[Asia Economy Reporter Donghyun Choi] Fintech startup Habit Factory announced on the 27th that its U.S. subsidiary's mortgage loan service, 'Loaning.ai,' has introduced a real-time mortgage interest rate inquiry feature in the United States.

Previously, customers had to provide a lot of personal information to check loan interest rates, including ▲income type ▲credit score ▲employment information ▲purchase purpose ▲housing type ▲loan amount. During this process, customers often felt anxious due to concerns about personal information leakage. Additionally, it took 2 to 3 days for the representative to input the customer's information into the loan company's system and check the interest rates. Even if customers only wanted to check, they had to spend a considerable amount of time.

Until recently, due to broker commission issues, many cases only provided specific interest rates even if lower rates were available. For example, when informed of a 6.750% rate, customers could choose 6.000%, 6.125%, 6.250%, 6.375%, 6.500%, or 6.625% by paying a discount point, but they were unaware that they could receive those rates.

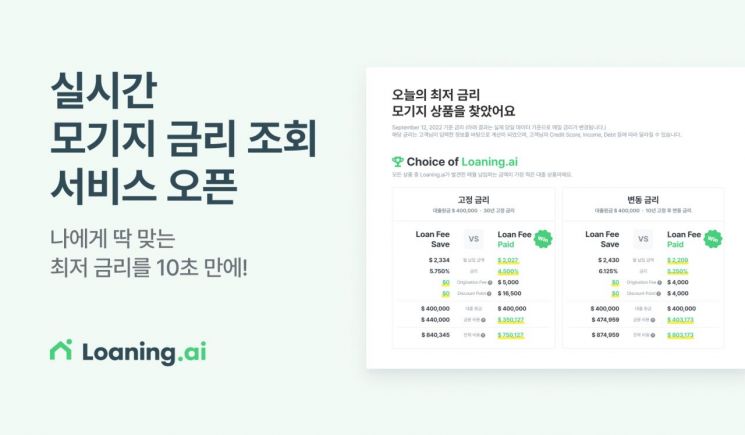

Loaning.ai judged that the optimal loan from the customer's perspective is "being able to easily know the interest rate level suitable for their situation, along with fees and total interest costs." It foresaw the need for real-time loan interest rate guidance to transparently provide information to customers. Therefore, using an engine developed with its own technology, it enabled a real-time interest rate inquiry service within 10 seconds.

This service has become an opportunity to maximize both customer convenience and work efficiency simultaneously. Since the same information can be shared with customers, consultations have become much smoother. It is meaningful in that it is a service that mainstream U.S. banks and lenders have not been able to provide.

Lee Dong-ik, co-CEO of Habit Factory and head of Loaning.ai, said, "There were almost no places in the U.S. mortgage market that provided accurate real-time interest rate information." He added, "Although the technical difficulty was high, the process of implementing the service so that customers could use it conveniently was a very meaningful journey." He further stated, "We plan to continue doing our best to lower customers' loan interest rates and process loan tasks quickly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.