Fund Returns 2.89% Since September FOMC... Impact of Early Interest Rate Hikes

[Asia Economy Reporter Minji Lee] In the financial markets where fears of tightening by the U.S. Federal Reserve (Fed) persist, only Brazilian funds are steadily accumulating solid returns. Thanks to being hit early by interest rate hikes, they have remained relatively unshaken despite strong tightening measures by major countries.

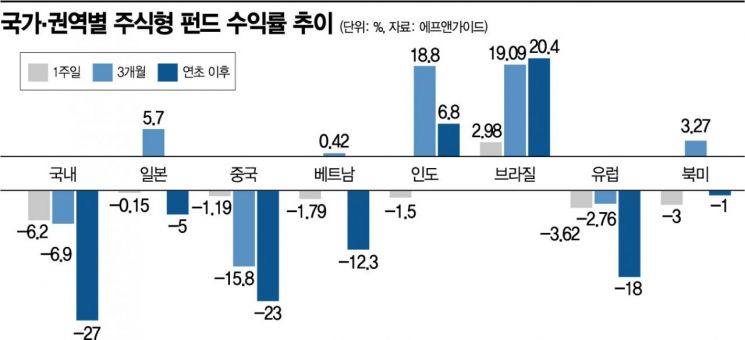

According to financial information provider FnGuide on the 28th, Brazilian equity funds posted a 2.89% return in the week following the U.S. Federal Open Market Committee (FOMC) meeting in September. During this period, domestic equity funds plunged with an average return of -6%, and both emerging and developed markets such as North America (-3%), Europe (-3.62%), China (-1.2%), and India (-1.5%) recorded negative returns, yet Brazilian funds alone posted positive returns. Looking at a broader period, over the three months since the June FOMC, Brazilian funds outperformed other countries with a 20.4% return.

Among individual funds, the best performer over the recent three months was the ‘Mirae Asset Brazil Sector Representative Fund,’ which achieved a return of around 24%. It grew by 2.7% in the past week, driven by a portfolio focused on Brazil’s leading companies in commodities and finance. Looking at the holdings, Brazilian mining company Vale and oil company Petroleo Brasileiro accounted for the largest shares at 6.6%, followed by Bradesco Bank (5.8%), holding company Itau Unibanco Holdings (5.4%), and Bradespa (3.9%), all of which have significant investments. Other funds such as Hanwha Brazil Securities Investment Trust (23%) and Multi-Asset Samba Brazil Securities Investment Trust (20%) also recorded excellent returns.

While the rise in commodity prices contributed, the fact that the pain of tightening is less severe than in other countries drove the stock price increase. Brazil began raising interest rates early in March last year to quickly respond to high inflation, increasing rates by 1175 basis points (1bp = 0.01%p) to date. The current benchmark interest rate is 13.75%, and Brazil froze the benchmark rate for the first time at this month’s monetary policy meeting. Last year, due to strong tightening policies, Brazil’s main stock index, the Bovespa Index, posted an annual return of -12%, the lowest performance, but now this is acting as a positive factor. In fact, the Bovespa Index has recorded a 3% annual return this year and about 8% over the recent three months.

Minyoung Park, a researcher at Shinhan Financial Investment, said, "Brazil’s inflation slowdown has eased the burden on consumer activity, and with the expected end of the tightening monetary policy cycle, growth forecasts are rebounding sharply." She added, "This year’s growth forecast has been revised upward from 0.4% at the beginning of the year to 2.7%, showing a short-term decoupling from the global economic trend."

However, the shadow of recession is deepening due to strong tightening in developed countries, which is a concern. As recession fears expand, commodity prices tend to decline sharply, and since most Brazilian stocks are composed of commodity-related companies, this poses a risk.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.