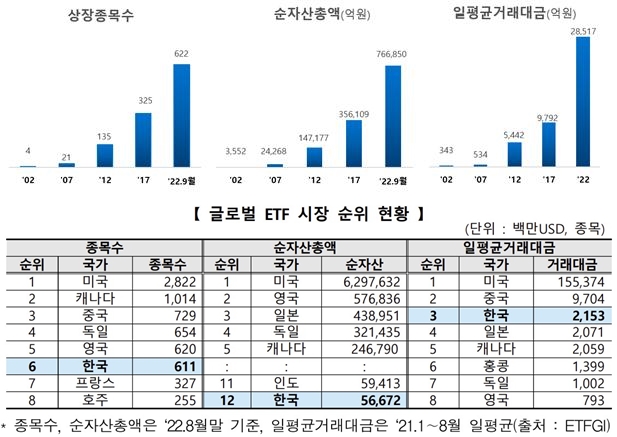

622 Listed Stocks... Total Net Assets of 76 Trillion KRW and Daily Average Trading Value Exceeding 2 Trillion KRW

Ranked 3rd in Trading Value Compared to Global ETF Markets

Korea Exchange to Host '2022 Global ETP Conference Seoul' Next Month

[Asia Economy Reporter Myung-Hwan Lee] The Korean Exchange-Traded Fund (ETF) market, which marks its 20th anniversary this year, continues its growth trend, with total net assets exceeding 76 trillion won.

The Korea Exchange recently announced on the 28th that despite increased market volatility due to inflation and rapid interest rate hikes, the domestic ETF market has maintained solid growth.

When the Korean ETF market opened in October 2002, it consisted of only 4 listed products with total net assets of 355.2 billion won and trading volume of 34.3 billion won. However, as of the 27th, the number of listed products (622) has grown approximately 155 times, total net assets (76.6 trillion won) have increased 215 times, and the average daily trading volume (2.8 trillion won) has risen about 83 times.

The Exchange explained that the market’s global standing has also improved. The Korean ETF market ranks 6th in the number of listed products, 12th in total net assets, and 3rd in average daily trading volume in the global ETF market.

The Exchange attributes this growth to the expansion of the product lineup. The product range, which was initially focused on domestic market representative types, has expanded to include overseas types, sector ETFs, bonds, and commodities, satisfying diverse investment demands. In particular, the introduction of 'bond ETFs with fixed maturity' and the 'relaxation of mixed asset ETF index requirements' supported the launch of products catering to investment needs in an inflationary and high-interest-rate environment.

The increase in participation by individual and foreign investors has also positively contributed to creating a balanced trading environment. While institutional investors such as liquidity providers (LPs) had a high share in the early days of the ETF market, the market’s maturation has led to increased trading shares by individuals and foreigners.

The expansion of the ETF market ecosystem has improved the investment environment as well. Recently, over-the-counter public fund managers have actively entered the ETF market, increasing the asset share of ETFs within public funds. On the demand side, ETF investments through pension accounts are rising, considering long-term investment trends and tax benefits.

Meanwhile, to commemorate the 20th anniversary of the ETF market, the Exchange plans to hold the '2022 Global ETP Conference Seoul' on the 31st of next month.

Now in its 12th edition, this conference will be held under the theme 'Possibilities and Challenges for the Next Decade.' The event will share trends and the latest investment themes in the domestic and international Exchange-Traded Products (ETP) markets. It will explore the development direction of the ETP market and next-generation product development, as well as discuss efficient ETP trading methods.

The Exchange will accept pre-registration for the conference through the official conference website from today until the 21st of next month. Financial planners (AFPK/CFP) attending the conference offline will be eligible for 6 continuing education credits from FPSB.

A Korea Exchange official stated about the event, "With the easing of quarantine rules, overseas experts will attend in person, providing an opportunity to share the latest global market trends and investment strategies amid high interest rates and inflation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)