[Asia Economy Reporter Kim Bo-kyung] A study has found that if the base interest rate reaches 3%, approximately 40,000 individual business owners and 60,000 small business owners will face an increased risk of bankruptcy.

On the 28th, the Small and Medium Business Venture Research Institute announced this through a report titled "Estimation and Implications of Insolvent Small Business Owners Due to Interest Rate Increases."

The report diagnosed changes in marginal small business owners under various scenarios amid worsening financial conditions caused by a surge in debt due to COVID-19 and rising interest rates and prices, and suggested directions for a soft landing.

The institute emphasized, "Small business insolvency is closely related to interest rates," adding, "Policies to minimize the shock of rising interest rates on small business owners are urgently needed."

It was found that over the past five years, 249,342 businesses experienced insolvency for at least one quarter, accounting for about 39.5% of the total.

Furthermore, 31% of businesses that entered insolvency continued operations in an insolvent state for more than a year. The study found that the longer the insolvency period, the larger the debt scale.

The institute stated, "There is a significant increase in cases where businesses continue operating in an insolvent state by covering costs with debt."

By industry, the proportions of insolvency and marginal status were high in accommodation, transportation and warehousing, and manufacturing sectors. By sales, it was concentrated in businesses with an annual average revenue of less than 100 million KRW.

The institute simulated how two variables, interest rates and producer prices, affect marginal small business owners.

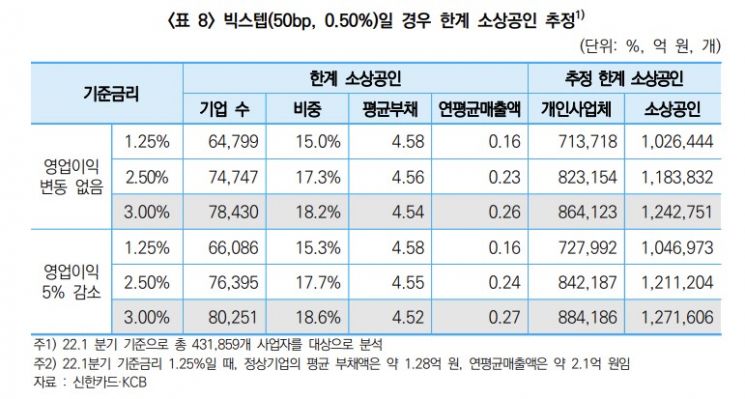

As a result, the proportion of small business owners at the margin was found to be 17.3% (approximately 820,000 to 1.18 million people) at the current base interest rate of 2.50%.

With a baby step increase to 2.75%, the proportion of marginal small business owners is estimated to rise to 17.7% (about 840,000 to 1.21 million), and with a big step increase to 3%, it is expected to increase to 18.2% (about 860,000 to 1.24 million).

In particular, at a 3% increase, it is estimated that 864,123 individual business owners and 1,242,751 small business owners will face a marginal situation where they cannot even cover debt interest with operating profits for four consecutive quarters. This represents an increase of 40,969 individual business owners and 58,919 small business owners compared to when the base interest rate was 2.50%.

With a giant step increase to 3.25%, the proportion of marginal small business owners is projected to rise to 18.6% (about 890,000 to 1.27 million).

Based on this analysis, the institute proposed policies including △ establishing a monitoring system for insolvent and marginal small business owners △ introducing a debt management system for small business owners △ preparing measures against profitable bankruptcies of small business owners △ supporting fixed costs such as labor and rent.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)