Hyundai Motor and Kia New Plant Expected to Operate in 2025... Tax Benefits Missed

Secondary Battery Industry Faces Short-Term Damage Due to Difficulty Meeting Battery Mineral and Component Conditions

Supply Chain Diversification Not a Choice but a Survival Issue... Government Support Urgently Needed

U.S. President Joe Biden is taking off his coat while giving a speech at the Inflation Reduction Act (IRA) legislative commemoration event held on the 13th (local time) at the South Lawn of the White House in Washington, DC. He repeatedly emphasized the achievements of the Inflation Reduction Act, highlighting the provision for subsidies on American-made electric vehicles as a major accomplishment.

U.S. President Joe Biden is taking off his coat while giving a speech at the Inflation Reduction Act (IRA) legislative commemoration event held on the 13th (local time) at the South Lawn of the White House in Washington, DC. He repeatedly emphasized the achievements of the Inflation Reduction Act, highlighting the provision for subsidies on American-made electric vehicles as a major accomplishment. [Image source=EPA Yonhap News]

[Asia Economy Reporter Choi Seoyoon] An analysis has emerged that the enactment of the U.S. Inflation Reduction Act (IRA) will weaken the competitiveness of South Korea's electric vehicle (EV) and secondary battery industries in the U.S. market.

According to the report titled "Impact and Implications of the U.S. Inflation Reduction Act on Domestic Industries: Focusing on the Automobile and Secondary Battery Industries," released on the 29th by the Korea Institute for Industrial Economics & Trade (KIET), significant damage is expected to the domestic automobile industry due to the enactment of the U.S. Inflation Reduction Act. This is because the domestic automobile industry, lacking a production base in the U.S., will not be eligible for EV tax benefits, placing it at a price competitiveness disadvantage compared to competitors in the U.S. market.

The domestic secondary battery industry is also expected to face short-term difficulties as it will be challenging to meet the battery-related regulations required by the Inflation Reduction Act. However, since South Korean secondary battery companies have been rapidly expanding their production bases in the North American region recently, the Act could serve as an opportunity factor in the mid to long term.

The report emphasized that to minimize the damage caused by the Inflation Reduction Act, proactive measures are necessary to defend market share in the U.S. EV market. To this end, it is crucial to expedite the establishment of EV production bases within the U.S. and to strive to secure maximum benefits for South Korea in upcoming practical negotiations with the U.S. It also pointed out the need to strengthen support for diversifying the supply chain of battery raw materials, materials, and components so that domestic secondary battery companies can maintain competitiveness in the U.S. market.

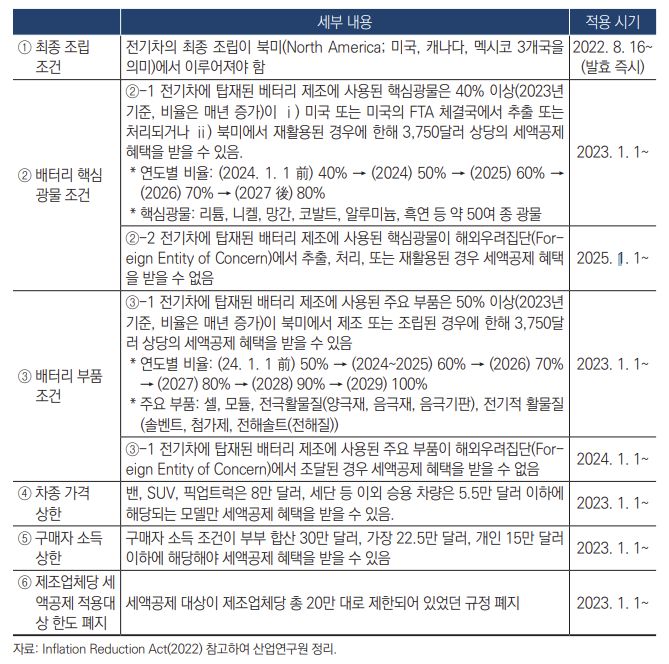

Changes in U.S. Electric Vehicle Tax Credit Requirements Due to Inflation Reduction Act Enactment

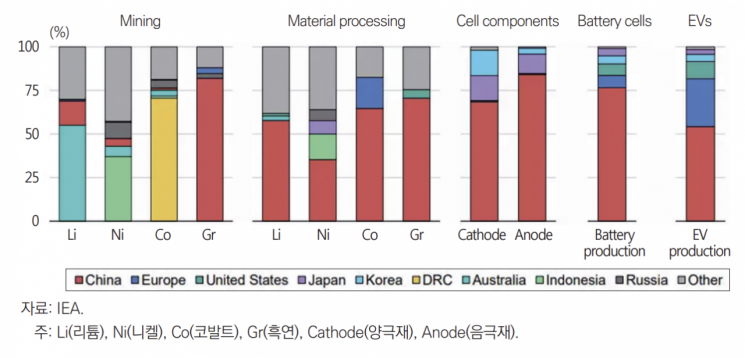

The Inflation Reduction Act, enacted to curb inflation and address climate change in the U.S., includes provisions that change the requirements for electric vehicle tax credits (effectively subsidies), which are expected to significantly impact the domestic automobile and secondary battery industries. The report noted that the enactment of the Inflation Reduction Act, along with the "Chips and Science Act" that took effect on August 9, clearly reflects the U.S. leadership's intention to build a U.S.-centered supply chain to counter China's rise in advanced industries such as semiconductors, electric vehicles, and secondary batteries through legislation.

Summarizing the key points of the EV tax credit-related provisions (Section 13401) of the Inflation Reduction Act, to receive EV tax benefits in the U.S., vehicles must meet conditions stipulated by the Act, including final assembly requirements, battery critical mineral requirements, and battery component requirements. In other words, the report stated that in the U.S. market, only EVs that are finally assembled in North America and use batteries with a certain percentage or more of critical minerals and components produced in the U.S. or countries with which the U.S. has free trade agreements will qualify for the EV tax credit.

Conditions for Applying U.S. Electric Vehicle Tax Credit. Photo by Korea Institute for Industrial Economics and Trade

Conditions for Applying U.S. Electric Vehicle Tax Credit. Photo by Korea Institute for Industrial Economics and Trade

The Core Damage to the Domestic Automobile Industry Is the Decline in Price Competitiveness in the U.S. EV Market

The Inflation Reduction Act is expected to have a negative impact on the domestic automobile industry in the short term. Since domestic automakers find it difficult to meet the final assembly condition, which has been enforced immediately after the Act's enactment, they will not be eligible for EV tax credits, placing them at a relative price competitiveness disadvantage compared to competitors in the U.S. market. Currently, Hyundai Motor and Kia supply EVs sold in the U.S. from South Korea due to the absence of a production base in the U.S.

In particular, the report noted that Hyundai Motor and Kia's market share in the U.S. EV market was only 4.7% in 2021 but increased to 9.1% by selling a total of 50,809 units from January to July this year, ranking second after Tesla. The loss of price competitiveness due to the enactment of the Inflation Reduction Act is expected to be a significant negative factor for Hyundai Motor and Kia, which had been rapidly increasing their market share in the U.S. with well-received models such as the Ioniq 5 and EV6.

However, the report advised a cautious approach in evaluating the mid- to long-term impact of the Inflation Reduction Act on the domestic automobile industry. This is because the battery-related regulations of the Act, which will begin next year and gradually strengthen annually, are difficult to meet not only for domestic companies but also for foreign automakers. The report emphasized that ultimately, the success or failure of South Korean companies in the U.S. EV market will depend on how quickly they can establish EV production bases in the U.S. and how successfully they can build a secondary battery supply chain that complies with the battery regulations of the Inflation Reduction Act.

Domestic Secondary Battery Industry Faces Short-Term Damage but Mid- to Long-Term Opportunities

The report stated that although the domestic secondary battery industry possesses global competitiveness, considering that the production and refining of critical minerals such as lithium and graphite are mainly concentrated in China and other countries, it is expected to be difficult to meet the battery critical mineral requirements of the Inflation Reduction Act starting next year.

In this case, automakers that trade with domestic secondary battery companies may not receive tax benefits in the U.S., which could negatively affect sales in the U.S. market to some extent. However, since foreign battery companies competing in the U.S., such as Panasonic, also have a high dependence on Chinese critical minerals, the negative impact is expected to be limited.

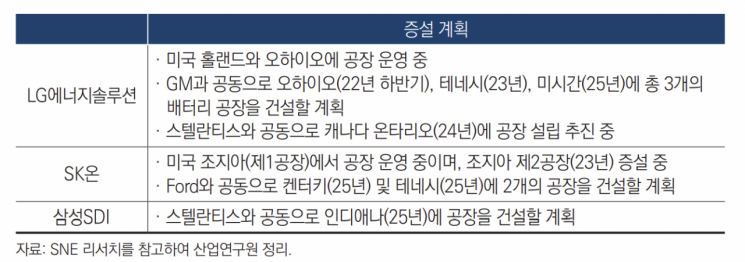

The report highlighted that the three major domestic battery companies are actively advancing into the U.S. market. LG Energy Solution plans to build four new plants in joint ventures with GM and Stellantis, in addition to its independent plants operating in Holland and Ohio. SK On is expanding its existing Georgia plant and is also pushing to build two new plants in partnership with Ford. Samsung SDI announced plans to construct a battery plant jointly with Stellantis by 2025.

The report predicted that the trend of expanding production bases in North America by South Korean secondary battery companies is clearly superior to competitors in both scale and speed. Moreover, since these companies maintain cooperative relationships with automakers like GM and Ford that have manufacturing facilities in the U.S., the enactment of the Inflation Reduction Act is likely to act as a beneficial factor in the mid to long term.

Expansion plans for U.S. production bases by domestic secondary battery companies. Table provided by the Korea Institute for Industrial Economics and Trade

Expansion plans for U.S. production bases by domestic secondary battery companies. Table provided by the Korea Institute for Industrial Economics and Trade

Early Establishment of EV Production Bases in the U.S. and Efforts to Diversify Secondary Battery Supply Chains Are Necessary

The Inflation Reduction Act, which includes de facto discriminatory subsidy policies for electric vehicles, can be seen as an extension of the U.S. "Buy American" policy applied to the EV and secondary battery sectors. The U.S. policy stance on strengthening climate change response, countering China, and reorganizing supply chains centered on the U.S. is expected to continue.

The report emphasized that to minimize damage to the domestic automobile and secondary battery industries caused by the Inflation Reduction Act, proactive measures are necessary to defend market share in the U.S. EV market, particularly by advancing the operation start date of Hyundai Motor and Kia's new plants in Georgia as much as possible.

Since foreign automakers also face difficulties meeting the battery critical mineral and component requirements, thorough efforts must be made to build a secondary battery supply chain that complies with the battery conditions of the Inflation Reduction Act. As the U.S. Treasury Department is scheduled to prepare follow-up guidelines for the Act within the year, efforts should be made to secure South Korea's interests to the fullest through practical negotiations between the two countries.

At this point, the most important task for domestic secondary battery companies to maintain competitiveness in the U.S. market is to reduce dependence on China for battery raw materials, materials, and components and to diversify the supply chain.

The report stated, "The European Union is also expected to pursue a Raw Material Act similar to the Inflation Reduction Act to build a de-China supply chain," and added, "Supply chain diversification is no longer a choice but a matter of survival, so government support for diversifying the supply chain of battery raw materials, materials, and components must be further strengthened."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.