Higher North American Sales Share Means Currency Gains... Dollar Loans Are a Burden

[Asia Economy Reporter Yuri Choi] As the won-dollar exchange rate continues to soar, game companies are experiencing mixed fortunes. Game companies with a high proportion of North American sales benefit from exchange gains as the exchange rate rises, but those burdened with foreign currency loans due to mergers and acquisitions (M&A) are facing increased pressure.

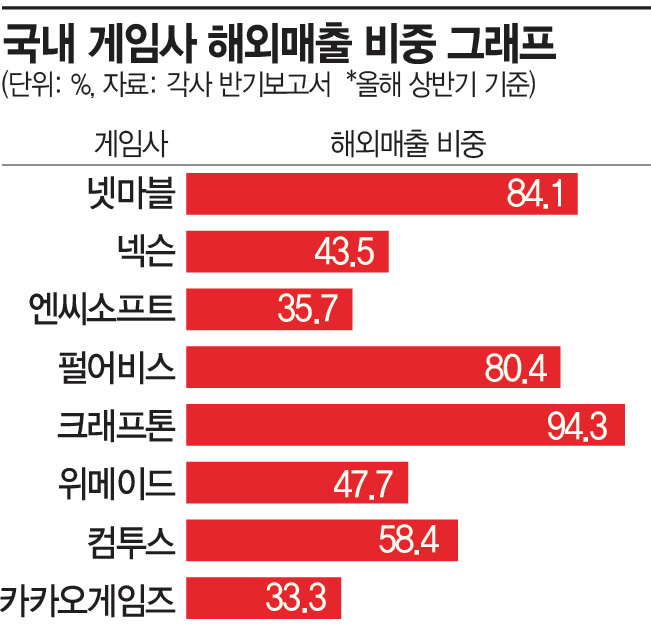

According to the industry on the 28th, more than 80% of overseas sales among domestic game companies come from Netmarble, Krafton, and Pearl Abyss. Netmarble's overseas sales in the first half of the year amounted to 1.0879 trillion won, accounting for 84% of total sales. Among these, the North American region accounted for 49%.

Krafton and Pearl Abyss earned 893.2 billion won and 218 billion won overseas, respectively. Krafton's flagship title, "Battlegrounds," was a global hit, resulting in overseas sales accounting for 94%. Pearl Abyss, led by the hit game "Black Desert," recorded 52% of total sales from North America and Europe. Com2uS and Wemade also earn half or more of their total sales overseas. During the same period, Com2uS's overseas sales reached 190.9 billion won. Fifty percent of the sales of the globally popular Summoners War intellectual property (IP) came from North America and Europe.

These game companies have a high proportion of North American market sales among their overseas sales, benefiting from the strong dollar effect. This is because they can realize exchange gains when reflecting dollar-based sales in domestic performance. Unlike manufacturing, which is affected by raw material price fluctuations due to a strong dollar, rising won-dollar exchange rates improve profitability.

Holding dollar assets also increases asset valuation, positively impacting net income. Pearl Abyss, with assets of 156 million dollars as of the second quarter this year, is a representative case. After deducting 5 million dollars in liabilities, it holds net assets of 150 million dollars. If the exchange rate rises 5% from the second quarter rate of 1,292 won, comprehensive income increases by about 10 billion won, and the current exchange rate has risen by about 10%. Despite an operating loss of 4.2 billion won in the second quarter, net income of 32 billion won was recorded, reflecting the exchange rate rise effect in non-operating income.

On the other hand, losses are increasing when foreign currency loan amounts are large. Netmarble acquired SpinX, the world's third-largest social casino game company, in August last year, and the dollar loan taken during the process is becoming a burden. Of the 2.5 trillion won acquisition price, about 1.6 trillion won was financed through loans from domestic and foreign banks. As the exchange rate rose, the loan burden increased from 1.65 trillion won at the end of last year to 1.8 trillion won in the second quarter of this year. Although exchange gains were realized due to a high proportion of North American sales, the loan burden is offsetting the benefits of the exchange rate.

An industry insider said, "The effect of a strong dollar varies depending on the proportion of sales by country and the scale of foreign currency assets held," adding, "Some game companies benefit from the exchange rate, but they are monitoring the market volatility closely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)