China's Electric Vehicle Sales 2.3 Times Higher This Year

"South Korea Needs to Revise Subsidy Policy"

[Asia Economy Reporter Kiho Sung] It is projected that the amount of electric vehicle subsidies paid for Chinese-made electric vehicles in South Korea will exceed 200 billion KRW this year. Amid the recent implementation of the U.S. Inflation Reduction Act (IRA), which has negatively impacted domestic automakers, Chinese electric vehicles are effectively being supported with taxpayers' money to foster the industry. For this reason, there are calls to reform the electric vehicle subsidy policy to protect the domestic industry.

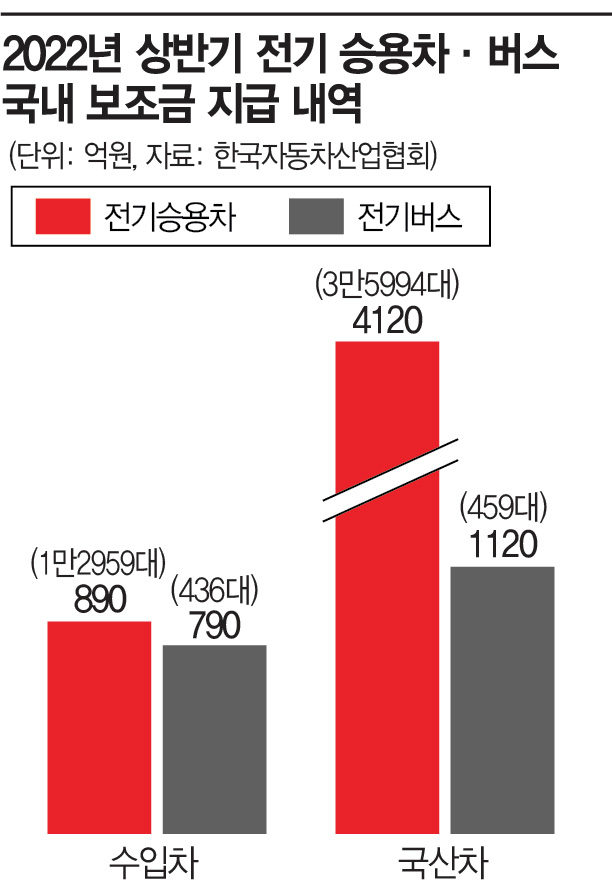

According to the Korea Automobile Manufacturers Association on the 3rd, the sales volume of imported Chinese cars in the first half of this year reached 5,112 units, a 2.3-fold (125.3%) increase compared to the same period last year (2,269 units). The subsidies received by Chinese electric vehicles amount to approximately 100 billion KRW. Among these, commercial vehicles (buses and trucks) surged 8.5 times (749%) from 159 units in the first half of last year to 1,351 units in the first half of this year. Notably, Chinese-made electric buses accounted for 436 units sold in the first half of this year alone, capturing a market share of 48.7%. The Consumer Sovereignty Citizens' Association recently forecasted that if this trend continues, subsidies paid to Chinese electric vehicles could reach 200 billion KRW this year.

Chinese electric vehicles are boosting sales with relatively low prices and a diversified model lineup. However, the biggest reason is pointed out to be the subsidy policy that does not differentiate between domestic and imported vehicles, which is a key factor in increasing market share. This contrasts with China’s policy, which favors domestic companies with subsidy programs.

Currently, the government provides subsidies based on fuel efficiency and driving range for electric vehicles priced under 55 million KRW (with a 100% subsidy cap). Vehicles priced under 55 million KRW receive 100% of the subsidy, those priced between 55 million and 85 million KRW receive 50%, and models over 85 million KRW receive no subsidy. In Seoul, the national subsidy is 6.51 million KRW, and local government subsidies add up to 1.86 million KRW, allowing for a maximum subsidy of 8.37 million KRW.

Electric buses also receive subsidies considering performance and vehicle size, with up to 50 million KRW for medium-sized and up to 70 million KRW for large buses. Local governments also provide subsidies up to 50 million KRW for medium-sized and 70 million KRW for large buses. However, factors such as the vehicle’s place of manufacture, price, and origin of parts are not considered at all.

In contrast, China has implemented the “New Energy Vehicle Recommended List” system, which only provides subsidies to electric vehicles equipped with Chinese-made batteries and parts. As a result, some major imported car brands install Chinese batteries in models sold in the Chinese market.

Notably, China even discriminates against batteries produced by Korean battery companies in Chinese factories, refusing to provide subsidies for electric vehicles equipped with Korean batteries. This has rendered Korean companies (LG Energy Solution, Samsung SDI), despite having large-scale factories in China, unable to function effectively. Although some subsidies have been extended to vehicles equipped with Korean batteries since regulatory easing in 2019, the impact remains minimal.

Therefore, there are calls to reform the electric vehicle subsidy policy. The Consumer Sovereignty Citizens' Association emphasized, “Only the Korean government is implementing policies that fatten China,” and urged, “South Korea should also provide more benefits to domestic electric vehicles and abolish subsidies for imported electric vehicles, reforming the subsidy policy based on the principle of reciprocity.”

Professor Pilsoo Kim of the Department of Automotive Studies at Daelim University said, “China and the U.S. do not provide subsidies for electric vehicles not produced domestically,” adding, “South Korea also needs to reform its policy within the bounds of not violating Free Trade Agreements (FTA).”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.