Announcement of Countermeasures Against Voice Phishing in the Financial Sector

New Daily Limit of 3 Million KRW Set for ATM Cash Deposit Receipts

Enhanced Identity Verification for Non-Face-to-Face Account Opening

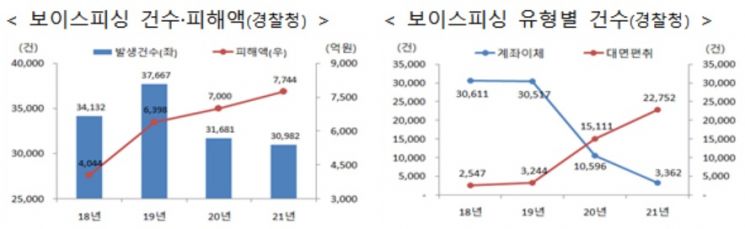

[Asia Economy Reporter Song Hwajeong] As voice phishing schemes such as face-to-face extortion, where cash is handed over to victims without bank transfers, and non-face-to-face account openings continue to run rampant, the government has decided to lower the ATM cash deposit limit to 500,000 KRW per transaction and newly set a daily receiving limit of 3,000,000 KRW to prevent such crimes. Additionally, identity verification will be strengthened during non-face-to-face account openings.

On the 28th, the Financial Services Commission announced these measures as part of its response plan to combat voice phishing in the financial sector.

First, victim relief procedures will be applied to face-to-face extortion-type voice phishing. Until now, under the Act on the Prevention of Telecommunications Fraud, financial companies could suspend payments on fraud-related accounts upon victim reports for telecommunication financial fraud, but face-to-face extortion-type voice phishing was not classified as telecommunication financial fraud, making it impossible to promptly suspend payments even if the perpetrators were caught. Accordingly, the Financial Services Commission will push for amendments to the Act on the Prevention of Telecommunications Fraud to allow victim relief measures such as payment suspension for face-to-face extortion-type voice phishing, including acts of receiving or providing cash.

ATM cash deposit limits will also be reduced within the scope of minimizing inconvenience to genuine users. ATM cash deposits without real-name verification are being exploited by criminal organizations to collect funds obtained through face-to-face extortion into their accounts. Since the same individual can make multiple deposits in a day (with a current per-transaction limit of 1,000,000 KRW), and there is no limit on the amount that can be received via ATM cash deposits, it is easy for criminal organizations to use this method for money laundering. To prevent this, the ATM cash deposit limit will be reduced from 1,000,000 KRW to 500,000 KRW per transaction, and a new daily receiving limit of 3,000,000 KRW will be set for ATM cash deposits without real-name verification of the receiving account. Deposits made via ATM media (passbook or card), teller counters, and non-face-to-face channels will remain unchanged.

Identity verification will be strengthened during non-face-to-face account openings. The process of verifying identity through submission of ID copies must go through the Financial Settlement Service’s ID authenticity verification system. If the ID authenticity verification system is not passed, the submission of ID copies cannot be used. Additionally, a facial recognition system will be introduced. During the initial phase of system implementation, consumer inconvenience due to low recognition rates may occur, so it will be operated as a recommendation for a certain period. To prevent the 1 KRW transfer method from being used to open fraudulent accounts, the real-name verification process via 1 KRW transfers will also be improved. The validity period for entering the authentication code sent via the 1 KRW transfer will be shortened to a maximum of 15 minutes, and the phrase "For account opening" will be displayed alongside the authentication code during the 1 KRW transfer.

As cases have occurred where criminals open prepaid phones in victims’ names and open accounts non-face-to-face to directly extort funds through open banking, the use of open banking will be restricted for a certain period. Financial companies will block fund transfers via open banking for three days after non-face-to-face account opening, and the Financial Settlement Service will reduce the daily usage limit for the customer from 10,000,000 KRW to 3,000,000 KRW for three days.

Penalties for voice phishing will also be strengthened. Currently, punishment regulations for voice phishing crimes vary and are relatively lenient, and there are no regulations for punishing simple accomplices. Accordingly, the Financial Services Commission plans to establish punishment provisions for voice phishing and simple accomplices in the Act on the Prevention of Telecommunications Fraud, imposing imprisonment of at least one year or fines ranging from three to five times the amount of criminal proceeds on telecommunication financial fraud offenders, and imprisonment of up to five years or fines up to 50 million KRW on simple accomplices. Attempts will also be punishable, and repeat offenders will face aggravated penalties.

The Financial Services Commission plans to promptly submit legislative proposals to the National Assembly immediately after announcing these measures for issues requiring legal amendments. A Financial Services Commission official stated, "We will swiftly proceed with system development and regulatory revisions to implement these measures promptly," adding, "Even after this announcement, we will continuously supplement various measures to respond to evolving voice phishing schemes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)