in the past.

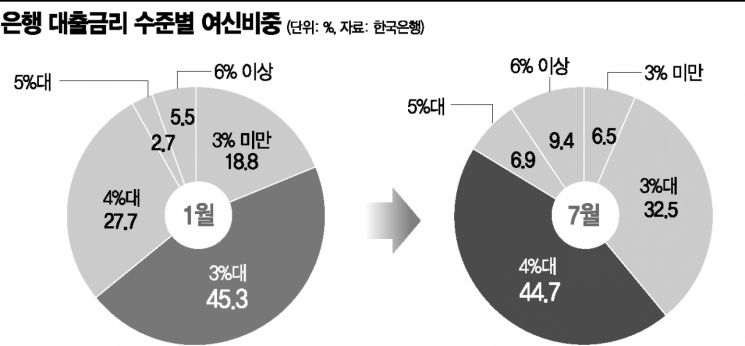

According to the Bank of Korea on the 29th, examining the proportion of loans by interest rate level (based on new loan amounts) at commercial banks in July, borrowers with loans between 4% and less than 5% accounted for the largest share at 44.7%. This is the first time in 9 years and 4 months since March 2013 that the 4% range interest rate has taken the largest share of new loans at commercial banks. At that time, the share of loans in the 4% range was 44.3%.

The share increased by 15.1 percentage points in one month from 29.6% in the previous month. Earlier this year, the Bank of Korea reported that the 4% loan share was about one-quarter of the total. This increase is the second steepest since the Bank of Korea began compiling statistics. The first was in January, when it jumped 16.1 percentage points from 11.6% in the previous month to 27.7%.

New loans with interest rates between 5% and less than 6% are also on the rise. The 5% range interest rate is typically applied by second-tier financial institutions to loans for high-quality borrowers or companies. However, loans in the 5% range at commercial banks accounted for 6.9%, marking the highest level in 9 years and 4 months. The share of loans in the 5% range had been only 0-2% over the past five years.

Low-interest loans have completely disappeared... "10% loan interest rates are coming"

On the other hand, low-interest loans are disappearing. The second largest share was loans with interest rates between 3% and less than 4%, accounting for 32.5%. This decreased by 17.3 percentage points from 49.8% in June. Loans under 3%, which were dominant during the COVID-19 pandemic since 2020, accounted for only 6.5%, less than loans in the 5% range. Loans under 3% had once soared to 89% (August 2020) during the unprecedented 0% benchmark interest rate phase.

The primary cause of the rapid rise in loan interest rates is the increase in the U.S. benchmark interest rate. The U.S. is quickly raising its benchmark rate to curb soaring domestic inflation. The U.S. Federal Reserve (Fed) implemented three consecutive 'giant steps' (0.75 percentage point increases) in June, July, and this month. Accordingly, the Bank of Korea also raised its benchmark rate by 0.5 percentage points in July and 0.25 percentage points in August, setting it at 2.50%.

The problem is that even compared to when Korea's benchmark interest rate was the same in the past, the proportion of high-interest loans is higher. When the benchmark rate was 2.25% in 2014, the share of loans in the 4% range was about 10-30%, lower than now. This is interpreted as banks setting a higher risk premium for borrowers. Banks judged that the risk of borrower default was much higher than before and raised loan interest rates to avoid potential losses.

The rapid interest rate hike trend is expected to continue until next year. Professor Kim Dae-jong of the Department of Business Administration at Sejong University said, "The U.S. is talking about a benchmark interest rate of 4.4% this year, and the Fed intends to keep raising the benchmark rate until inflation reaches 2%," adding, "If Korea follows the pace of the U.S. benchmark rate increase, we will see loans with interest rates of 7-8% by the end of the year and even 10% range loans (at banks) next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)