Trade Association Releases 'Analysis and Implications of Korea-Taiwan Trade Structure with China'

Taiwan Maintains Trade Surplus with China, Korea Faces Deficit for 4 Months

"Urgent Need to Strengthen Competitiveness in Korea's System Semiconductors, Materials, and Equipment"

[Asia Economy Reporter Han Ye-ju] It has been pointed out that the cause of South Korea's trade deficit with China stems from structural issues within domestic companies heavily focused on memory semiconductors.

The Korea International Trade Association (KITA) announced on the 28th that it had released a report titled "Analysis of the Trade Structure between Korea and Taiwan with China and Its Implications."

According to the report, South Korea's trade balance with China has recorded a deficit for four consecutive months since May, whereas Taiwan has maintained a steady trade surplus with China based on strong exports centered on system semiconductors, despite the recent deterioration in cross-strait relations.

Looking at individual items, South Korea's exports of displays, petroleum products, and semiconductor manufacturing equipment have been sluggish, while imports, mainly of intermediate goods such as lithium-ion batteries, raw materials, and LCDs, have increased sharply. In particular, as China's self-sufficiency rate in semiconductor equipment rises and Korean companies operating in China expand local production, exports of semiconductors and equipment have decreased.

On a cumulative basis from January to August, South Korea's trade balance with China shows a surplus of $3.2 billion, but the surplus size has decreased by 79.8% compared to the same period last year ($15.8 billion).

Despite China's lockdown measures and strained cross-strait relations, Taiwan maintained a stable trade surplus with China. Even though China imposed various economic sanctions and military threats on Taiwan in retaliation for U.S. House Speaker Pelosi's visit to Taiwan in August, Taiwan's semiconductor exports to China increased by 21.8%. From January to August this year, semiconductors accounted for half (51.8%) of Taiwan's exports to China, with system semiconductors (24.0%) and memory semiconductors (17.8%) showing balanced strong performance.

During the same period, Taiwan's semiconductor trade surplus with China reached $22.3 billion, a 21.7% increase compared to $18.3 billion in the same period last year. Semiconductors accounted for a remarkable 92.7% of Taiwan's total trade surplus with China ($24 billion).

China, benefiting from increased self-sufficiency, strong exports, and slowed imports this year, recorded trade surpluses with the U.S. and Germany and significantly reduced trade deficits with South Korea and Japan, but the trade deficit with Taiwan remained largely unchanged. Intermediate goods such as semiconductors account for 83.4% of Taiwan's exports to China, and China heavily depends on Taiwan for intermediate goods like electronics and machinery, maintaining a mutually complementary economic structure between the two countries.

The reason Taiwan has been able to maintain a trade surplus with China is attributed to Taiwan's world-class foundry technology, increased outsourced demand, and system semiconductor-centered exports to China. The combined global market share of Taiwan's four foundry companies was 64.0% as of the first quarter of this year, and system semiconductors accounted for 73.8% of Taiwan's semiconductor exports to China from January to August.

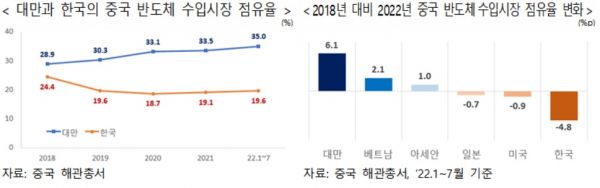

Taiwan also possesses world-leading technology in the final stage of semiconductor manufacturing, post-processing (packaging and testing), establishing a semiconductor ecosystem within the country that connects fabless-foundry-post-processing. Leveraging the competitiveness of fabless system semiconductor design companies and foundries, Taiwan has surpassed memory-focused South Korea in semiconductor exports to China since 2019.

Taiwan is utilizing the semiconductor supply shortage in China caused by U.S. export controls as an opportunity to increase exports to China. While China's system semiconductor procurement has concentrated on Taiwan due to U.S. export restrictions, memory-focused South Korea has seen a decline in market share in China due to falling memory semiconductor prices and the purchase halt by major Chinese customer Huawei.

Jung Man-ki, Vice Chairman of the Korea International Trade Association, stated, "Taiwan's semiconductor industry has built a robust ecosystem covering the entire production process, serving as a strong pillar for exports and trade balance amid the U.S.-China hegemonic rivalry, and also acts as a strategic weapon to protect national interests from a security perspective." He added, "For us, while leveraging our strengths in memory semiconductors, we need to pursue balanced semiconductor industry growth by enhancing competitiveness in system semiconductors and semiconductor equipment. Within the division of labor system with China, where technological capability is key, the government should continue to develop R&D support systems aimed at expanding corporate R&D investment and improving productivity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)