Even Samsung Electronics, the National Stock, Could Not Escape

Many Blue-Chip Stocks with High Retail Investor Proportion

Signs of Prolonged External Risks

Focus on Stocks Less Affected by Economic Conditions

[Asia Economy Reporters Kwon Jae-hee and Lee Myung-hwan] Forty percent of all listed companies have fallen to their 52-week lows.

According to the Korea Exchange on the 27th, the KOSPI closed at 2,220.94, down 3.02% from the previous trading day. The KOSDAQ index also closed at 692.37, down 5.07% from the previous day, breaking below the 700 mark. Both indices closed at their lowest levels this year.

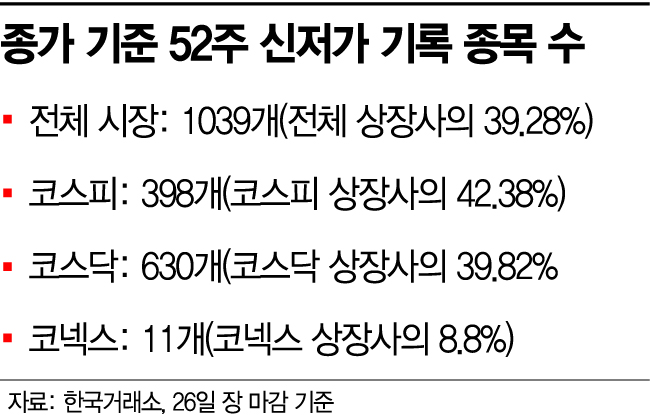

As the stock market plummeted, the number of stocks hitting new 52-week lows reached 1,039. Considering that the total number of listed stocks is 2,645, this corresponds to 39.28% of all listed companies. Based on intraday prices, 1,043 stocks also set new lows.

Breaking down the stocks that recorded 52-week lows by market, there were 398 in KOSPI, 630 in KOSDAQ, and 11 in KONEX. Compared to the total number of listed companies in each market, this represents 42.38% of the KOSPI market and 39.82% of KOSDAQ.

Looking at the stocks that hit 52-week lows on that day, many blue-chip stocks with high individual investor holdings were included. Semiconductor stocks such as Samsung Electronics (-1.10%), SK Hynix (-1.20%), and Samsung Electronics Preferred (-2.41%), which are leading KOSPI stocks, fell to new lows. Growth stocks like NAVER (-2.85%) and Kakao (-2.13%) also showed new lows.

Recently, there has been a surge in stocks closing at their all-time lows since listing, surpassing the 52-week period. A total of 199 stocks, accounting for 7.52% of all listed companies, closed at their lowest prices since listing. Large-cap stocks that recorded all-time lows include KakaoBank (-7.04%), Samsung SDS (-2.55%), KakaoPay (-4.16%), and SK Bioscience (-1.86%). Among them, KakaoBank, which has the highest market capitalization, closed at a price less than half of its peak price in the 90,000 KRW range shortly after listing.

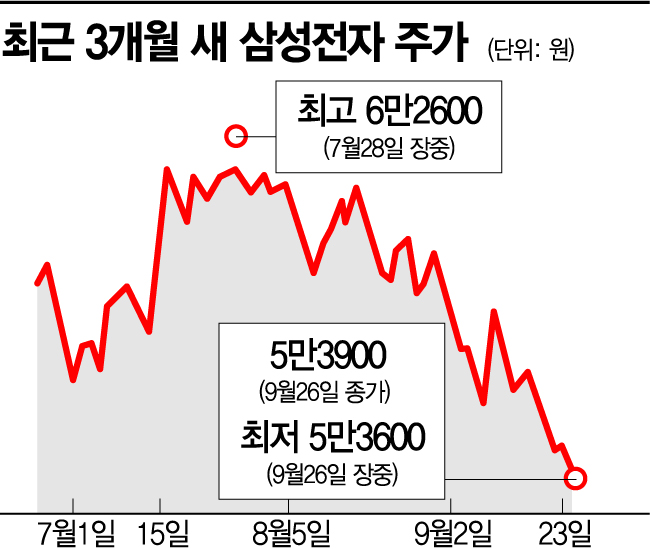

The 'national stock' Samsung Electronics was not spared from the impact of the domestic stock market collapse. Its stock price fell to the 53,000 KRW range, raising concerns that the '40,000 KRW Samsung Electronics' era might be imminent. Samsung Electronics' stock price has dropped about 8% this month. At the beginning of the month, Samsung Electronics was in the 58,000 KRW range, and except for one day (September 1), foreign investors have been net sellers for 15 consecutive trading days. During this period, foreign investors net sold 1.6327 trillion KRW worth of Samsung Electronics shares, while individual investors net bought 2.1243 trillion KRW worth.

The securities industry forecasts that this downward trend will not be short-lived. Risks such as a strong dollar and global economic slowdown are weighing down the domestic stock market. Since no improvement in the market is expected in the near term, it is advised to build a defensive portfolio focused on profits. Choi Jae-won, a researcher at Kiwoom Securities, advised, "It is necessary to continue defensive strategies centered on profit momentum factors that can confirm short-term profit outlook improvements, including the recently strong defensive style."

Focusing investments on sectors less affected by the economy can also be an alternative, as predicting the direction of stock indices is difficult. Kim Young-hwan, a researcher at NH Investment & Securities, recommended, "Approach mid-cap stocks focusing on promising themes unrelated to the economy (electric vehicle charging infrastructure, K-Entertainment, iPhone components, fertilizers, etc.) or invest in long-term issues such as factory automation, logistics automation, and service-related automation (humanoid robots, medical assistant robots)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.