TSMC-Samsung Electronics Gap at 36.9 Percentage Points

TrendForce: "Leading-Edge Process Growth Amid 3Q Demand Decline"

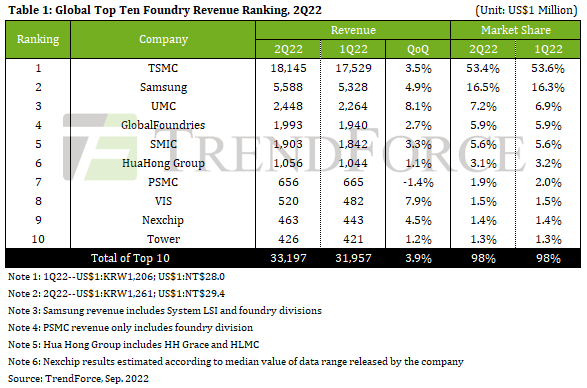

Second Quarter Revenue and Market Share Table of Top 10 Global Foundry Companies / Source=TrendForce

Second Quarter Revenue and Market Share Table of Top 10 Global Foundry Companies / Source=TrendForce

[Asia Economy Reporter Kim Pyeonghwa] While the market share of Taiwan's TSMC, the world's No.1 foundry (semiconductor contract manufacturing) company, slightly declined in the second quarter, Samsung Electronics, ranked second, increased its share by the amount TSMC lost. There is also a forecast that although major foundry players will be affected by decreased demand in the third quarter, growth centered on advanced process technology will continue.

TSMC and Samsung's fortunes diverge by '0.2 percentage points'

On the 27th, market research firm TrendForce released the second-quarter market shares of the world's top 10 foundry companies. The No.1 was Taiwan's TSMC. TSMC recorded total sales of $18.145 billion in the quarter, a 3.5% increase from the previous quarter. However, its market share slightly decreased by 0.2 percentage points to 53.4% from 53.6% in the previous quarter.

TSMC increased sales thanks to demand in high-performance computing (HPC), Internet of Things (IoT), and automotive sectors. However, due to wafer price increases, the sales growth rate was limited to 3.5% compared to the previous quarter. TrendForce explained that with customers such as US-based Nvidia and AMD, Chinese Bitmain, and other HPC-related clients continuously launching new products, TSMC's 5nm and 4nm process-related sales in the second quarter grew approximately 11.1% quarter-over-quarter.

Samsung Electronics, ranked second, conversely increased its market share by 0.2 percentage points to 16.5% from 16.3% in the previous quarter. Its sales rose 4.9% from $5.328 billion to $5.588 billion.

Samsung achieved these results by shifting production capacity from the existing 7nm and 6nm processes to the 5nm and 4nm processes, improving yield rates. Another achievement was the start of mass production at the end of the second quarter of the first-generation 3nm (3GAE) process based on the next-generation Gate-All-Around (GAA) technology. The first customer was PanSemi, a Chinese fabless semiconductor company producing Bitcoin mining ASICs. However, TrendForce noted that since GAA-based 3nm process mass production is still at an early stage, it is unlikely to contribute to sales within this year.

From third to fifth place were Taiwan's UMC, US-based GlobalFoundries, and China's SMIC, respectively. UMC recorded $2.448 billion in sales in the second quarter, increasing its market share by 0.3 percentage points to 7.2%. GlobalFoundries held a 5.9% market share with sales of $1.993 billion. SMIC recorded sales of $1.930 billion with a 5.6% market share.

3Q demand decline... "Growth centered on advanced processes" to continue

TrendForce explained that due to sustained demand in automotive and industrial equipment sectors and increased wafer shipments from new capacity, the top 10 foundry players' sales reached $33.2 billion in the second quarter. However, due to decreased demand for IT devices at the consumer level, the sales growth rate was limited to 3.9% in the second quarter.

In the third quarter, as customer order reductions become more pronounced, the foundry market is expected to face difficulties. Specifically, TrendForce explained that order volumes may decline in ▲large display driver ICs (LDDI), ▲touch display driver ICs (TDDI), ▲TV system-on-chip (SoC), ▲mobile application processors (AP), ▲power management ICs (PMIC) for consumer electronics, and ▲low- to mid-range microcontroller units (MCU). However, Apple's launch of new iPhone series products in the quarter is expected to have a positive effect.

TrendForce stated, "The top 10 foundry players' profits in the third quarter are expected to maintain growth centered on high-priced processes," adding, "Quarterly growth rates are expected to be slightly higher than in the second quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.