Martial Arts Report... "Grow Domestic Lithium Mining and Refining Business"

Lithium, called the 'white oil' because it is widely used in electric vehicle batteries and more.

Lithium, called the 'white oil' because it is widely used in electric vehicle batteries and more. (Photo by Asia Economy DB)

[Asia Economy Reporter Moon Chaeseok] As the price of lithium, a key raw material for cathode materials in electric vehicle batteries, has surged by 356% this year, concerns have been raised about the urgent need to strengthen domestic industrial competitiveness due to China's import dependence reaching 64%. This has become a critical issue for the three major domestic battery companies: LG Energy Solution, SK On, and Samsung SDI.

On the 29th, the Korea International Trade Association's International Trade and Commerce Research Institute released a report titled "Supply Chain Analysis of Key Battery Raw Materials: Lithium," which included these findings.

The report stated that according to Bloomberg's survey, the average price of lithium as of March reached a record high of $74,869 per ton. Even as of the 26th, the price remained high at $70,404 per ton. By the third quarter, lithium accounted for about 65% of the manufacturing cost of cathode materials for ternary batteries, indicating its high price.

The global lithium market is already structured as an oligopoly, giving raw material companies strong bargaining power in sales negotiations. This could lead to increased material costs for the domestic battery industry. Competition in the electric vehicle market is intensifying, and the transactional relationships between automakers and battery companies in various countries are sensitive. Battery companies find it difficult to easily raise the selling price of finished batteries.

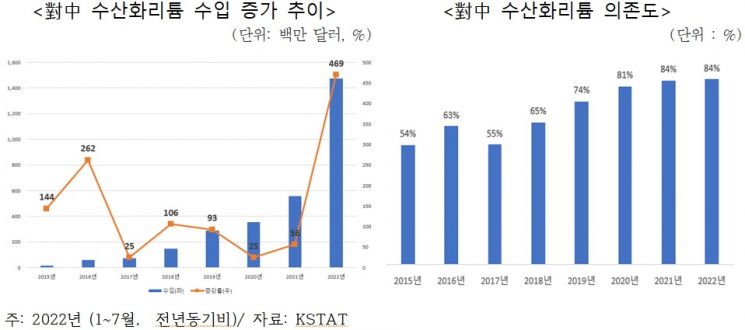

Meanwhile, domestic companies rely entirely on overseas sources for lithium demand, with particularly high dependence on China. Since 2020, China has been Korea's top lithium import partner. The share of imports from China has increased from 47% in 2020 to 59% last year, and 64% from January to July this year.

The problem is that imports of lithium hydroxide, which is necessary for producing high-performance ternary batteries mainly manufactured by domestic companies, are rapidly increasing. As of January to July, 91% of lithium imports from China were lithium hydroxide. The import value of lithium hydroxide surged 469% from $259 million in the same period last year to $1.476 billion this year. Moreover, as domestic companies increase production of high-energy-density high-nickel batteries, dependence on lithium hydroxide imports from China is expected to grow further.

This year, the lithium import growth rate soared to a record high of 356.1%, with price increases accounting for 263.6%, far exceeding the 92.5% increase due to volume growth. This significantly increases the cost burden on domestic battery companies.

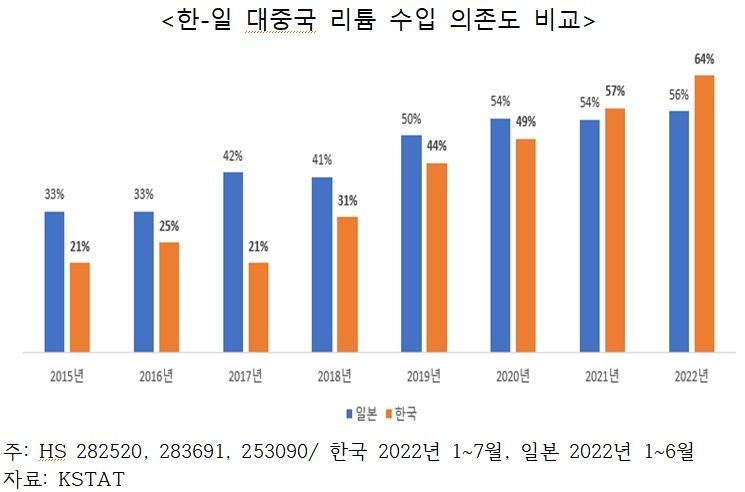

In the case of Japan, a competing battery nation, lithium-related import items are diverse, including lithium hydroxide, lithium carbonate, and spodumene, and efforts to diversify import sources have kept China's lithium import dependence at 56%. The remaining 44% is procured from Chile, the United States, Argentina, and others. Korea's lithium hydroxide import share is 69%, higher than Japan's 41%. Overall, Korea's lithium import dependence on China is 64%, also higher than Japan's 56%.

The report expressed concerns that the lithium supply chain concentrated in China could trigger future supply instability and origin issues. If climate change within China or political conflicts between the two countries escalate, the possibility of lithium procurement disruptions increases. Last month, a drought and power outage led to the closure of a plant in Sichuan Province responsible for over 20% of lithium supply, causing lithium prices to surge. China has also used rare earth elements as strategic materials to exert political pressure during conflicts with Japan. There is no guarantee that lithium will not be used in the same way.

The report explained that strengthened requirements for regional production in the U.S. battery supply chain and the European Union's raw material environmental standards could present some opportunities for Korea. As the implementation of battery ESG (Environmental, Social, and Governance) policies accelerates?such as the U.S. Inflation Reduction Act (IRA), the EU's carbon footprint regulations, supply chain due diligence systems, and designation of lithium as a hazardous substance?batteries using Chinese raw materials may face rejection in the international market.

Research Director Cho Sang-hyun emphasized, "The battery raw material supply chain dependent on China poses a threat to Korea's battery ecosystem. Without directly mining and refining lithium or diversifying supply sources, Korea will remain vulnerable to risks originating from China." He added, "The government should actively foster an eco-friendly lithium mining and refining industry and focus on Australia and Argentina as promising alternative supply sources." He further stated, "From a resource security perspective, investment in overseas resource development projects should be expanded, and Korea should take a leading role in discussions within the Indo-Pacific Economic Framework (IPEF) to build supply chains with regions outside China."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)