Rising to 1431.9 KRW During Trading

Significant Resistance Fades

Breaking 1500 KRW Is Only a Matter of Time

US-China Economic Slowdown Concerns

Strong Dollar Sentiment Unlikely to Reverse Easily

On the 27th, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI index opened at 2,224.39, up 3.45 points (0.16%) from the previous day. The won-dollar exchange rate opened at 1,428 won, down 3.3 won. Photo by Moon Honam munonam@

On the 27th, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. On this day, the KOSPI index opened at 2,224.39, up 3.45 points (0.16%) from the previous day. The won-dollar exchange rate opened at 1,428 won, down 3.3 won. Photo by Moon Honam munonam@

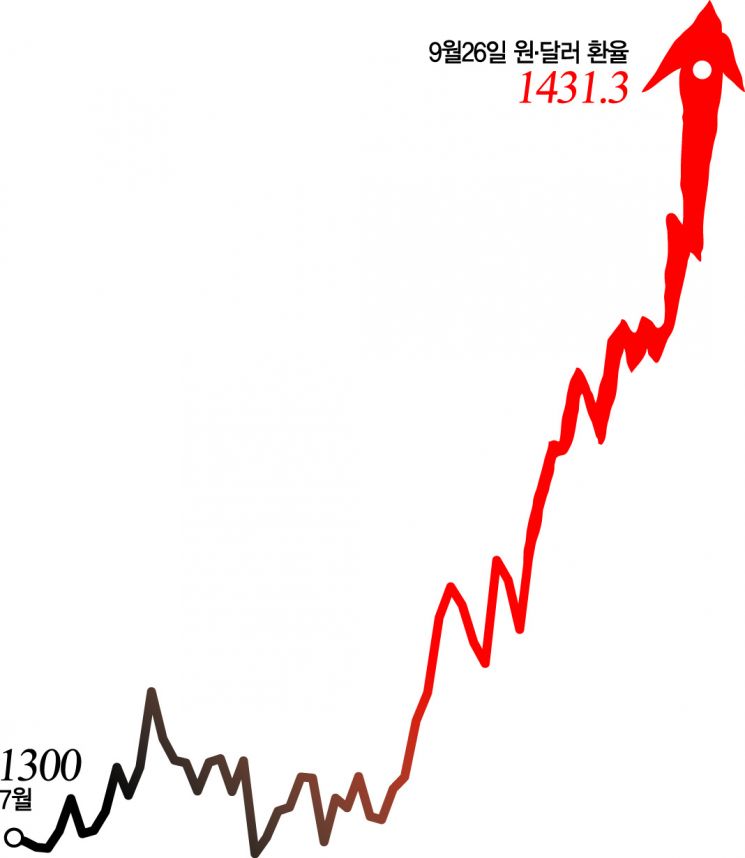

[Asia Economy Reporter Seo So-jeong, Sejong = Reporter Son Seon-hee] The won-dollar exchange rate is rising at the second fastest pace since the 2008 global financial crisis, spreading the fear of a "King Dollar" (ultra-strong dollar) over the South Korean economy. Given the high external dependence of our economy, if the high exchange rate continues, it is feared that the increase in corporate costs due to rising import prices will not only stimulate domestic inflation further but also have an adverse effect on the overall economy.

According to the Seoul foreign exchange market on the 27th, the won-dollar exchange rate recorded 1,427.4 won as of 10 a.m., moving within the 1,420 won range. The exchange rate opened at 1,428.0 won, down 3.3 won from the previous trading day, then rose to a high of 1,431.9 won around 9:06 a.m., surpassing 1,430 won again following the previous day before falling back. As the British pound plummeted to an all-time low, spreading fears reminiscent of the global financial crisis and pushing risk aversion to the extreme, Asian currencies including the yen and yuan also showed weakness.

In the market, with the psychological barrier of 1,400 won broken and meaningful resistance levels fading, there are forecasts that the won-dollar exchange rate will exceed 1,500 won within the year. Moon Hong-chul, a researcher at DB Financial Investment, said, "Without factors supporting won appreciation, the exchange rate rise phase can only calm down if the U.S. shifts its tightening policy. However, as the Federal Reserve (Fed) signals continued high-intensity tightening for the time being, the strong dollar phenomenon will intensify until the end of the year," adding, "The upper limit could break through 1,500 won."

In past economic crises, the turning point for exchange rate rises was supported by global economic recovery, but now, with growing concerns over economic slowdowns in the U.S. and China, it is difficult to reverse the strong dollar trend. In March 2009, during the financial crisis, a meaningful exchange rate turning point was formed as the global leading economic index, manufacturing Purchasing Managers' Index (PMI), and domestic terms of trade rebounded. However, currently, the global leading economic index is below the baseline, and additional Fed tightening, winter energy crises, and uncertainties from war are increasing. As winter approaches, when South Korea’s energy import volume rises, improving the trade balance becomes more difficult, putting pressure on the exchange rate. The continued trade deficit with China is also a problem.

Amid the exchange rate emergency, Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho met with former Financial Services Commissioners Shin Je-yoon and Choi Jong-gu on the same day to discuss the recent volatility in the financial and foreign exchange markets. Both individuals were key figures who led active market interventions to defend against the exchange rate soaring to record highs in 2008. Professor Sung Tae-yoon of Yonsei University’s Department of Economics advised, "To stabilize the foreign exchange market, the government should implement multifaceted measures and actively pursue currency swap agreements with the U.S."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.